IRS Forms

Internal Revenue Service tax documents and forms. Get the tax forms that you need to file your taxes and perform your duties.

-

PTIN Renewal 2023 - 2024

Preparer Taxpayer Identification Number (PTIN) is the taxpayer identification number used by tax professionals. PTIN Renewal is open for those…

-

W4 Form 2023 - 2024

Who Needs to Fill Out a W4 Form? Eligibility: Anyone who is employed in the United States and earns income…

-

Tax Documents Checklist 2023 - 2024

Why Is a Tax Documents Checklist Important? Avoid Penalties: Missing or incorrect information can lead to fines and penalties. Maximize…

-

Form W4 Spanish 2023 - 2024

Form W4 Spanish, also known as Form W4 SP is the employee’s withholding certificate in Spanish. Employees can fill out…

-

Form 8990 Instructions 2023 - 2024

If you are a taxpayer generating gross receipts of $25 million or more yearly, you will have to file Form 8990.…

-

1095-A Instructions 2023 - 2024

Health Insurance Marketplace Statement or better known as Form 1095-A is the form that summarizes the Marketplace premiums and other…

-

1099 Form 2023 - 2024

In June , the IRS announced that they were going to launch a filing portal special for the 1099 Form. This…

-

W7 Form 2024

Form W7 is the application for Individual Taxpayer Identification Number (ITIN) for aliens in the United States for tax purposes.…

-

Form 1099-MISC Instruction 2024

Form 1099-MISC is a tax form that reports miscellaneous payments made in a trade or business. The Form can be filled…

-

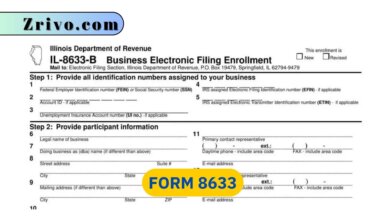

Form 8633

Individuals or entities seeking to become authorized e-file providers with the IRS must complete Form 8633. Tax professionals, including tax…