Fair Market Value

Fair market value is a term used in many different settings, including real estate transactions, the IRS review of non-arms length sales to determine gift, estate, and capital gains taxes and insurance claims. It is important to understand what FMV is and how it's used in taxation.

Contents

Fair market value is a term that describes the price an asset would sell for in a free market. It is used in many different areas, including real estate and tax matters. It is also used in salary negotiations, business sales, and other transactions requiring an appropriate price estimation. In addition to being useful in real estate transactions, fair market value is also used in other types of business situations, such as mergers and acquisitions and insurance matters. The IRS also uses fair market value when assessing gifts of property or calculating charitable deductions. In some cases, a court may also rely on fair market value when deciding on equitable distributions and other legal matters. In all these scenarios, a professional such as an attorney or an appraiser can help determine a fair market value.

How to Calculate the Fair Market Value of a Property?

There is no clear formula for determining fair market value, but it can be determined by looking at various factors. These can include the cost or selling price of the asset, sales of comparable assets, replacement cost, and opinions of experts. The IRS has a table in Publication 561, reproduced below, that illustrates some major factors influencing fair market value.

One way to determine the fair market value of a home is by looking at comparable homes, or comps, that have recently sold in the area. An agent preparing a comparative market analysis can use these properties to estimate the fair market value of a home, and an appraiser will include them in an appraisal report.

Other factors that could influence the fair market value of a property include location, condition, and amenities. If you’re interested in learning more about determining your home’s fair market value, speak with a financial advisor today.

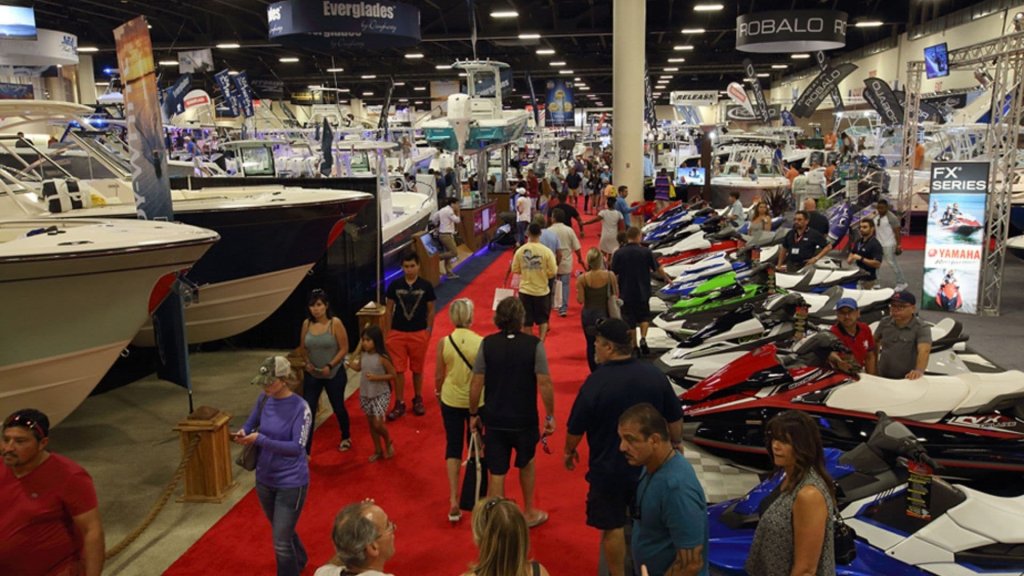

How to Calculate the Fair Market Value of a Boat?

When determining the fair market value of your boat, it’s important to take into account all of the factors that affect its worth. The most obvious factor is the condition of the vessel. If your boat has been damaged or needs repairs, it will depreciate in value, even if it has other positive qualities. A marine survey is a great way to independently assess your boat’s condition and valuation. The report is designed to help you make an informed buying decision, and it will also provide a document that can be used for insurance purposes.

A professional, licensed marine surveyor who is familiar with your type of boat should perform a marine survey. The surveyor will assess the boat’s condition and determine if it meets U.S. Coast Guard regulations and nationally recognized standards. It will also give you a good idea of how much the boat is worth, so you can set a reasonable asking price.

Another factor that can impact the fair market value of your boat is its location. If the boat is located in a remote area, it may be harder to find buyers, which could reduce its value. Similarly, if the boat is located in an area that experiences frequent storms or flooding, it may be less desirable for buyers.

Finally, the equipment on the boat can significantly impact its value. A well-documented maintenance schedule and recent upgrades are often attractive to potential buyers, as are simple cosmetic improvements such as a fresh coat of wax or a thorough cleaning.

How to Calculate the Fair Market Value of a Car?

It is important to note that the fair market value of a vehicle may not always be the final sale price. For example, you may be willing to sell your car for $100, but that does not mean it has a fair market value of $100.

- One of the best ways to determine a fair market value is to look at prices for comparable vehicles in your area.

- You can find these in online used-car guide sites.

- You can also calculate the fair market value of your car by entering its details on an automobile industry website. These sites offer tools to enter your vehicle’s information, including the options and mileage.

- Such tools offer a range of pricing for vehicles based on factors like location, vehicle sales trends, and equipment. They can also help you calculate dealer invoice pricing and MSRP.

- Alternatively, you can check local used car listings to see what other sellers are asking for their vehicles.

These methods are easy to use and can help you get the most accurate valuation for your car. However, it’s important to look fairly at the value of any asset you buy or sell, or else you could face accusations of fraud. However, as long as you make a reasonable attempt to get an accurate number, you should have little to worry about.