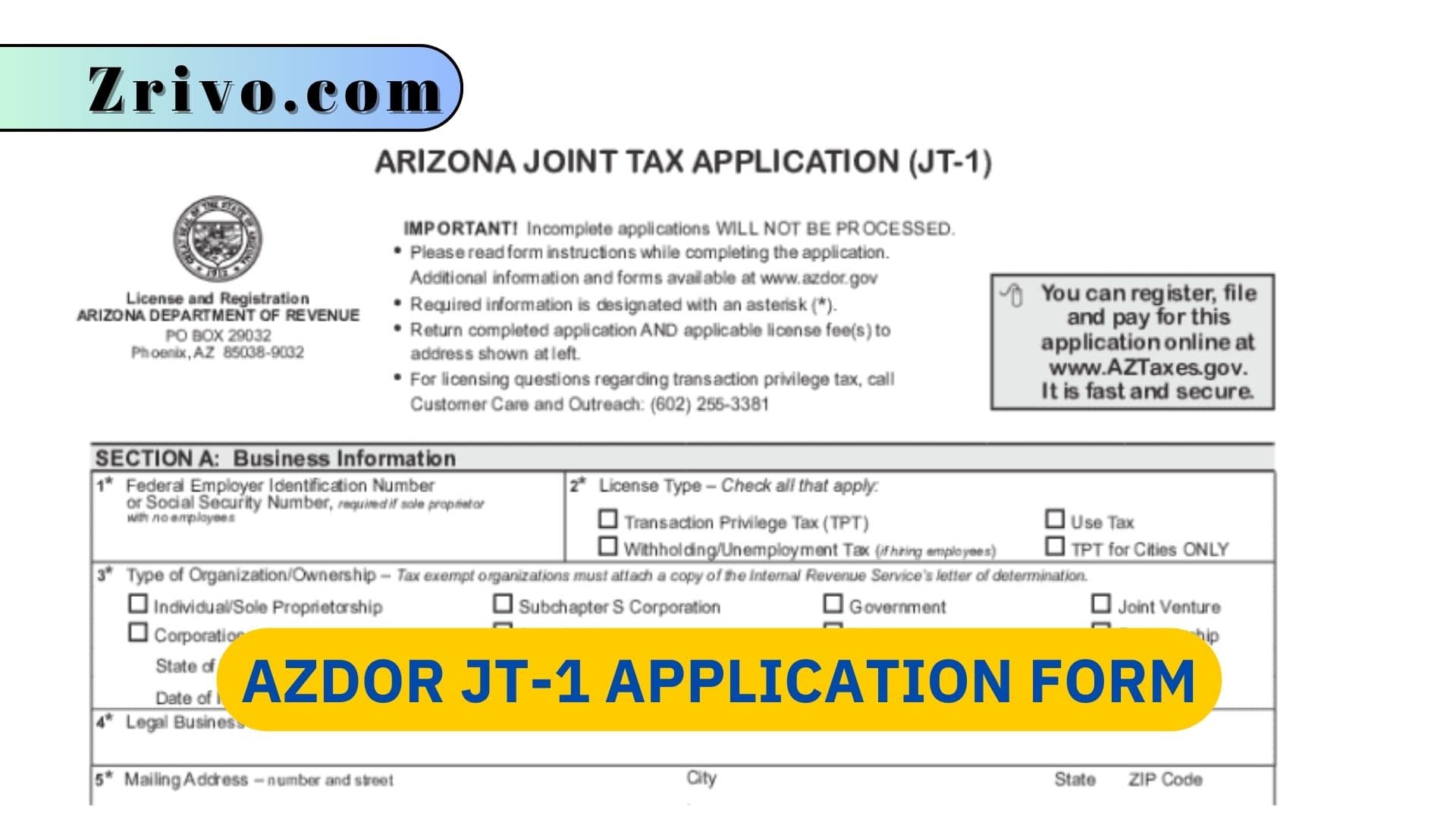

AZDOR JT-1 Application Form

To start a business in Arizona, you must file a JT-1 form. The form collects important information about the business. It also helps you meet local tax obligations. It is critical to fill out the form accurately. Failure to do so could result in penalties and legal trouble.

The form is available online at the Department of Revenue website. It requires a number of pieces of information, including the legal name of the business and its physical address. It is also necessary to provide contact details and ownership information. The information you provide on the JT-1 form will become part of your official record. This record may be useful for future reference or audits.

If you are applying for a transaction privilege tax license, you must complete Section B of the form. In this section, one or more sole owners, partners, corporate officers, managing members, trustees, receivers or personal representatives must type or print their names, give their title and the date and sign the form. You must also provide information about the NAICS code, and a description of your business.

Once you have finished the application, you must submit it to the Department of Revenue. The department will notify you of the status of your application. If the department approves your application, you must pay the required fees.

How to Fill Out Arizona Joint Tax Application JT-1

This standard form is used by many states and localities to collect essential information about businesses. It serves as a one-stop shop for reporting your business details to tax authorities and obtaining the required licenses to operate legally in the jurisdiction. It also helps you stay in compliance with the law and avoid penalties for late filing or non-payment of taxes.

The basic information required in the application includes your business name, legal structure (sole proprietorship, partnership, corporation, or LLC), and mailing address. You must also indicate your federal Employer Identification Number (EIN) if applicable. In addition to these general requirements, some businesses are required to register for industry-specific taxes.

For example, if you are a contractor, you will need to provide information about your business, including the types of services provided and their value. You will also be asked to list any state and city business income taxes for which you are liable. If you purchase products for resale, you must provide a resale certificate to your vendors.

Using a tax software solution to fill out AZDOR JT-1 forms can save you time and effort by allowing you to easily edit the document on any device. such tools are easy to use and come with advanced features, including adding text fields, rearranging pages, creating watermarks and page numbers, and more.