Sales Tax

Sales tax rates for all states. Find out what portişon of your purchases goes towards taxes.

-

Kentucky Resale Certificate

You can use a Kentucky resale certificate to buy goods or materials tax-free if you plan to resell them or…

-

Texas Car Sales Tax

The state of Texas has a car sales tax that is applied to every vehicle purchase. This tax varies by…

-

California Seller’s Permit

The California seller’s permit is required for anyone who sells tangible personal property in the state. This includes retailers, wholesalers,…

-

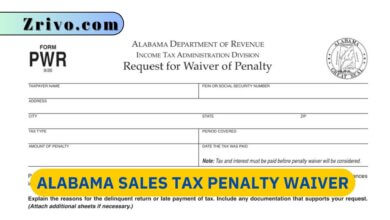

Alabama Sales Tax Penalty Waiver

The Alabama Department of Revenue (ALDOR) has several options for businesses that are behind on sales tax payments. You can…

-

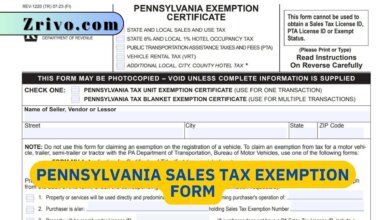

Pennsylvania Sales Tax Exemption Form

The Pennsylvania Department of Revenue recently launched an online application for nonprofit organizations seeking tax-exempt status. The tool is designed…

-

Washington Capital Gains Tax 2023 - 2024

Washington’s capital gains tax is a 7% excise tax on individual long-term capital assets above $250,000. The tax applies to…

-

Wyoming Sales Tax Exemption Certificate

If you have sales tax nexus in Wyoming and sell taxable goods or services to residents, you’re required to register,…

-

Wyoming Sales Tax 2023 - 2024

Wyoming’s state sales tax rate is 4%, and there are also additional taxes at the county, city, and special district…