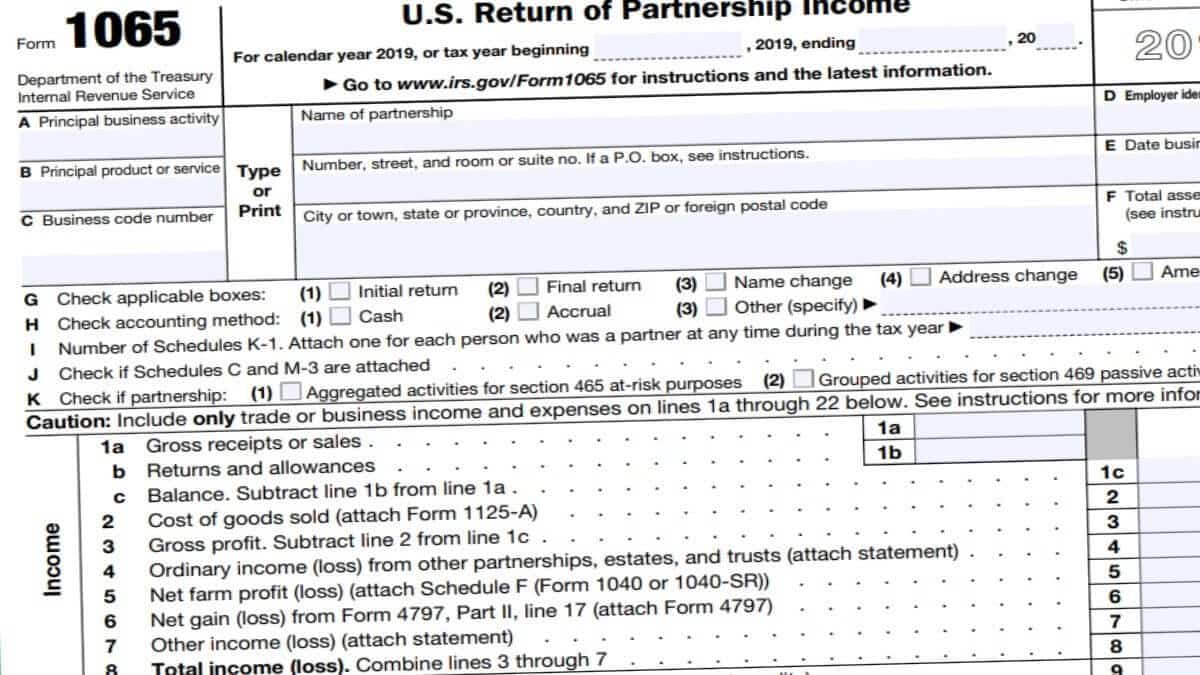

1065 Form 2023 - 2024

Form 1065—U.S. Return of Partnership Income is for reporting income, gains, losses, deductions, and credits. Since partnerships don’t pay tax on the income earned, this isn’t a tax return. This is basically similar to an information return that reports the above.

Partnerships pass through profits and losses to its partners. The partners must use the information provided on Form 1065 to include partnership items on their tax returns. That said, Form 1065 will work as a guide rather than an information return.

Whether you’re a partner in a business partnership, LLC, or you’re self-employed, you will likely have to complete a 1065 Form at some point. This form helps you report information about your business, including profits and losses, credits, and deductions. You can fill out the form by hand, using a paper copy, or by completing the form electronically.

The 1065 Form is five pages long and includes information about your company’s finances and profits. In addition, you’ll need to provide a business tax ID number, start and end dates, and the total assets of your partnership. Including information about interest, taxes, and other expenses is also necessary.

1065 Form Pages and Sections

1065 Form is a five-page form with two sections. Here is detailed information about the sections and pages of the 1065 Form:

The first section, called Schedule M, requires additional information about your business. The information includes your principal product, beginning inventory values, and accounting method.

The second section, which is called Schedule K, reveals each partner’s share of the partnership’s income. It also asks questions about your specific situation. If you answered yes to the question, “Do you own or manage a partnership?” you will need to fill out a Schedule K-1.

- The first page of the form has a space for your business’s tax ID number and date. It will also ask you for your employer’s name, the number of partners, and your accounting method. You’ll be required to file many tax documents throughout the tax year. In most cases, the process will be handled by a tax accountant. However, you can also use tax software to help with the data-gathering process.

- The next two pages of the form have 29 line items that require you to answer questions about your partnership. You’ll need to specify the number of partners and your starting and ending dates for the tax year. You’ll need to report your income, total assets, and sales. You may consider filing for an extension if your business has several partners.

- The last two pages of the form have boxes that ask you to report your taxes, deductions, and other information. You’ll need to include your total debts and any guarantees you’ve made to your partners. You’ll also need to report your beginning and ending inventory values.

The following must be reported on Form 1065 for the 2023 tax season.

- Income

- Deductions

- Tax and Payment

Attached to Form 1065, you will find the Schedules B, K, L, M-1, and M-2.

- Schedule B reports other information related to income and taxes.

- Schedule K reports partners’ distributive share items.

- Schedule L is works as balance sheets per books.

- Schedule M-1 is the reconciliation of income per books with income per return.

- Schedule M-2 is the part where partnership analysis of partners’ capital accounts.

Filing Form 1065 on your own can be quite challenging. It’s best to file it with a tax professional. If you’re going to file it by yourself, get the online fillable Form 1065—U.S. Return of Partnership Income to file in 2023 below.