Form 4506-T

Whether you are filing your taxes or hiring a professional, Form 4506-T is one of the most important tax documents you will fill out.

Contents

How to Request a Form 4506-T

This form will give you a summary of your gross income and deductions. It can also request a copy of your tax return from the IRS. You can also use the form to file your taxes online.

Requesting a copy of your tax return

Getting a copy of your tax return can be as straightforward or complex as you choose. It may be a matter of keeping old records for tax purposes, or it may be a matter of needing them for a loan application.

Getting a free copy of your tax return can be as simple as filling out a form with your tax preparer or as complicated as filing a request for a transcript. IRS transcripts are available for the current year but can also be requested for the past six years.

The IRS offers five different types of transcripts. The official IRS website can help you locate the right type for your situation. The IRS claims it can provide you with a transcript of your past taxes within 10 to 30 business days. However, some research may be required.

Choosing the correct type of transcript will require you to fill out the form appropriately. The IRS will limit the amount of personal information on the transcript.

Filing online

Using the IRS website, you can request tax transcripts online. You will need to remember your username and password. You will also need to provide personal information about yourself. The IRS process time for these requests varies depending on the filing type.

You can request a transcript of your individual or business tax return or a third party’s tax return. You may need a transcript for some reason. It could help you complete your current-year tax return or to apply for government benefits or financial aid. The transcript will show you your adjusted gross income, payments, and balances due. You can also use the tax return transcript to prepare your taxes or for other self-purposes.

You can use the IRS website to request a tax return transcript or send a mail request. Depending on the type of request, it can take up to 75 days to receive a response from the IRS.

Mailing in the form

Whether you are an individual or a business owner, you may need to mail in Form 4506-T. This official IRS form enables you to obtain a tax return transcript. The form can be requested online, by fax, or by mail. The receiving address will vary depending on the type of transcript you are requesting.

The most important aspect of the form is that it will allow you to retrieve information about your tax returns. Three main offices provide this service. The addresses can vary from one region to another, but the official IRS site lists addresses for each part. The official website also reveals which lessons are the most up-to-date.

The IRS requires several other forms to get your tax transcript, including a request for a transcript from an employer. If you are a business owner or a sole proprietor, you can use the form to request a transcript of a W-2 or Form 1099 from an employee.

Requiring a tax pro to obtain and interpret tax information

A copy of your tax return is required if you are applying for a mortgage, federal student aid, or other government benefits. You can get a copy of your tax return by completing Form 4506-T. You can also request a transcript of your tax return. This is a computer printout of your tax return, showing your adjusted gross income, a breakdown of your dependents, and more. The IRS allows you to request up to eight years worth of information on a single form.

If you have a question about your transcript, you can call the IRS’s online hotline for tax professionals. These tax professionals can access IRS records and interpret the information on your transcript. They can help you determine whether or not you are eligible for a refund, if you are entitled to a refund, or if you have filed your taxes correctly. They can also help you determine whether you are eligible for a mortgage or student loan benefits.

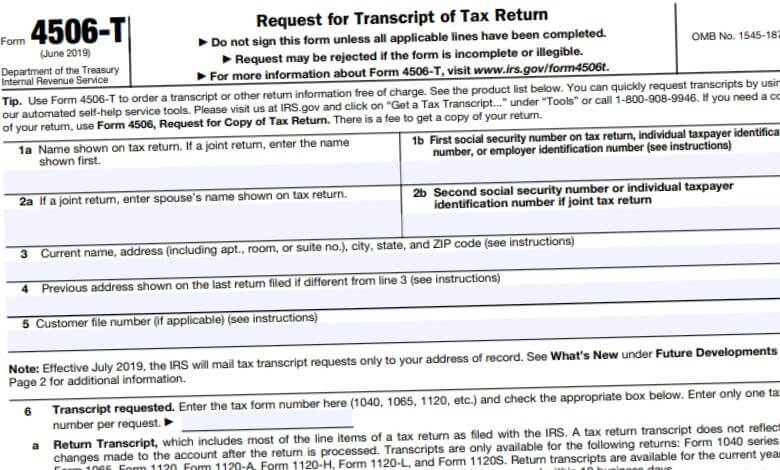

Form 4506-T—Request for Transcript of Tax Return is an IRS tax form that is used by taxpayers to—well, request their tax return transcripts. Use Form 4506-T or 4506T-EZ to request tax transcripts by mail. You also have the option to request tax transcripts online. If you’re in need of tax transcripts as soon as possible, we suggest obtaining them online as it’s going to take significantly less time.

Filing Form 4506-T

Form 4506-T requires only basic information. On the Request for Transcript of Tax Return form, you will need to provide the following.

- Name of you and your spouse (if filing jointly) Boxes 1a and 2a

- Your Social Security Number and your spouse’s (if filing jointly) Boxes 2a and 2b

- Current address

- Previous address shown on the last return if it is different from the current address.

- Customer file number (if applicable)

- Transcript requested;

- Whether or not you request to get return transcript

- Whether or not you request to get account transcript

- Whether or not you request record of account

- Verification of Nonfiling

- Whether or not you request Form W-2, Forms 1099, Forms 5498 trancsript

- Tax year or period requested

After you sign Form 4506-T, you can mail it to the IRS. The following tables show the mailing address for each state for individual and business returns.

Form 4506-T Mail Address

| State of Residence | Mailing Address |

| Alabama, Kentucky, Louisiana, Mississippi, Tennessee, Texas, a foreign country, American Samoa, Puerto Rico, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Island | Internal Revenue Service RAIVS Team Stop 6716 AUSC Austin, TX 73301 Phone Number: 1-855-587-9604 |

| Alaska, Arizona, Arkansas, California, Colorado, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Utah, Washington, Wisconsin, Wyoming | Internal Revenue Service RAIVS Team Stop 37106 Fresno, CA 93888 Phone Number: 1-855-800-8105 |

| Connecticut, Delaware, District of Columbia, Florida, Georgia, Maine, Maryland, Massachusetts, Missouri, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Vermont, Virginia, West Virginia | Internal Revenue Service RAIVS Team Stop 6705 S2 Kansas City, MO 64999 Phone Number: 1-855-821-0094 |

Business Mailing Address:

Internal Revenue Service

RAIVS Team

Post Office Box 9941

Mail Stop 6734

Ogden, UT 84409

Phone Number: 1-855-298-1145

OR

If you live in Maine, Massachusetts, New Hampshire, New York, Pennsylvania, and Vermont mail it to:

Internal Revenue Service

RAIVS Team

Stop 6705 S2

Kansas City, MO 64999

Phone Number: 1-855-821-0094