Form 944 Mailing Address 2023 - 2024

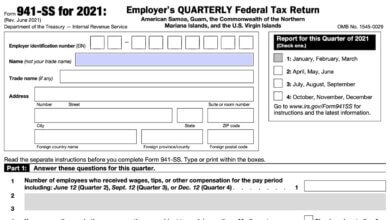

Not all employers are required to file Form 941 for every quarter if the taxes withheld is less than $1,000 for the tax year. These employers can file Form 944 once a year and be done with this tax obligation – reporting payroll taxes.

In a previous article, we’ve covered how you can file Form 944, including the online filing aspect of it and others. This article will present you with everything you need to know about where to file Form 944, things to keep in mind when preparing the form, and more.

Where to mail: Form 944

There isn’t a single mailing address Form 944 and where you’ll send the tax form depends on two factors: your state of residence and whether or not you’re enclosing payment with the form. However, if you’re paying online rather than sending it with money or check order, mail Form 944 to the address without payment. Here is where to mail Form 944 to taxpayers in every state.

| State | With Payment | Without Payment |

|---|---|---|

| Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, and Wyoming | Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 | Department of the Treasury Internal Revenue Service Ogden, UT 84201-0044 |

| Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, and Wisconsin | Department of the Treasury Internal Revenue Service P.O. Box 806532 Cincinnati, OH 45280-6532 | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0044 |

| No legal residence or place of business? Mail Form 944 to: | Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 | Internal Revenue Service P.O. Box 409101 Ogden, UT 84409 |

If you’re sending Form 944 for an exempt organization or government organization, including Indian tribal government entities, mail Form 944 to the following address.

With Payment:

Internal Revenue Service

P.O. Box 932100

Louisville, KY 40293-2100

Without Payment:

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0044