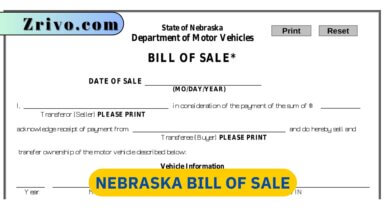

Customs Declaration Form 6059B

In this guide, we will explore what the Customs Declaration Form entails, who must file it, and how to properly fill it out.

Contents

International travel brings the excitement of exploring new destinations and experiencing diverse cultures. However, it also involves adhering to customs regulations and completing essential paperwork, such as the Customs Declaration Form. This form, designated as Form 6059B, is a critical document that travelers must complete when entering the United States or many other countries. The Customs Declaration Form 6059B is an official document used by customs authorities to monitor and regulate the movement of goods and certain items across international borders. The form serves as a declaration by the traveler, providing information about the goods they are bringing into the country, including any items that may require inspection or assessment of duties and taxes.

Who Must File Form 6059B?

Anyone traveling to the United States or other countries, whether arriving by air, land, or sea, must complete the Customs Declaration Form 6059B. This includes both U.S. citizens and foreign visitors. The form is typically distributed during the flight, on the ship, or at the border crossing, and it must be completed and submitted to customs authorities upon arrival.

How to file Form 6059B?

Filing the Customs Declaration Form is a straightforward process, and it is essential to do so accurately and really. Failure to provide accurate information or attempting to smuggle prohibited items can result in significant penalties and legal consequences. As mentioned earlier, the Customs Declaration Form 6059B is usually provided to travelers during their journey. If you haven’t received one, you can request it from the flight attendants, the ship’s crew, or border officers. Before filling out the form, carefully read the instructions provided. It’s crucial to understand the information required and the rules and regulations related to customs declarations.

How to Complete Form 6059B?

The form consists of two sides, and it is essential to fill out both sides accurately:

- Start by providing your personal details, including your full name, date of birth, and passport number.

- Fill in the details of your flight number, the vessel’s name, or the mode of transportation that brought you to the country.

- If you are a U.S. resident, provide your address in the United States. If you are a foreign visitor, you can indicate the address where you will be staying during your visit.

- You must declare whether you are bringing any items subject to customs regulations. This includes fruits, vegetables, meats, animal products, firearms, currency over a certain threshold, and more. Be sure to declare all items accurately.

- If you are eligible for duty-free allowances (specific quantities of certain items that can be brought into the country without paying duties), you can specify them in the appropriate section.

- After completing the form, sign, and date it to certify that the information provided is true and accurate to the best of your knowledge.

- Before submitting the form to customs authorities, take a moment to review all the information you have provided. Ensure all the details are correct and you have not missed declaring any items.

- Upon arrival at your destination, present the completed Customs Declaration Form 6059B to the customs officer. They may ask you additional questions about the items you have declared, and in some cases, they may inspect the items or collect applicable duties and taxes.

Important Tips About Customs Declaration Form 6059B Filing Process

Always provide truthful and accurate information on the form. Attempting to hide or smuggle prohibited items can lead to severe consequences. If you are unsure whether an item needs to be declared, it’s better to declare it and seek clarification from the customs officer. If you have made significant purchases abroad, keep the receipts handy, as they may be required to verify the value of the items you bring into the country. Familiarize yourself with the duty-free allowances for the country you enter. Exceeding these allowances may result in paying duties and taxes on the excess items.