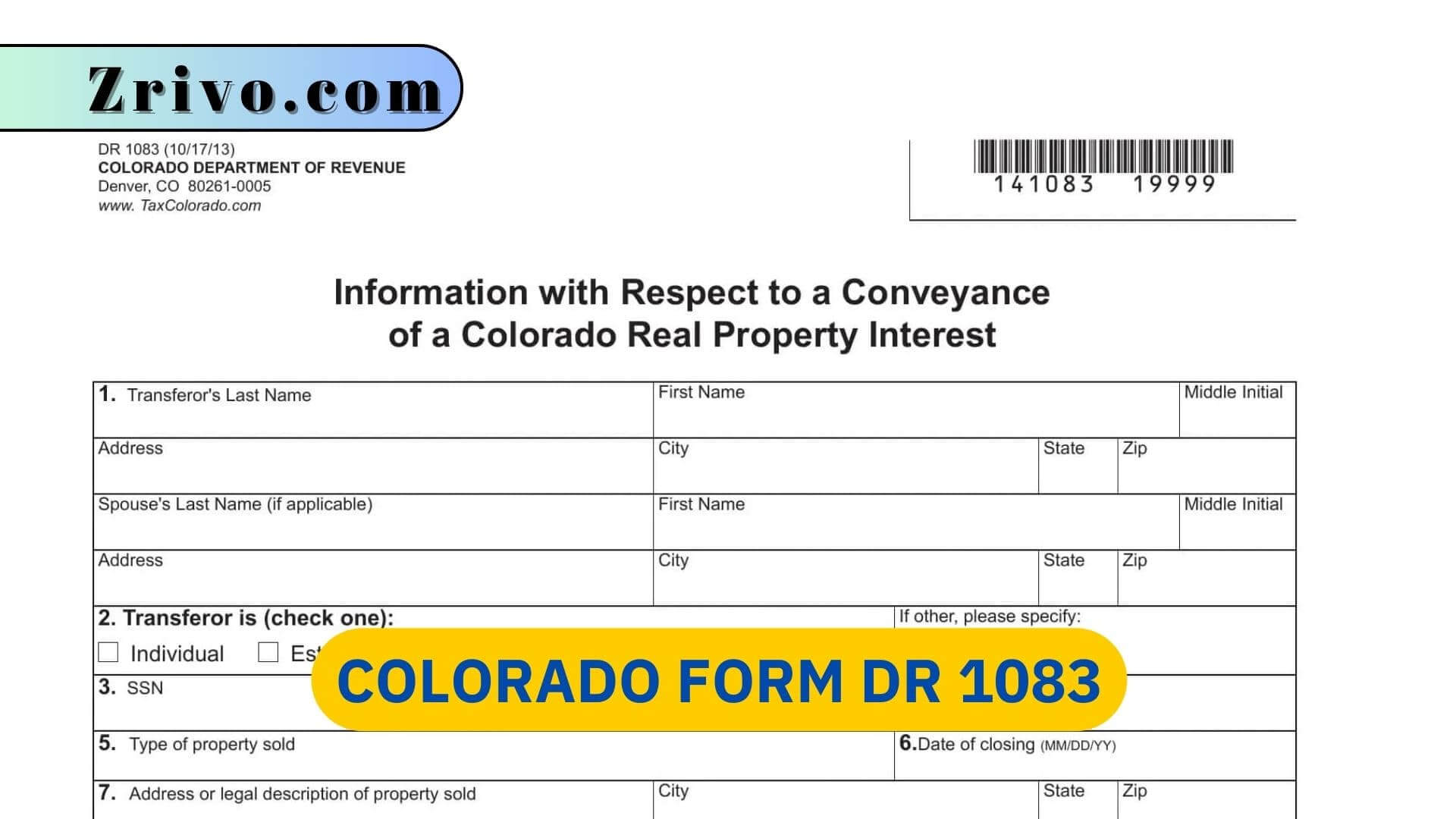

Colorado Form DR 1083

If a nonresident seller is performing an exchange under SS 1031, the withholding requirement is waived, provided they submit Form DR 1083 and certify that their sale is part of an eligible transaction

Colorado Form DR 1083 is a document that needs to be filled out by a non-resident individual, corporation, estate, or trust on the sale of any real property in excess of $100,000. Under state law, a withholding tax is imposed on such sales. This withholding tax is the lesser of two percent (2%) of the sales price or the net proceeds. At closing, the title company will remit the withholding tax to the Department of Revenue. The seller can then claim credit for the estimated payment against their actual income tax liability when they file their Colorado income tax return.

If the seller is performing a Section 1031 exchange, they may be exempt from this withholding. The 1083 form allows them to share this information with the state government and certify that they won’t be taxable on the sale of their investment property. This is an important step to take if you want to make sure that you don’t get hit with a large tax bill come tax time!

An online tax software solution can make it easy to complete a Colorado Form DR 1083 online. They can secure electronic signatures that comply with all major eSignature regulations, including ESIGN, UETA, and eIDAS. Some can also use strong multi-factor authentication to protect user identities and ensure that the documents they sign are legally binding.

What is Section 1031 Exchange?

A Section 1031 exchange, also called a like-kind exchange or Starker exchange, is a tax strategy in the US that allows investors to defer capital gains tax on the sale of investment real estate. It’s named after Section 1031 of the Internal Revenue Code (IRC).

Here’s how it works:

- You sell a business or investment property.

- Instead of keeping the proceeds, you reinvest them in a similar property (like-kind property) within specific timeframes.

- If the exchange follows the IRS rules, you can postpone paying capital gains tax on the profit from the sale.

A 1031 exchange can be valuable for real estate investors looking to grow their portfolio and defer capital gains taxes. However, the process can be complex, so consulting with a tax advisor is recommended to ensure you qualify and follow the IRS regulations.