Where to send Forms W4?

Where to send Forms W4 filled out for adjusting tax withheld? The Internal Revenue Service suggests employees fill out Form W4 so that their employers know how much tax to withhold from their wages.

As an employee, you aren’t required to mail Form W4 to the Internal Revenue Service. You can simply fill out Form W4 for the 2023 tax year and hand it to your employer. Your employer will then use it to figure out the needed amount of income tax withholding. There is no place to send Form W4 because of this. You will simply furnish your employer with a copy of Form W4 – not the IRS.

On the other hand, employers may need to send Forms W4 to the Internal Revenue Service for certain employees. The IRS may ask Forms W4 to be sent to ensure that the given employee is withholding enough tax to pay at least 90 percent of tax liability.

Since the Internal Revenue Service requires taxpayers to pay at least 90 percent of tax liability during the tax year, it’s sometimes important for the IRS to keep track of it.

Having all this said, you aren’t going to send Form W4 to the IRS. The only occasion where you may need to send Form W4 is when you furnish your employer. There is no place to send Form W4 other than that.

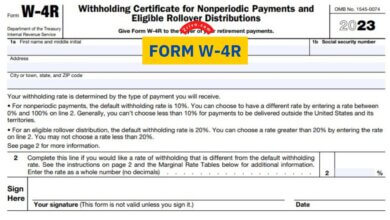

Where to mail my w4 for social security to the IRS? Live overseas,retired and have no employer