Latest news

- Credits

How to Get a Utah Clean Energy Credit?

The Utah Clean Energy Credit (RESTC) is available for homeowners installing solar PV, wind, geothermal, biomass, or renewable thermal systems. It is not available for residential batteries and fuel cells. The credit is worth 30% of the system costs and…

- State and Local Taxes

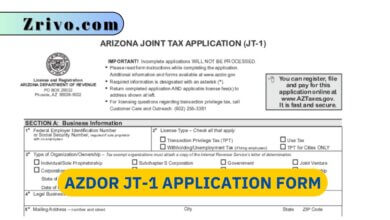

AZDOR JT-1 Application Form

The form is available online at the Department of Revenue website. It requires a number of pieces of information, including the legal name of the business and its physical address. It is also necessary to provide contact details and ownership…

- State Income Tax

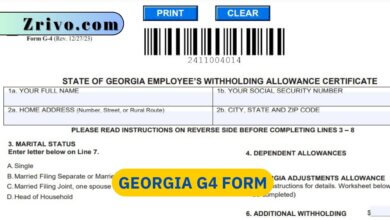

Georgia G4 Form 2023 - 2024

If you work in the state of Georgia, you must file a G4 form with your employer to report state income tax. You can complete the form on your computer or by hand. Once you have completed the form, sign…

- Finance

Where’s My Refund: Wisconsin

Whether you file your return online or on paper, the Wisconsin Department of Revenue is committed to processing refunds promptly. Its help center is staffed with representatives who can answer questions and address concerns. You should expect your refund to…

- Business

How to Get a Liquor License in Wisconsin?

The state of Wisconsin sets alcohol licensing rules and regulations, but local municipalities can also have their own ordinances. These can include quotas, reserve fees, and other restrictions. Liquor licenses are available for businesses such as restaurants, bars, and grocery…

Business

- State and Local Taxes

AZDOR JT-1 Application Form

The form is available online at the Department of Revenue website. It requires a number…

-

-

-

-

Finance

- Finance

Where’s My Refund: Wisconsin

Whether you file your return online or on paper, the Wisconsin Department of Revenue is committed to processing refunds promptly.…

-

-

-

Calculator

- Paycheck Calculator

New Mexico Paycheck Calculator 2023 - 2024

The question “How much is taken out of paycheck in New Mexico?” depends on several factors. These include the number…

-

-

-