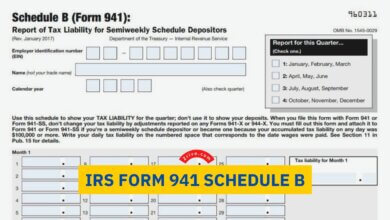

941-SS 2023 - 2024

Form 941, Employer’s Quarterly Federal Tax Return, is the tax form used for reporting wages paid, Social Security, Medicare, and income taxes withheld from employees’ income during one quarter.

This tax form also has a different version titled 941-SS. It’s pretty much the same as the primary version of Form 941 but isn’t for employers in the 50 states. Instead, Form 941-SS is for reporting the above information of employees in the following US territories.

- American Samoa

- Guam

- Commonwealth of the Northern Mariana Islands

- US Virgin Islands

Even if your company is based in either one of the 50 states, you must fill out Form 941-SS for the employees in these above US territories. That said, don’t file Form 941 to report wages and taxes of employees working in these US territories to the Internal Revenue Service.

Fill out Form 941-SS online

Below is the online fillable, editable version of Form 941 you can fill out online and print out a paper to mail to the Internal Revenue Service. Don’t confuse this with e-filing, as you’ll need the assistance of a tax preparation service for that. This is literally a PDF file that you can fill out online.

Other US territories

The US territories other than the above, such as Puerto Rico, has their own version of this tax form titled Form 941-PR. Use the appropriate quarterly federal tax return to save yourself time, as passing the deadline can result in late-filing penalties, even if you filed it before but it was an incorrect one.

Get 941 Form 2022 for 50 states

Form 941-SS mailing address

Since this tax form is for different US territories scattered in different directions, it would come to mind that the mailing addresses would be different for each. That’s not the case, as the IRS requires taxpayers to mail it to the same address in Kentucky.

Mail Form 941-SS with payment to:

PO Box 932100

Louisville, KY

40293-2100

Mail Form 941-SS without payment to:

PO Box 932100

Louisville, KY

40293-2100

Once mailed, proceed with the usual steps of Form 941. There isn’t a difference between Form 941-SS and the 941. The only difference is in the title, so you can fill it out following the 941 Form instructions to file for 2024 taxes, which you’ll file a federal income tax return in 2024.