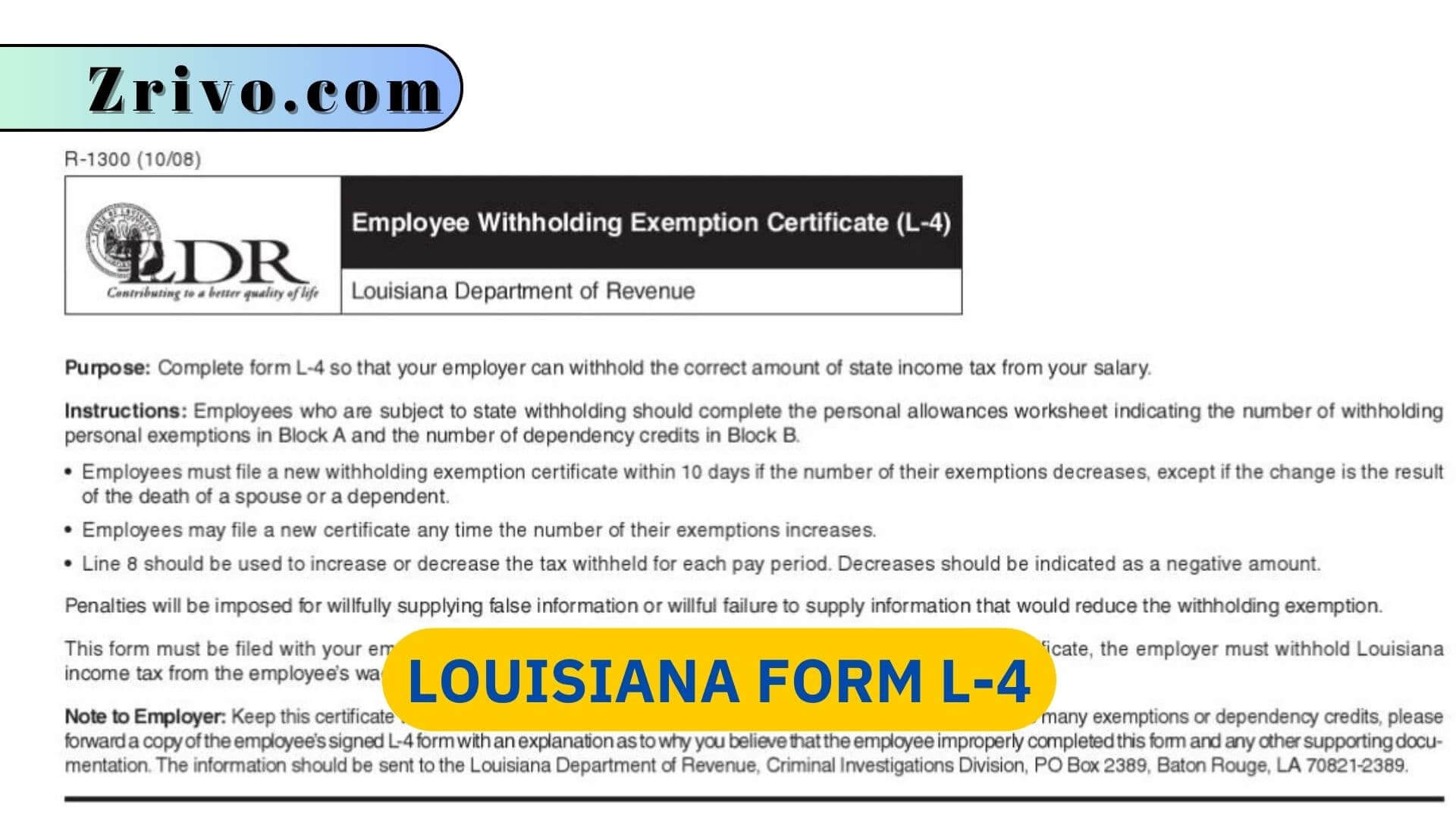

The Louisiana Form L-4, or Employee Withholding Exemption Certificate, is crucial for ensuring you have the correct amount of Louisiana state income tax withheld from your paycheck. If you’re working in Louisiana, you must complete this form and submit it to your employer. By completing the included worksheet, you indicate the number of allowances you’re eligible for, which takes into account factors like your filing status and dependents. This directly affects how much state tax is withheld from each paycheck.

The form also allows you to adjust the withholding amount optionally. Failing to file the L-4 or providing inaccurate information can result in penalties, so it’s important to understand your allowances and complete the form accurately. The Louisiana Department of Revenue offers the official form and instructions on their website to help you navigate this process.

How to Fill out Louisiana Form L-4?

Louisiana Form L-4 requires an employee to provide personal information such as their name, social security number, and address. They must also indicate their filing status as either single, married filing jointly, or head of household. Then, they must specify the number of allowances they are claiming. This will determine the amount of tax that is withheld from each paycheck.

During the filing process, an employee should ensure that they provide accurate information regarding their claimed exemptions and dependency credits. It is also important to note that an employer will not send this form to the State Department of Revenue.

The most common situations that call for an L-4 form are changing family circumstances (such as getting married or divorced, adding a new child to the household, or taking on a second job), making changes to one’s current withholding amounts, or starting a new fiscal year at a company. Employees who wish to change their withholding amounts should submit a new L-4 form within the next one to three pay periods.

How to I Become Tax-exempt in Louisiana?

You can become tax-exempt in Louisiana if you meet certain requirements. These include registering for sales tax, collecting and remitting taxes on your transactions, and claiming the appropriate exemptions. You must also file an annual reconciliation form at the end of each taxable year.

Some goods are exempt from sales tax in Louisiana, including most non-prepared food items and prescription drugs. Additionally, the state offers several incentives to attract and retain businesses, including industrial tax exemption programs and quality job rebates.