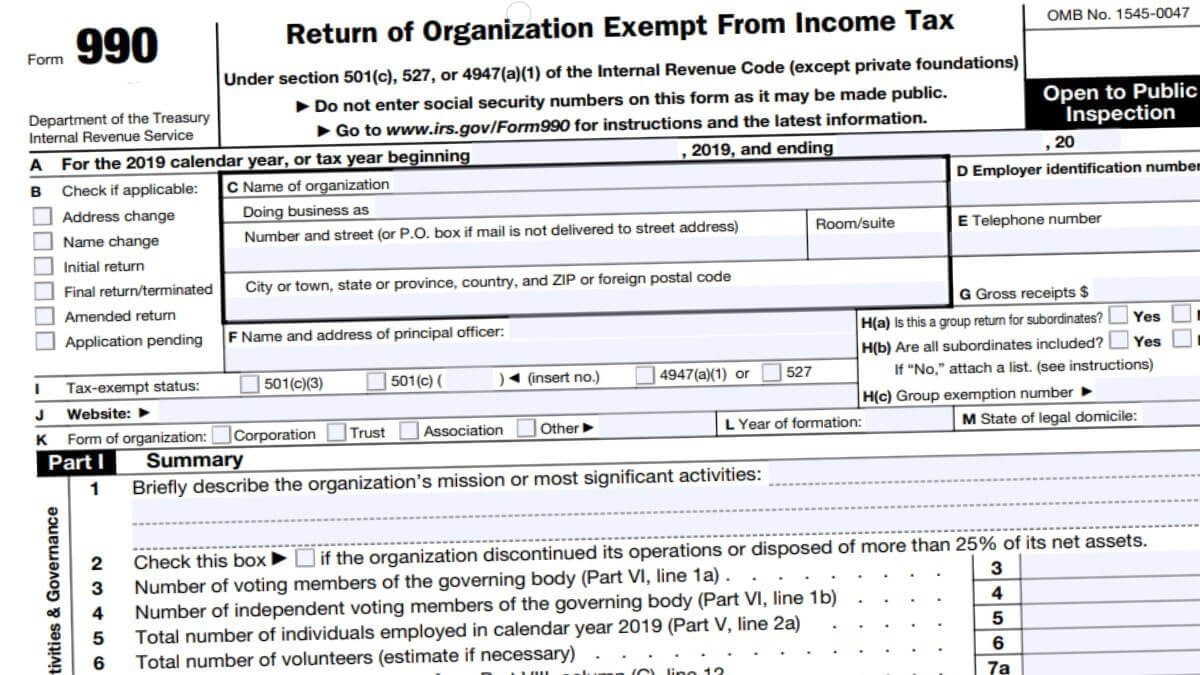

990 Form 2023 - 2024

Form 990—Return of Organization Exempt from Income tax is the tax return of tax-exempt organizations. Form 990 is filled out in 2024 by nonexempt charitable trusts and section 527 political organizations.

Though it doesn’t exactly work as a tax return, all organizations that are exempt from paying income tax must report their activities. This is the purpose of Form 990. This tax form must be filed and submitted to the IRS annually. Unlike Form 1040—U.S. Individual Income Tax Return which works similarly to it, Form 990 must be sent to the IRS by May 15.

On Form 990, the tax-exempt organizations must provide the following information.

- Summary of the organization

- Signature

- Statement of the organization’s mission statements, revenues, and accomplishments

- Checklist of required schedules

- Statements about other IRS filings

- Information about governing body and management and policies

- Compensation paid to employees, current and former officers, directors, independent contractors, and employees receiving more than $100,000 in payment from the organization

- Statement of the organization’s revenue from exempt or related funds and unrelated business income

- Statement of functional expenses

- Balance sheet

- Reconciliation of net assets

- Financial statements and reporting

As you can see, there are plenty of differences between filing a federal income tax return and filing a Form 990. These differences shouldn’t be confusing. In general, it takes about 3 to 4 hours to file a Form 990 as long as the information required on it is in your hands.

File Form 990 Printable 2023 - 2024

Form 990 online fillable PDF can be found below. This form is for those who are going to submit a paper application. Click the boxes to start filling out a Form 990. You can enter any text as well as money amounts on your computer or smartphone or tablet.

Once you’re done, there isn’t anything else you need to do to print out. Get to the top right corner of Form 990 and print out a paper copy or save it as a PDF to keep it for your own records.

Electronic Filing (e-file) Form 990

Form 990 along with other tax forms for tax-exempt organizations can be filed electronically through an e-file provider. These tax forms including but not limited to:

- Form 1120-POL

- Form 7004

- Form 8868

- Form 990

- Form 990-EZ

- Form 990-PF

- Form 990-N

- Form 8868

Click here to learn more about how to file these tax forms electronically through an IRS-authorized e-file provider.

990 Form 2021

Pdf - 10

Fillable - 10

Download - 10

10

10

Form 990—Return of Organization Exempt from Income tax is the tax return of tax-exempt organizations. Form 990 is filled out in 2021 by nonexempt charitable trusts and section 527 political organizations.