Colorado Form DR 0024 – Standard Sales Tax Receipt For Vehicle Sales

DR 0100 reports state sales tax, county sales tax, and any statutory city sales tax for home rule cities (home rule cities self-collect sales taxes). It also shows the purchaser's and dealer's addresses.

Colorado Form DR 0024 is filed by the dealer when a vehicle sale is made. The form can be filled out in person or online and must be signed by the seller(s) and odometer reading acknowledged. It is submitted with the Title Packet to the county. It is required for all dealers and lienholders.

If one or more owners’ names are listed differently on the odometer disclosure, the odometer must be updated to reflect the new ownership information. In addition, the odometer statement must be signed by both owners to indicate that they agree with the information. If the odometer was filled out incorrectly by an employee or another party, a DR 2424 correction statement must be attached.

A sales tax exemption number is not automatically granted to any entity in Colorado. To be exempt, a corporation must apply to the IRS for a federal determination of exemption and meet strict criteria. Individuals may also apply to the state of Colorado for an exemption number by submitting their articles of incorporation or of organization and financial statements.

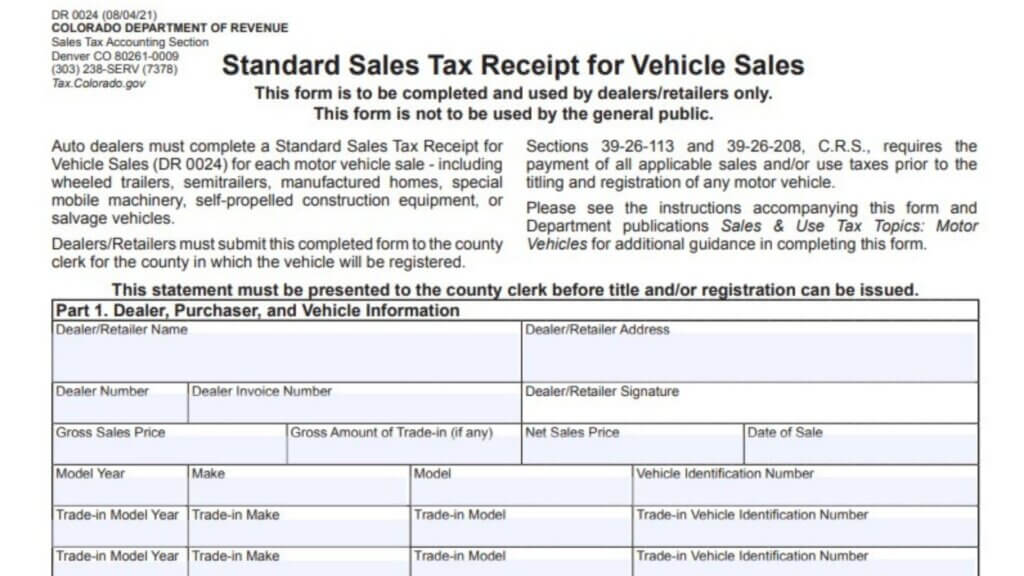

How to Fill out Colorado Form DR 0024?

The process of submitting Colorado Form DR 0024 does not have to be complicated anymore. Nowadays, people tend to get through paperwork entirely online from their apartment or workplace using an intuitive digital solution. Such a tool provides a variety of useful instruments for handling any document that can be signed and sealed without the need to go to a physical office.

The application form asks for information about the vehicle purchase, including the gross sales price of the car, the dealer’s name and address, the city where tax is collected and remitted, the county where the sale took place, and the sales/use tax rate in each jurisdiction. The form also includes fields for claiming an exemption from sales tax and indicating whether or not the purchaser itemizes deductions.

Auto dealerships must complete this form for each motor vehicle sale. This includes wheeled trailers, semitrailers, manufactured homes, special mobile machinery, and self-propelled construction equipment. In addition to the purchase price of a vehicle, the sales/use tax receipt must include all fees, charges, and discounts related to the vehicle. It is important to carefully itemize these items to apply the appropriate sales/use tax.

The application can be filled out on an individual basis or completed by a business entity. A person who is exempt from paying sales/use tax can submit the form along with a valid sales/use tax exemption certificate (DR 0715). A valid exemption certificate is one that has a start date of 2021 or later and is not expired.