What Does the Nebraska Department of Insurance Do?

The Nebraska State Insurance Department accepts, researches, investigates, and resolves individual consumer complaints against insurance companies.

Contents

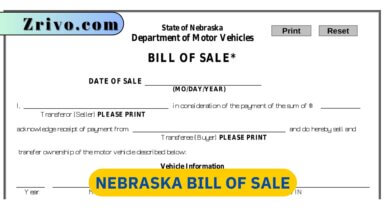

Whether you are an insurance consumer, producer, or interested in becoming licensed to sell Nebraska property and casualty insurance, the Nebraska Department of Insurance has many helpful resources. Nebraska law requires insurance companies to affirm or deny life, sickness, and accident claims within fifteen days. Insurers must also send a claimant the necessary forms and offer reasonable assistance in filling them out. Nebraska laws protect the privacy of insurance consumers. Insurers may not disclose nonpublic personal financial information to third parties without written consent from the consumer.

Nebraska Producer Licensing

Insurance producers (agents and brokers) who wish to sell, solicit, or negotiate insurance in the United States must be licensed to do so. State insurance departments oversee producer activities as part of a comprehensive regulatory framework designed to protect consumer interests in insurance transactions.

Before becoming a licensed insurance producer in Nebraska, you must successfully complete pre-licensing education and pass the state licensing exam. Nebraska offers one exam for each line of insurance: property and casualty, life & annuities, and accident & health. You should study for one line at a time and take the exam only once you are confident in your knowledge. The exams are administered by Prometric and are computer-based.

Once you are licensed, you must maintain your license by completing the required continuing education credits. Continuing education requirements vary by state, but most insurance producers must obtain 24 hours of CE each renewal period. This includes three hours of ethics training. You should use a state-approved provider to meet your continuing education needs.

Nebraska Company and Producer Search

The Nebraska Department of Insurance has partnered with State Based Systems (SBS), a National Association of Insurance Commissioners business partner, to provide you with access to the Nebraska Producer and Company Lookup. Using this tool, you can search for the name and licensure status of licensed property and casualty agents or companies in the state of Nebraska.

Licensing is the first step in becoming an insurance agent in Nebraska. Once you’ve completed your pre-licensing education, passed your Nebraska state exam, and received your license, the next step is to find the right coverage for your customers. Our local insurance agents are ready to help you understand the specific needs of your customers and connect them with the policies that will give them confidence to take on life’s risks.

In order to renew your Nebraska insurance license, you must complete the required number of continuing education (CE) hours prior to your licensing expiration date. You can renew online via NIPR once you have completed the CE courses. You should do so 60 days before your license expires to ensure the CE course provider has ample time to report your completion to NIPR.

Insurance Consumer Complaints

The Nebraska Department of Insurance also investigates insurance consumer complaints. Consumers who believe their insurance company or producer has treated them unfairly can file an insurance consumer complaint. The complaint is then examined to determine if the insurance company or producer violated Nebraska’s insurance laws.

Once a complaint is filed, the Consumer Affairs Investigator assigned to the case will notify the insurance company or producer of the complaint. The agent or producer is then provided fifteen business days to respond to the consumer complaint. The Consumer Affairs Investigator will then advise the insurance consumer of the outcome of the investigation.

Insurance consumers are encouraged to check their insurance policy’s “suit against us” deadline. If no lawsuit deadline is specified, a suit should be filed within 12 months of the date of loss or the date the insurance company closes the claim.