Form 1041 is an IRS tax form filed by a trustee or representative of an estate or trust to report taxable income the estate or trust generated after the death of the decedent. It is a part of Section 1041 of the Internal Revenue Code and must be submitted by the 15th day of the fourth month following the close of the tax year. In most cases, a trust or estate must file Form 1041 if it has a gross income of $600 or more during the tax year or if any of its beneficiaries are nonresident aliens. However, if the income is from a pooled income fund, an electing small business trust, or a qualified disability trust, an alternative reporting method may be available to allow these entities to avoid filing Form 1041.

How to file Form 1041?

- The first step in preparing Form 1041 is to gather information about the assets the estate or trust holds and their potential income. This includes information about interest, dividends, capital gains, trade or business activity income, rental property, charitable contributions, and any other types of income generated from the trust or estate.

- Once the information is gathered, you can then fill out Form 1041 and complete other IRS forms to report the income generated by the trust or estate. To report interest and other taxable income, you will use Schedules C, E, and F (or S in the case of an S-corporation). Irrevocable trusts must also file a form to get an employer identification number (EIN). The EIN is used on the 1041 and other tax returns, such as Form 706. If you are filing for the first time, apply for the EIN online or by mail.

- You can also report capital gains or losses on Schedule D. These must be submitted along with Form 1041 and can include the sale of any assets owned by the estate or trust during the year.

- You can also claim deductions for expenses incurred by the estate or trust, such as attorney, accountant, and fiduciary fees. The IRS allows you to include this information with Form 1041 as long as it is in the right place and doesn’t exceed the amount of tax-exempt income.

How to fill Out Form 1041?

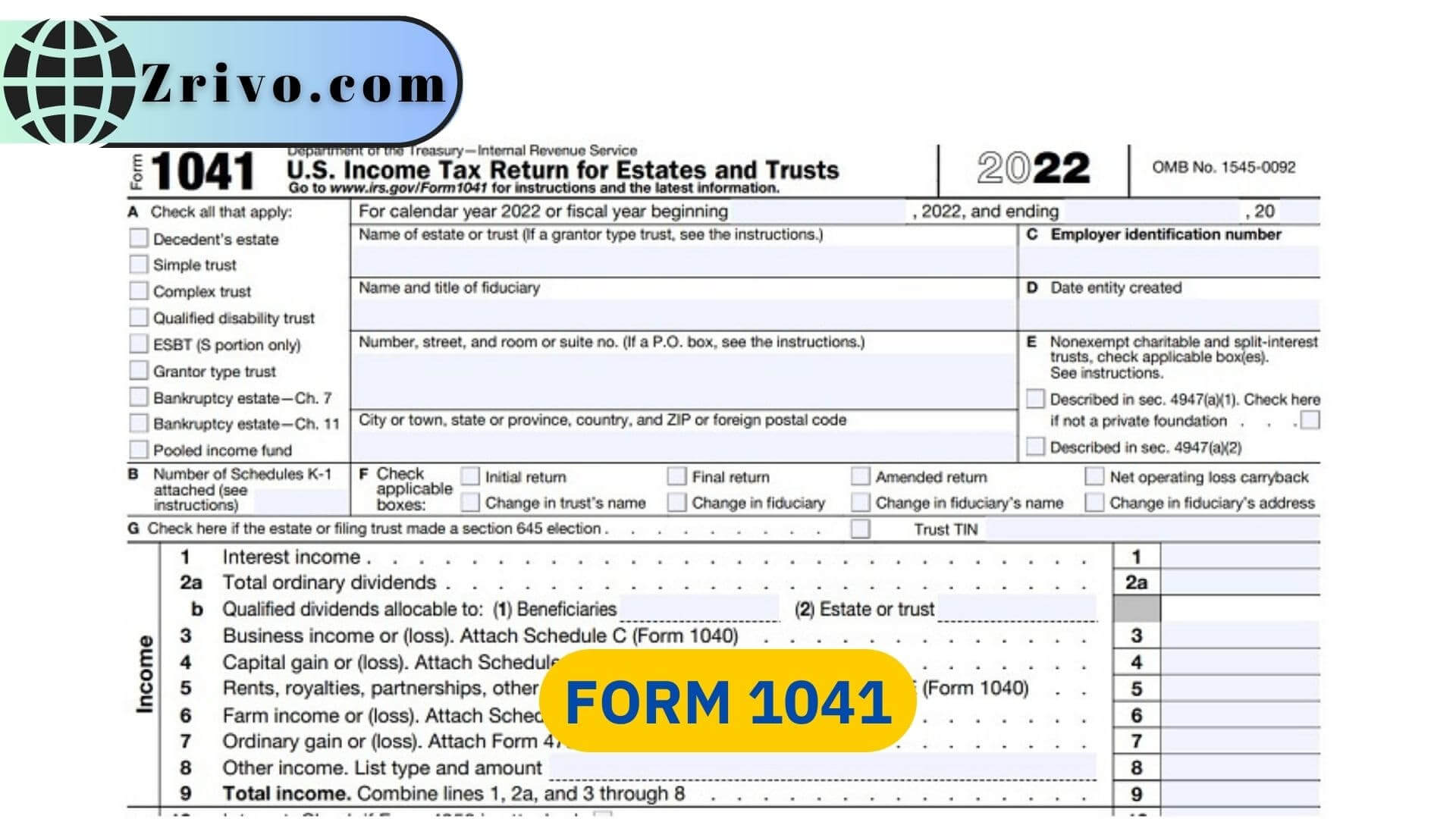

- Enter the estate or trust’s name, address, and tax identification number in the top section of Form 1041. Indicate whether the entity is a trust, estate, or bankruptcy estate.

- Check the box next to the calendar year or fiscal year you are filing the return.

- Provide the fiduciary’s name, address, tax identification number, and the person responsible for keeping the records.

- Report all income received by the estate or trust during the tax year. This includes interest, dividends, capital gains, rental income, and other types of income. Be sure to include all income, even if it was paid directly to the beneficiaries.

- Report all deductions taken by the estate or trust during the tax year. This may include trustee fees, attorney fees, and other administrative expenses. Be sure to include all allowable deductions.

- Subtract the total deductions from the total income to arrive at the taxable income for the estate or trust.

- Use the tax tables in the instructions to determine the tax liability for the estate or trust. Alternatively, use tax software to calculate the tax liability.

- Enter the tax liability, credits, and payments in Part 4. Calculate the total tax due or overpayment and enter it on line 22.

- If necessary, complete Schedules A, B, and G to provide additional information about deductions, beneficiaries, and transfers.

- Sign and date the form.