Sales tax is levied on the sale of tangible goods and certain services, with the responsibility of collecting and remitting the tax falling on the seller. Exemptions are available for buyers that have a legal basis to not pay the tax. Examples include resale certificates, exemptions from local taxes, purchases made with food stamps, and nexus.

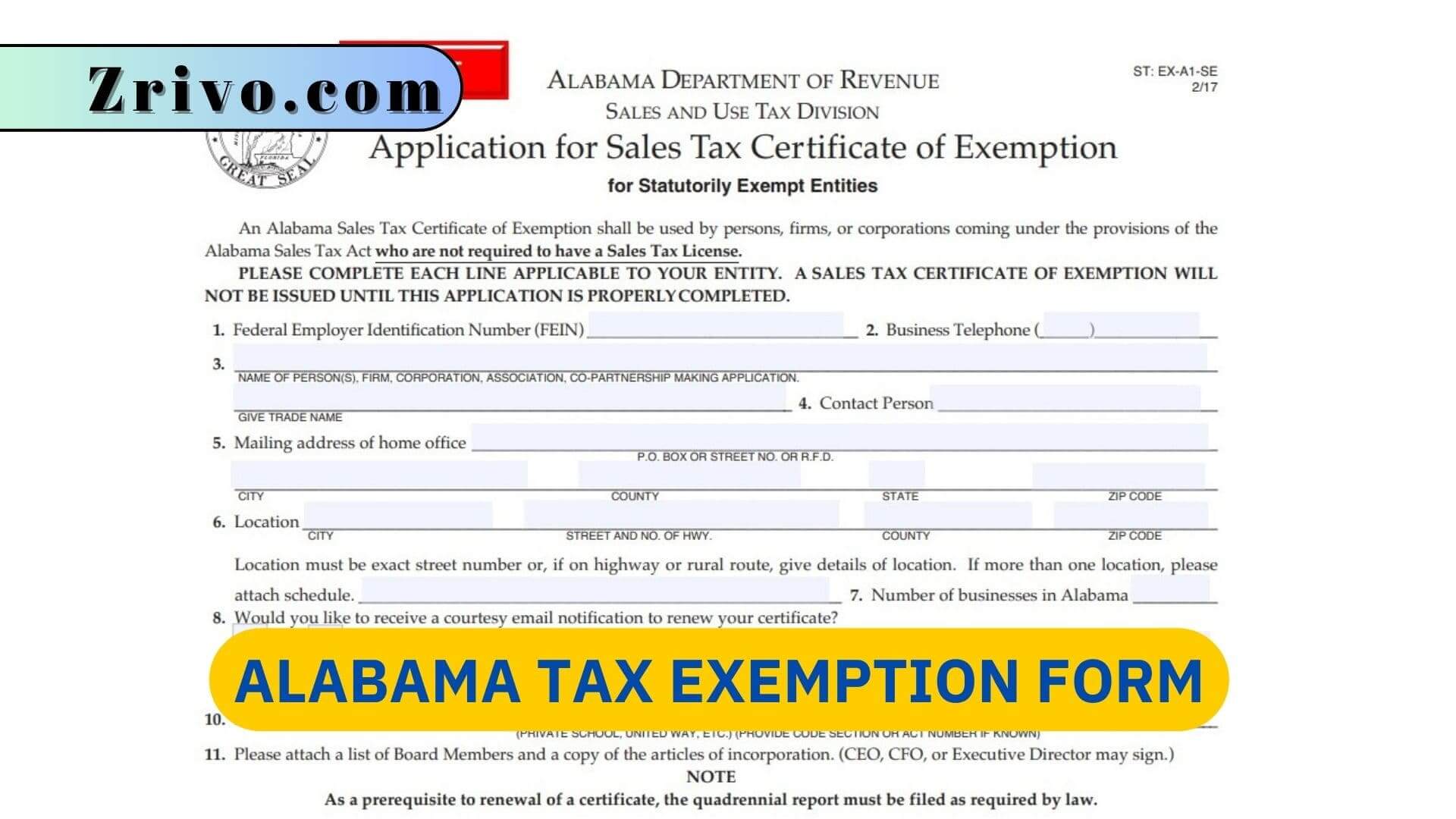

Businesses that are exempt from collecting sales tax in Alabama must register with the department for a sales and use tax exemption certificate. This can be done online, and it is free of charge. A resale certificate is a document that legally documents a buyer’s exemption from sales and use tax in Alabama. The document must contain the date, both the buyer and seller’s names and addresses, and the legal basis for the exemption. It must be renewed annually to remain valid. Once the department approves your application, you will receive a registration number and filing due dates.

How to File Alabama Tax Exemption Form?

There are several steps involved in filing for a sales tax exemption in Alabama. First, you must determine whether or not you have sales tax nexus in the state. If you do, you must register with the state and local tax authorities. After registering, you must file returns and remit all collected taxes on time. Failure to do so may result in penalties and interest charges.

Next, you must complete an Alabama tax exemption form. This form must be signed by the buyer and include the date it was created, the buyer’s name, address, and tax registration or business license number, and the legal basis for the exemption being utilized. Finally, the buyer must provide a description of the goods or services being purchased.

If you are purchasing items to resell, you must submit an Alabama resale certificate before making the purchase. Also known as a wholesale certificate, reseller’s permit, or sales tax exemption certificate, this document certifies that the purchaser is exempt from paying sales and use tax on purchases made at wholesale prices.

In some states, sales tax is based on the seller’s location and the origin of the sale (origin-based sourcing). In other states, like Alabama, sales tax is based on the destination of the shipment or use of the item (destination-based sourcing). The state of Alabama is a member of the Streamlined Sales and Use Tax Agreement, so buyers can use a single blanket resale certificate for all purchases from a vendor in the state.

Alabama Sales Tax Exemption Eligibility

There are several requirements that must be met to qualify for sales tax exemption in Alabama. For example, the entity must present a certificate that is created by an authorized individual or agency. The certificate must include the date, both the seller and buyer’s names and addresses, the legal basis for the exemption, and a description of the products being purchased. The exemption is valid for one year from the date of issue. The entity must re-certify each year to maintain their sales tax exemption status.