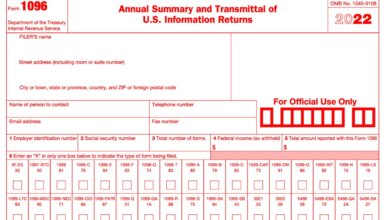

IRS Forms

Internal Revenue Service tax documents and forms. Get the tax forms that you need to file your taxes and perform your duties.

-

1099 vs. W-2

1099 vs. W-2: What’s the difference? In the U.S., the distinction between a 1099 and a W-2 is significant when…

-

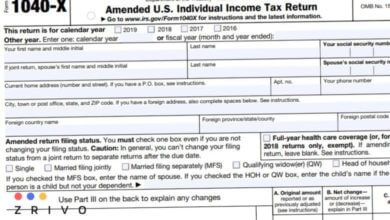

1040-X Form Instructions 2023 - 2024 Amended Tax Return

The 1040-X Form, officially named the “Amended U.S. Individual Income Tax Return,” is a document provided by the U.S. Internal…

-

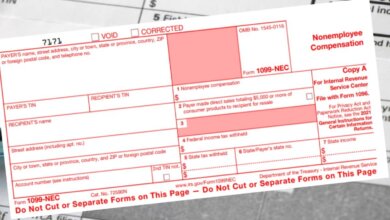

Form 1099-NEC Instructions 2023 - 2024

The Form 1099-NEC has been re-introduced by the IRS to specifically address the reporting of nonemployee compensation. It is paramount…

-

941 Instructions

941 Instructions: A Comprehensive Guide The 941 form, commonly referred to as the Employer’s Quarterly Federal Tax Return, is a…

-

941 Form 2023 - 2024

941 form: What is it? IRS Form 941 is a federal payroll tax form that employers must file quarterly to…

-

W-2C Form 2023 - 2024

Tax season can be a daunting time, but it’s essential to ensure your financial records are accurate. The W-2C form…

-

W-2G Form 2023 - 2024

Gambling can be a thrilling pastime, and for some, it can be quite lucrative. However, when it comes to reporting…

-

1040 Form 2023 - 2024

The tax year starts on January 1 and ends on December 31 every year. If you are going to file…

-

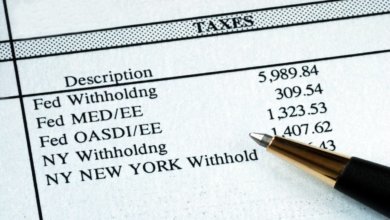

W2 Form 2023 - 2024

The W2 Form is used to report how much income tax you have paid to the government. This includes the federal…

-

W9 Form 2023 - 2024

The W9 form is an important IRS form for independent contractors and gig workers to file taxes. But there have…