Form IT-2104 must be filed by employees who work in New York State and want to adjust their withholding allowances or claim exemptions. This form allows you to ensure the correct amount of state income tax is withheld from your paycheck. You can obtain Form IT-2104 from the New York State Department of Taxation and Finance website (https://www.tax.ny.gov/forms/). You can print out a copy of the form or request a physical copy from your employer or local tax office. After you have the copy, complete the form with the necessary information.

Form IT-2104 Instructions

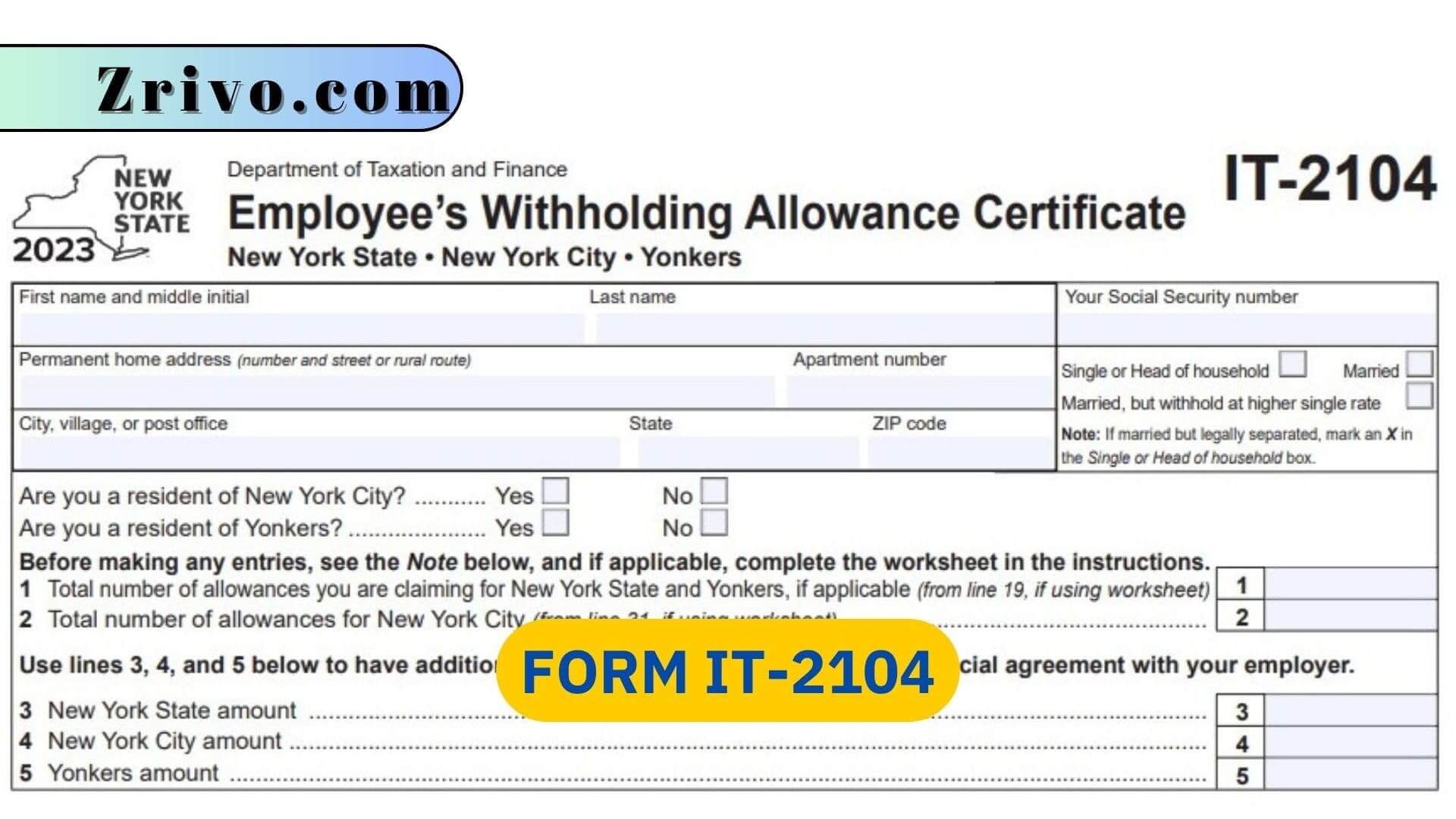

- First, you will provide your personal details, including your full name, social security number, address, and filing status (e.g., single, married, head of household).

- Then, if you believe you qualify for an exemption from New York State withholding, indicate it in Form IT-2104. Exemptions may apply if you expect to have no New York State tax liability for the year. Examples of situations that might qualify for an exemption include being a non-resident for tax purposes or having no New York State tax liability in the previous year.

- If you want extra amounts withheld from your paycheck to cover any additional tax liability, you can indicate the additional withholding amount on Form IT-2104. This may be useful if you have other income sources or anticipate owing more tax.

- The withholding allowance determines the New York State tax amount to be withheld from your wages. The more allowances you claim, the less tax will be withheld. The form provides a worksheet to help you calculate the appropriate number of allowances based on your personal situation, such as dependents, deductions, and credits.

- In the Certification part, sign and date Form IT-2104 to certify that the information you provided is accurate. By signing, you acknowledge that any false statements or omissions may result in penalties.

If your personal or financial circumstances change during the year and you need to adjust your withholding allowances or additional withholding amount, you can complete a new Form IT-2104 and submit it to your employer. It’s important to keep your withholding allowances up to date to ensure the correct amount of tax is withheld from your paycheck.

Once you have completed the form, provide it to your employer’s payroll or human resources department. They will use the information on the form to calculate the appropriate New York State income tax amount to withhold from your wages.