Arkansas Gross Receipts Regulations

Arkansas gross receipts tax regulations are outlined by the Arkansas Department of Finance and Administration (DFA) Division of Revenues

Arkansas gross receipts regulations require businesses to report their monthly earnings. These earnings are the sum of all sales before subtracting expenses or bad debts. Businesses must pay the state tax, which is 6.5%. The state also levies local sales and use taxes. Membership fees are not taxable. See GR-11 for more information.

Sales tax

The sales tax is a state tax that must be paid on the value of the goods and services you sell. The amount of tax you owe depends on your business type and the state where it is located. A business’s gross receipts are the total amounts of money you receive from your products and services before subtracting any expenses or bad debt deductions. This figure is usually calculated monthly, quarterly, or yearly. It includes the value of all goods and services and any taxable royalties, fees, commissions, and dividends you receive from a business venture.

Some items are exempt from sales taxes, including charitable organizations and nonprofits. Nonprofits that are 501(c)(3) are generally exempt from paying sales and use taxes, but you must still report them on your IRS tax statement. You may also be subject to other local and county taxes.

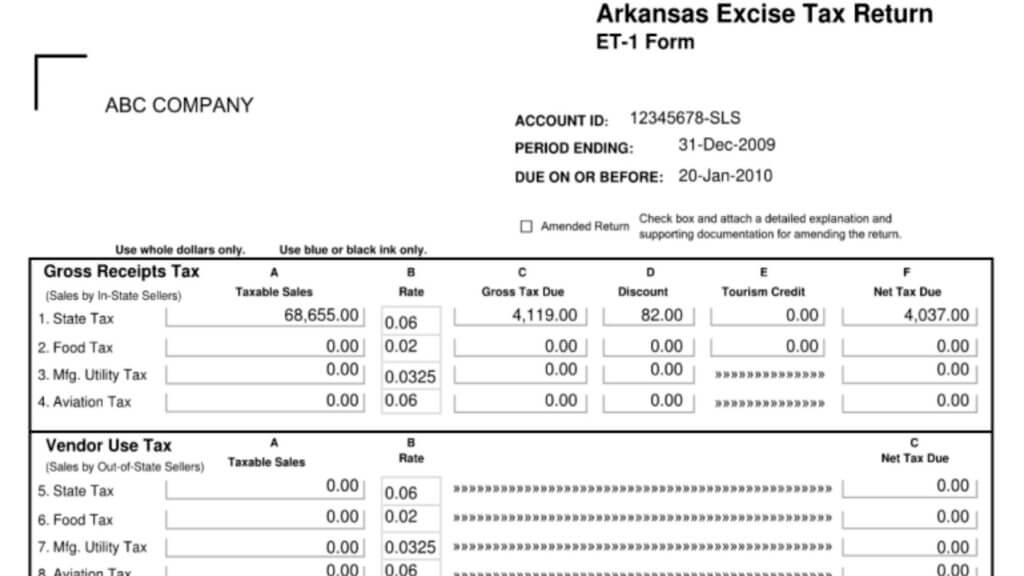

The sales tax in Arkansas is six percent, and it covers most goods and services. The exceptions are alcoholic beverages (which are subject to additional taxes), tobacco, and dietary supplements. Food is also taxed at two percent. The definition of “food” for purposes of this tax is any substance, in liquid, concentrated, solid, frozen, dried, or dehydrated form, sold for ingestion or chewing and consumed for its taste or nutritional value.

Excise Tax

If you’re a business owner that sells goods to customers in Arkansas, you may be subject to gross receipts taxes. These taxes are levied by the state department of finance and administration, and they can be complicated to navigate. In addition to a base sales tax rate, Arkansas also has local rates and city rates that apply depending on where your business operates.

The definition of taxable goods is broad and includes services and certain tangible personal property like machinery and equipment. The tax is calculated on the amount of the transaction, and it may be passed on to the consumer. It is also possible to use bad debt deductions to reduce the net amount of the taxes due.

Some customers are exempt from paying sales and excise taxes. These include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. To qualify for an exemption, the purchaser must present a valid certificate. The seller may use a blanket certificate to cover multiple transactions with the same buyer as long as it includes all the information required for a resale certificate.

