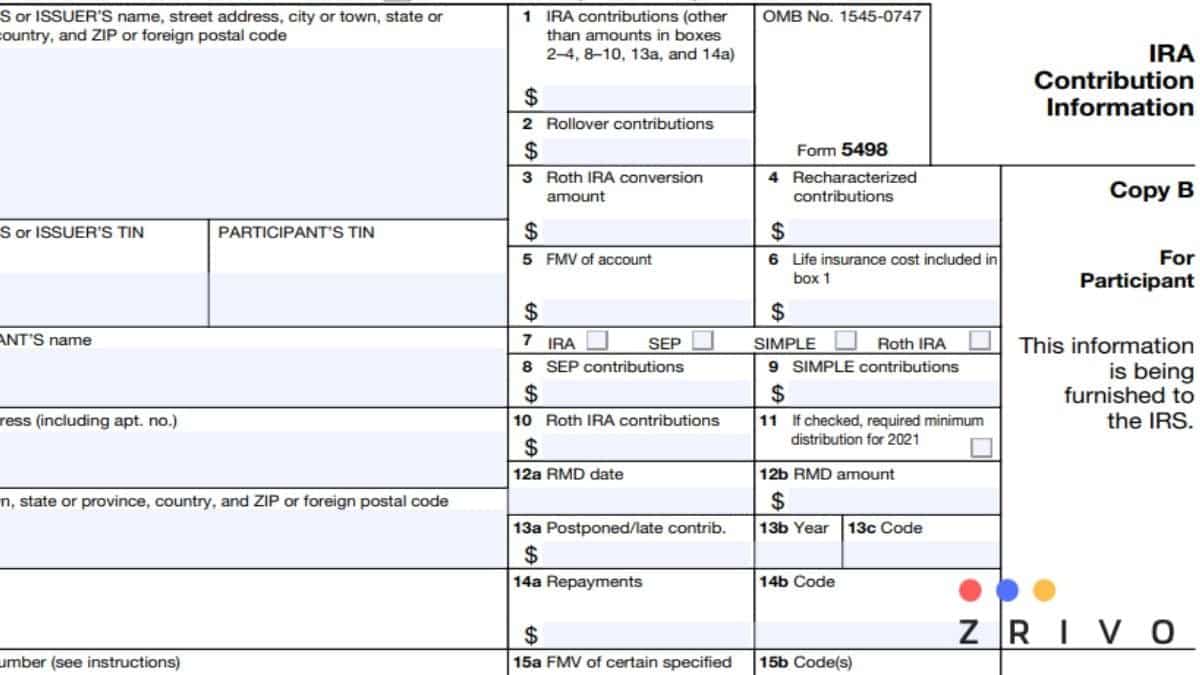

Form 5498—IRA Contribution Information is given to individuals who have an Individual Retirement Account to report contributions. You can think of Form 5498 as the W-2—Wage and Tax Statement.

It works the same way as the W-2 because it reports the contributions made but only for informational purposes. This tax form is also sent to the IRS. On your Form 5498, you will see:

- Contributions

- Rollovers

- Roth IRA Conversions

- Required Minimum Distributions

Do not mistaken Form 5498 with the Form 1099-R—Retirement Income. If you took a distribution from your IRA, you will be furnished with a 1099-R to report the income earned.

Distributions and Withdrawals on Form 5498

Those who need Form 5498 the most are retirees who are over 72 and older. This is due to the Required Minimum Distributions. Since Form 5498 will show the RMDs from the account for the year it’s filed, it will detail this amount.

In addition to those who are 72 and older, surviving spouses and minor children who inherit an IRA and elect not to roll over it into their accounts or withdraw funds on a five-year schedule need it.

Content of Form 5498

In order, you will see:

- IRA Contributions on Box 1

- Rollover Contributions on Box 2

- Roth IRA Conversion Amount on Box 3

- Recharacterized Contributions on Box 4

- FMV of Account on Box 5

- Life Insurance Cost Shown on Box 6

- State whether or not it’s an IRA – SEP – SIMPLE – Roth IRA on Box 7

- SEP Contributions on Box 8

- SIMPLE Contributions on Box 9

- Roth IRA Contributions on Box 10

- Box checked if RMD for the next tax year (current year) on Box 11

- RMD Date on Box 12a

- RMD Amount on Box 12b

- Postponed or Late Contributions on Box 13a

- Year and Code on Box 13b/c

- Repayments and Code on Box 14a/b

- FMB of Certain Specified Assets and Code on Box 15a/b

By law, you are required to be furnished with a Form 5498 by January 31st. If you haven’t received it by this date, contact the financial institution acting as trustee or custodian to ask whereabouts of your 5498.

Note: There have been certain changes due to COVID-19. This may push the date you normally receive your 5498. If that’s the case