California Seller’s Permit

If you sell tangible property in California that is subject to sales tax, then you need a seller's permit.

The California seller’s permit is required for anyone who sells tangible personal property in the state. This includes retailers, wholesalers, and service providers. It is important for businesses to know the requirements for this permit so they can avoid fines and other legal consequences.

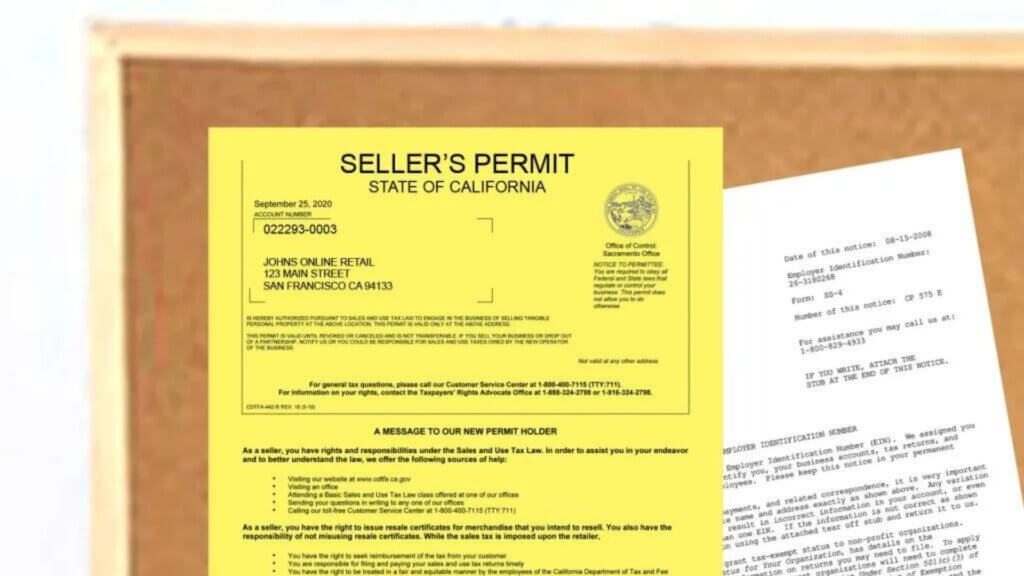

Obtaining a seller’s permit is easy and free in the state of California. You can do so online through the California Department of Tax and Fee Administration (CDTFA). Once you’ve registered for an account, you can access your business tax information quickly and file your required documents. You can also file your documents in person at any CDTFA field office.

When you fill out the application for a California seller’s permit, you must provide several pieces of information. This includes your home and business mailing addresses; how you will process sales; supplier information; estimated monthly sales; and more. You should also include a security deposit, which the state will hold if you fail to pay your taxes.

The california seller’s permit aims to ensure that sales tax is collected and remitted. Verifying that your current recordkeeping system is thorough and accurate is important. Otherwise, you may miss a crucial deadline and incur penalties. Mosey offers solutions that can help you stay on track with compliance. Schedule a demo to learn more about how our tools can make your job easier.

How to Apply for a California Seller’s Permit?

You must apply for a seller’s permit before you begin selling taxable goods in the state of California, and you may need to submit a security deposit when applying.

The application requires a wealth of information, including your social security number or another personal ID number; the date you founded or modified your business; bank and supplier details; estimated monthly sales; and contact information for your bookkeeper or accountant. It’s important to complete the form accurately to avoid any penalties or fines. A business that makes a mistake in submitting its sales tax data can face fines of up to $10,000. In addition, if you close your business or stop selling products, you must notify the CDTFA so that they can cancel the permit.