You must have a physical presence in Arkansas to be required to collect sales and excise taxes. This is called nexus. Examples of nexus include:

- Maintaining retail facilities or warehouses.

- Having an office in the state.

- Storing inventory in Arkansas.

It also includes affiliate nexus, which occurs when you have a connection with another business or person that’s located in the state.

Bad Debt Deduction

A bad debt deduction is a special exception to the gross receipts tax that allows a business to deduct certain expenses. It is usually calculated quarterly or yearly, and it includes the total amount of cash and property received by the business during the tax year. It excludes any other deductions, such as cost of goods sold or deductible expenses.

The gross receipts tax applies to sales in Arkansas made by businesses with a taxable business license. The taxes are collected by retailers and passed on to the Department of Finance and Administration. The tax is also imposed on rental fees for long-term leases of tangible personal property, including motor vehicles. In addition, the tax is imposed on the sale of beer and other alcoholic beverages.

It is important to understand the rules of the gross receipts tax before determining how much your business should pay. The rules vary from state to state, but in general, you will need to collect the tax on each sale of tangible personal property that is delivered or shipped to a buyer in this state. Typically, this includes each sale of merchandise at retail price and any sales that are delivered or shipped to a buyer from outside the state. However, certain types of income are not taxable, such as interest earned on loans.

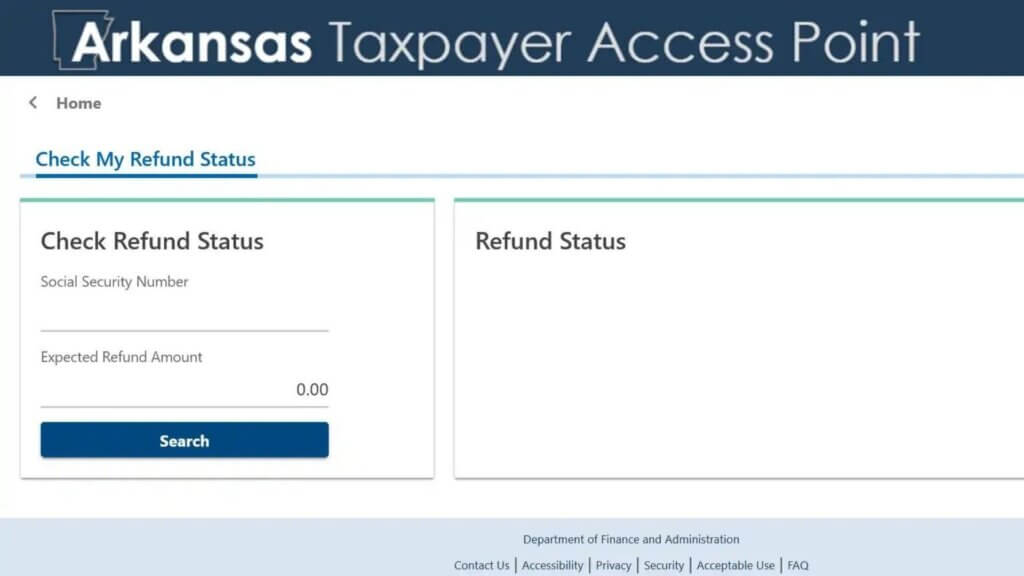

Refunds

A business owner in Arkansas who collects sales and use tax must file a gross receipts report with the Department of Finance and Administration. This report identifies the amount of sales and use tax collected each month. It also includes details about the taxable goods and services, as well as exemptions and bad debt deductions. A copy of the report must be provided to any consumer who is entitled to a refund.

In addition to sales and use taxes, the state also levies a gross receipts tax on some services. Taxable services include gas, water, electricity, solid waste disposal, telephone, and prepaid telecommunications. The tax on these services is calculated by multiplying the sales and use tax rate by the service provider’s gross receipts.

Generally, the gross receipts tax is imposed on both retail and wholesale transactions. However, some exemptions apply to certain types of items or activities. For example, a manufacturer may claim an exemption for repairs and replacement parts purchased to modify, replace, or repair manufacturing machinery and equipment. This exemption is also available for food that is sold in public school cafeterias.

The gross receipts tax rates vary depending on the type of business and the location. Some cities and towns impose additional local sales taxes. In addition, some businesses may be required to obtain a special permit from the city or town before collecting the tax.