If you work at a company that pays out nonperiodic payments or eligible rollover distributions from an employer retirement plan, annuity, or individual retirement arrangement (IRA), your company needs to withhold federal income tax from your paycheck based on the information on your Form W-4R. This is to ensure that you don’t owe taxes or penalties when filing your tax return in April.

To match individuals’ withholding instructions to changes in tax law, the IRS has redesigned Forms W-4P and W-4R. These forms include substantial changes to the federal tax withholding elections available. You can file a new Form W-4R with your pension company to change your tax withholding on your monthly retirement income. If you’re a pension participant, your company will need to send the new Form W-4R to the IRS along with your withdrawal request.

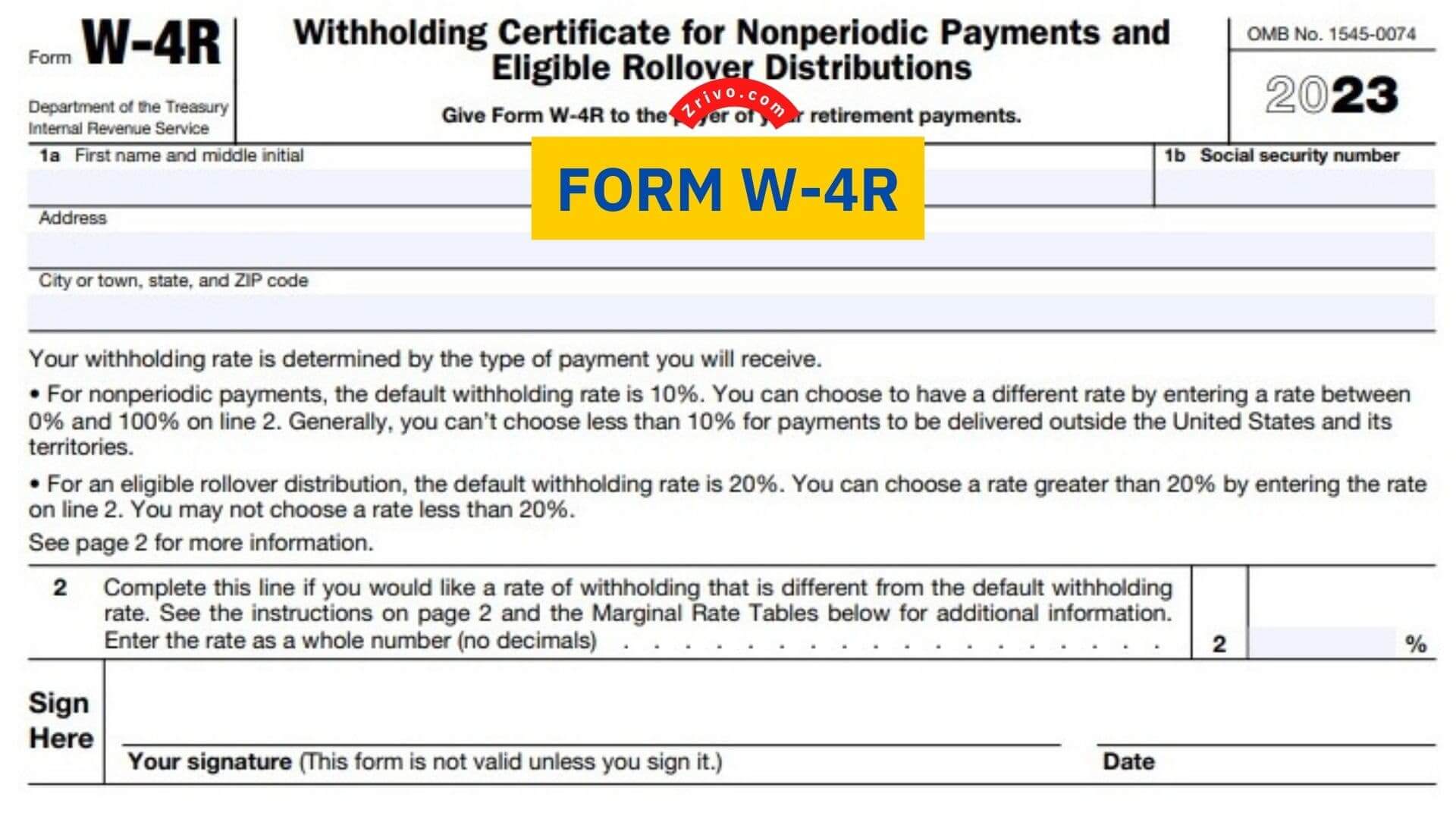

How to Fill Out Form W-4R?

Filling out Form W-4R is not a complicated form to fill out, but it’s crucial that you do so correctly if you want to get the most out of your paycheck and minimize your tax bill at tax time. To fill out Form W-4R, you need to provide the following personal information:

- Name

- Address

- Social Security number

- Filing status.

You can also enter your spouse’s or other dependents‘ information if you have them. Depending on your situation, you may need to fill out different sections of the W-4R. However, the most important portions are the ones that are required for everyone.

- The first portion of the form asks you to state whether or not you plan to claim exemptions from withholding. If you do not want to, then skip this step and just enter the information about your dependents in the second portion of the form.

- In the next section, you can choose to claim a certain number of withholding allowances. The number of withholding allowances you choose here determines how much your employer will withhold from each paycheck.

- Another important portion of the form asks you to estimate the amount of additional income you will receive during the year. This extra income could come from capital gains, interest on investments, or self-employment. You can also estimate the amount of any deductions you are planning to claim.

- Finally, you can adjust your withholding allowances if you anticipate claiming other deductions or credits on your tax return. These adjustments are important because they ensure your employer withholds the correct amount of federal income tax from your paycheck throughout the year.