941 Instructions

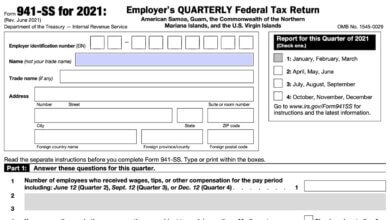

Form 941 is the employer's quarterly federal tax return used for reporting income paid to employees and the taxes withheld from their income. This tax form is filed for every quarter reporting the total employee payments. So an employer is going to file Form 941 for all employee payments in a single document.

Contents

941 Instructions: A Comprehensive Guide

The 941 form, commonly referred to as the Employer’s Quarterly Federal Tax Return, is a crucial document that many employers in the U.S. must be familiar with. This form serves as a way to report wages paid, tips received, and employment taxes withheld from employees’ wages. In this comprehensive guide, we’ll delve deep into how to complete Form 941, its significance for employers, and other essential details.

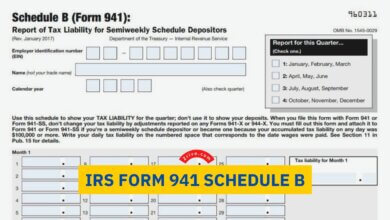

How to Complete Form 941

Completing the Form 941 can seem daunting at first glance, but with the right 941 instructions and understanding, the process becomes more straightforward. Here’s a step-by-step guide:

- Identification: Enter your Employer identification number (EIN) and other necessary details.

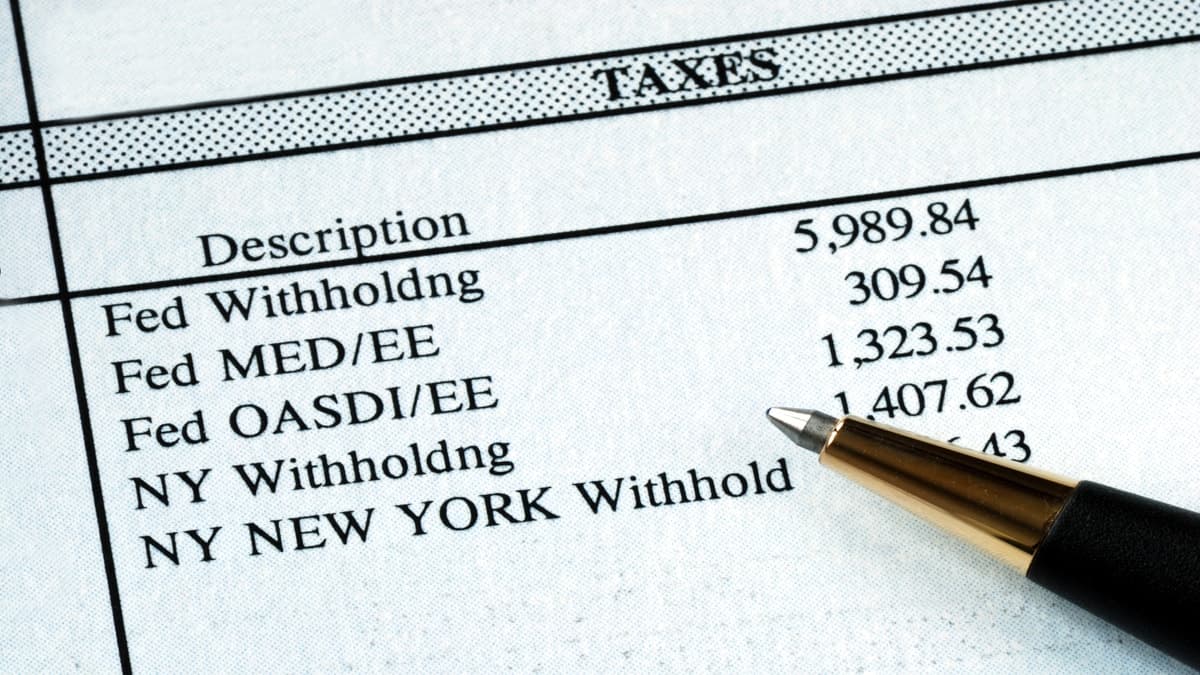

- Wages, Tips, and Taxes: Report total wages paid, tips received by employees, and the corresponding Social Security tax, Medicare tax, and unemployment tax withheld.

- Adjustments: If there are any corrections from previous periods, they should be noted here.

- Total Taxes: After all calculations, report the total employment taxes owed for the quarter.

- Deposit and Payments: Indicate your Federal tax deposit amounts and any overpayments from previous quarters.

- Sign and Date: After verifying all information, sign, and date the form.

941 Form Instructions for Employers

For employers, understanding how to complete form 941 is crucial. The form serves as the quarterly tax return for employment taxes. It ensures that employers correctly withhold federal taxes from employee wages, ensuring compliance and reducing the risk of penalties.

| Important Sections of Form 941 | Description |

|---|---|

| Wages | Total wages paid during the quarter |

| Tips | Total tips reported by employees |

| Social Security tax | Taxes withheld based on the Social Security rate |

| Medicare tax | Taxes withheld based on the Medicare rate |

| Unemployment tax | Taxes withheld for federal unemployment |

941 Form: A Step-by-Step Guide

Refer to the above “How to Complete Form 941” section.

941 Form: What You Need to Know

- Employee’s Social Security number (SSN): Required for reporting and tracking purposes.

- Employee’s wages: This is the gross amount before any deductions.

- Employee’s tips: Essential for industries where tipping is common, like hospitality.

- Federal tax deposit: This is the employer’s contribution based on the employee’s wages and tips.

- Quarterly tax return: Form 941 is filed every quarter, making it a quarterly tax return.

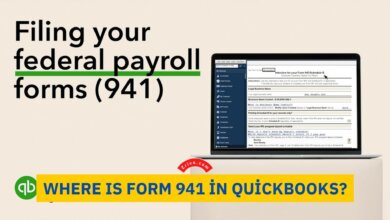

941 form example

Due to the text format, we can’t visually display the form. However, the IRS website or any tax software can provide visual examples.

941 Filing Deadlines

The 941 form is a quarterly tax return, meaning it has to be filed four times a year. The deadlines are as follows:

- 1st Quarter (January to March) – Due by April 30

- 2nd Quarter (April to June) – Due by July 31

- 3rd Quarter (July to September) – Due by October 31

- 4th Quarter (October to December) – Due by January 31 of 2024

941 Penalties

Non-compliance or late filing of Form 941 can result in penalties. Here’s a breakdown:

- Late Filing: If you file your 941 form after the deadline, there’s a 5% penalty for each month or part of the month it’s late, up to 25%.

- Late Payment: There’s a 0.5% penalty on unpaid taxes for each month, up to 25%.

Understanding the 941 instructions and ensuring timely and accurate filing is crucial for employers. It not only ensures compliance but also reduces the risk of incurring hefty penalties. Whether you’re a seasoned business owner or just starting, familiarizing yourself with the 941 form can save you time, money, and potential legal hassles.