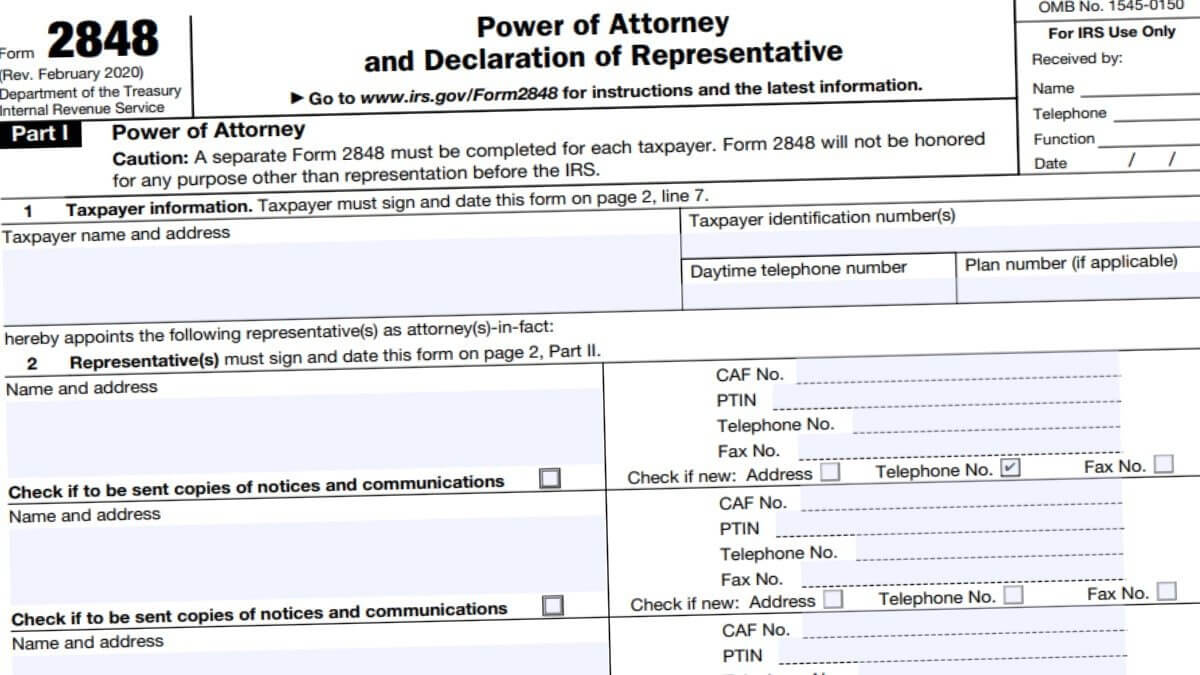

2848 Form

Form 2848—Power of Attorney and Declaration of Representative is the IRS form where individuals can authorize someone else to represent them before the IRS. This tax form is mostly used for giving authorization to attorneys but can be filled out to give authorization to anyone.

Since the purpose of Form 2848 is very simple, the form itself is only a two-page. So, nobody should have a hard time filing Form 2848.

This tax form can also be used for authorizing a student who works in a qualifying Student Tax Clinic Program or Low Income Taxpayer Clinic. As long as Form 2848 is filled out correctly, the student can represent a taxpayer under a special appearance authorization. This is issued by the Taxpayer Advocate Service.

Online Fillable and Printable Form 2848

Before you get to filling out Form 2848, know that it can’t be filed electronically. It can only be sent to the IRS via mail.

Start filling out Form 2848 below. You can check the boxes and enter every piece of information needed on the fillable form. After you’re done, click on the download button on the top-right corner to save it as a PDF or print out a paper copy right away.

Where to mail Form 2848

Mail Form 2848 to the following addresses depending on your state of residence.

| State of Residence | Mail Form 2848 to: |

|---|---|

| Alabama, Arkansas, Connecticut, Delaware, District of Columbia, Florida, Georgia, Illinois, Indiana, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Mississippi, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, or West Virginia | Internal Revenue Service 5333 Getwell Road Stop 8423 Memphis, TN 38118 |

| Alaska, Arizona, California, Colorado, Hawaii, Idaho, Iowa, Kansas, Minnesota, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, Wisconsin, or Wyoming | Internal Revenue Service 1973 Rulon White Blvd., MS 6737 Ogden, UT 84201 |

| American Samoa, nonpermanent residents of Guam or the U.S. Virgin Islands, or Puerto Rico | Internal Revenue Service International CAF Team 2970 Market Street MS: 4-H14.123. Philadelphia, PA 19104 |

Note: If the box found on Line 4 is checked, Form 2848 must be mailed to the IRS office handling the specific situation.