Where is My Stimulus Payment 2024

Contents

The Internal Revenue Service started giving the coronavirus stimulus checks. Apply to get yours online using the guide below.

Before we get into how you can apply for the stimulus checks, you may not be eligible. Your adjusted gross income on your 2024 tax return will determine this. For single filers, the stimulus checks completely phase out at $99,000. For joint filers, this is $198,000. The phaseout starts at $75,000 for single filers and $150,000for joint filers.

There is also an additional $500 given to qualifying individuals with children under the age of 17. The phaseout limits apply to this as well. By just doing the math, we can say for every $2,500 on adjusted gross income that exceeds the phaseout limit, the check will be reduced by $125. How to make your stimulus check application? How to check the status of your application? All is below.

Stimulus Check Application

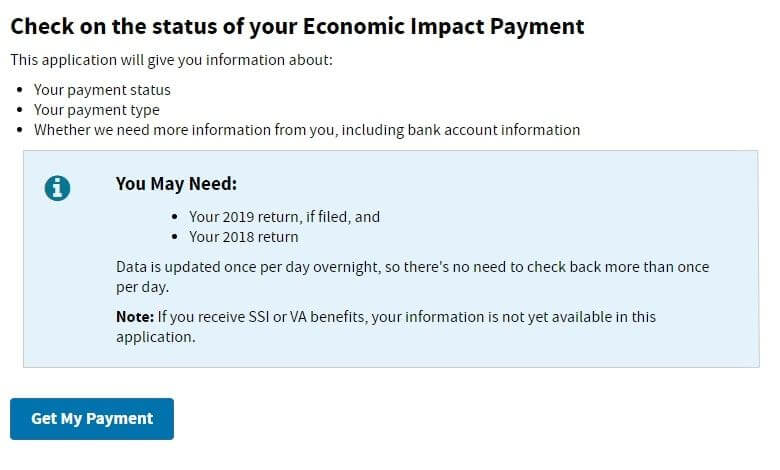

Since all aspects of life is moved online—at least the ones that can be, stimulus check applications along with many other federal and state provisions can be completed online. On IRS.gov, the page you’re going to make your stimulus payment application and check the status of it is the same.

It works similarly to the Where’s My Refund tool. After all, there is pretty much no difference between tax refunds and the stimulus payment as far as the IRS is concerned. Click here to open the IRS Get My Payment for applying to get your stimulus check or check the status.

Status of Stimulus Payments

Once you get to the link above, click on Get My Payment and enter the following.

- Social Security Number or Individual Taxpayer Identification Number

- Date of Birth

- Address

Then, click on continue and you’ll see the status of your stimulus payment. By any chance, if you get the “status not available”, it may be because you are not eligible for the stimulus check or your application hasn’t been processed yet. Also, those who receive SSI or VA benefits will not be able to track the status of their stimulus payment applications. For that, check in with the SSI or VA.

How Can I Check the Status of My Stimulus Payment?

To check the status of your 2024 stimulus payment, you have several options:

- Online Portal: The IRS provides an online portal where you can track the status of your payment. Visit the “Get My Payment” tool on the official IRS website and enter your information to get updates.

- IRS2Go Mobile App: You can also use the IRS2Go mobile app, available for both Android and iOS devices, to check your payment status on the go.

- Paper Notice: If you received a paper notice from the IRS, it will contain information about your payment, including the payment date and method.

Remember to have your Social Security number, date of birth, and mailing address or ZIP code ready when using these tools.

What Should I Do if I Haven’t Received My Stimulus Payment?

If you haven’t received your 2024 stimulus payment, follow these steps:

- Check Eligibility: Ensure that you meet the eligibility criteria for receiving a stimulus payment. Eligibility can depend on factors like income and filing status.

- Review Payment Method: Confirm that the IRS has your correct banking information for direct deposit. If you provided the wrong information or have since changed banks, you may need to update your details.

- Contact the IRS: If you’ve checked your eligibility and payment method and still haven’t received your payment, contact the IRS for assistance. They can provide guidance on your specific situation.

Here’s a comparison table summarizing the key differences between 2024 and 2023 stimulus payments:

| Aspect | 2024 Stimulus Payment | 2023 Stimulus Payment |

|---|---|---|

| Payment Amount | Amount determined by legislation at the time. | Amount determined by legislation at the time. |

| Eligibility Criteria | Eligibility criteria based on income, filing status, and dependents. | Eligibility criteria based on income, filing status, and dependents. |

| Payment Distribution | Payments distributed via direct deposit, paper checks, or prepaid debit cards. | Payments distributed via direct deposit, paper checks, or prepaid debit cards. |

| Payment Timeline | Timelines may vary but aim for quick distribution. | Timelines may vary but aim for quick distribution. |

| IRS Resources | “Get My Payment” tool and IRS2Go app for tracking payments. | “Get My Payment” tool and IRS2Go app for tracking payments. |