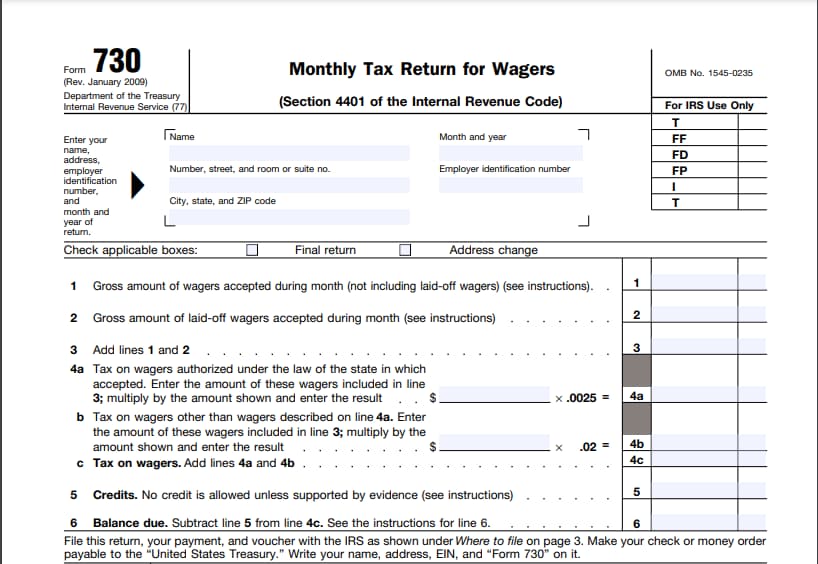

Form 730: Monthly Tax Return for Wagers

In the event that you accept bets, you’re required to file a Form 730 monthly tax return. This document identifies all taxable wagers and collects the appropriate tax. The information on this form helps the IRS determine whether or not those accepting bets are correctly reporting these activities and paying the proper taxes. The form for this report expires every year on April 30.

To calculate your monthly wagering tax, you need to add Items 1 and Item 2 while you are filling it out. Then, multiply the total amount by Item 3. In addition, you must enter any credits and deductions. You should note that you must include any evidence that substantiates the credits you claim. After you’ve calculated your tax, sign the form. It’s easy to make a mistake when filing this tax return. In general, a mistake can cost you a large amount of money.

We would like to point out that you can claim the tax credit if you receive bets from a liable taxpayer. To claim the tax credit, you must claim it within three years of the date you paid the tax or two years after you filed your Form 730. In addition, you need to include a detailed explanation of your credit claim and any previous claims. If you’ve filed a Form 730 monthly tax return for wagers in the past, you can claim a credit for any unpaid taxes.

In some cases, taxpayers who accept a wager may be entitled to a refund. The refund will be credited to the account of the wagering tax that was paid. If this is the case, you need to attach a statement stating why you’re claiming a refund and attach the statement from the date you paid the wager. You must also indicate whether you’ve filed a claim for a refund or a credit for a previous wager.

The amount of taxable wagers includes all the charges incurred while placing the wager, including those made to a bookmaker to guarantee a pay-off based on the odds of a race. The amount paid to a lottery operator allows you to contribute to a bank or pool. In addition to these, you should also keep in mind that the amount you receive in cash is not taxable.

Lastly, in addition to the monthly Form 730 monthly tax return for wagers, you also need to pay an excise tax on wagers made by people. This tax is based on the gross amount of wagers accepted during the month. If you’re a bookmaker, it’s also necessary to pay the excise tax on the number of bets you accept in a month. In addition to this, you need to keep track of all the winnings and losses you make.