Timing of Payments for 1099

The timing of payments for 1099-MISC is simple. You can send each recipient of Form 1099-MISC with a single payee statement to report all the payments types.

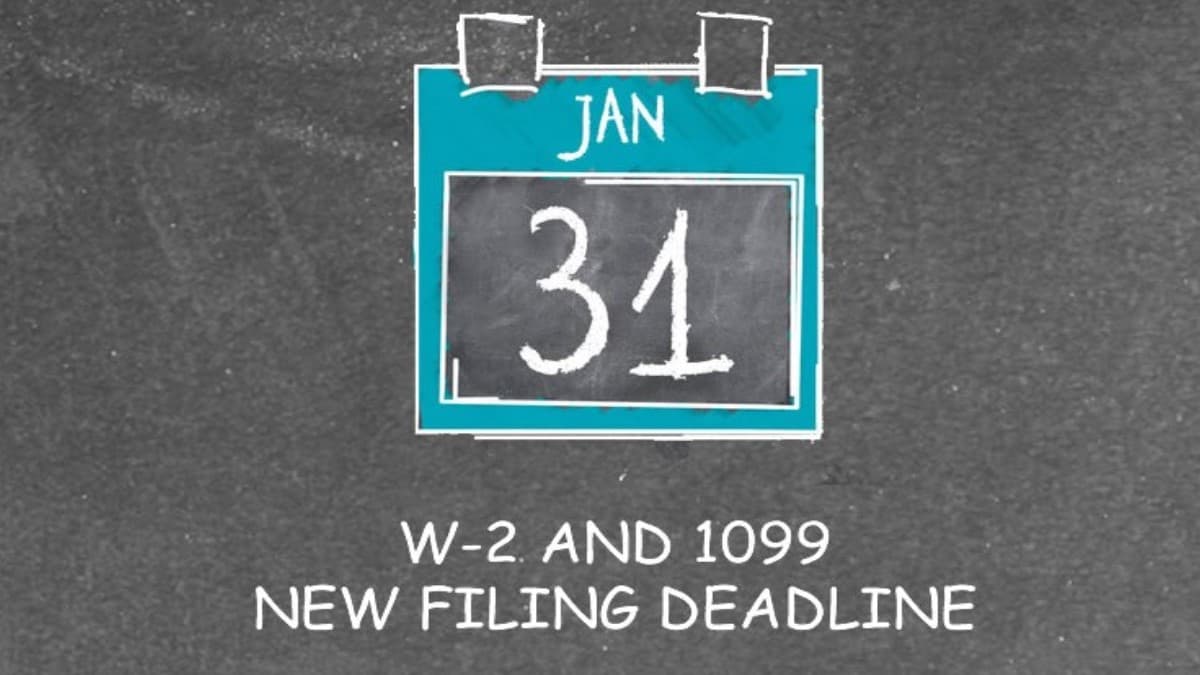

Form 1099-MISC timing is important because there are different deadlines that you should be aware of. You must furnish the recipients with a copy of Form 1099-MISC by January 31st. The deadline remains the same whether you e-file or send out a paper copy.

Here is when Form 1099 due shown on a table.

| Deadline to File with IRS (Paper) | February 28 |

| Deadline to File with IRS (e-file) | March 31 |

| Deadline to File to the Recipient | January 31 |

On the other hand, Form 1099-MISC is due with the IRS by February 28 if filing a paper 1099 or March 31 if e-filing. It is highly recommended to e-file not only because you get an extended deadline to file but to fulfill this tax obligation easily.

Along with sending out Form 1099-MISC to the recipient and the IRS, you must file Form 1096 with the IRS for every type of information return. Regardless of the number of Forms 1099 that you’ve filed, you can file a single Form 1096 transmitting the information reports summarized on an annual basis.