Idaho Pass-Through Entity Tax 2023 - 2024

Affected business entity tax is an Idaho state income tax that applies to LLCs, S corporations, and certain other pass-through entities. Its purpose is to offset the $10,000 limit on individual owners' deduction for state and local taxes.

Companies may be responsible for many different state and local business taxes. So, it’s important to know what the Idaho Pass-Through Entity Tax is and how it affects your company. The State Tax Commission (STC) website is a great resource to help you understand your company’s state and local tax obligations. In 2021 the Idaho legislature passed a law to create a workaround for the $10,000 limit on deducting state and local income taxes by pass through entities. This law allows eligible pass-through entities to elect to pay Idaho income tax at the entity level, which is then credited to the individual owners.

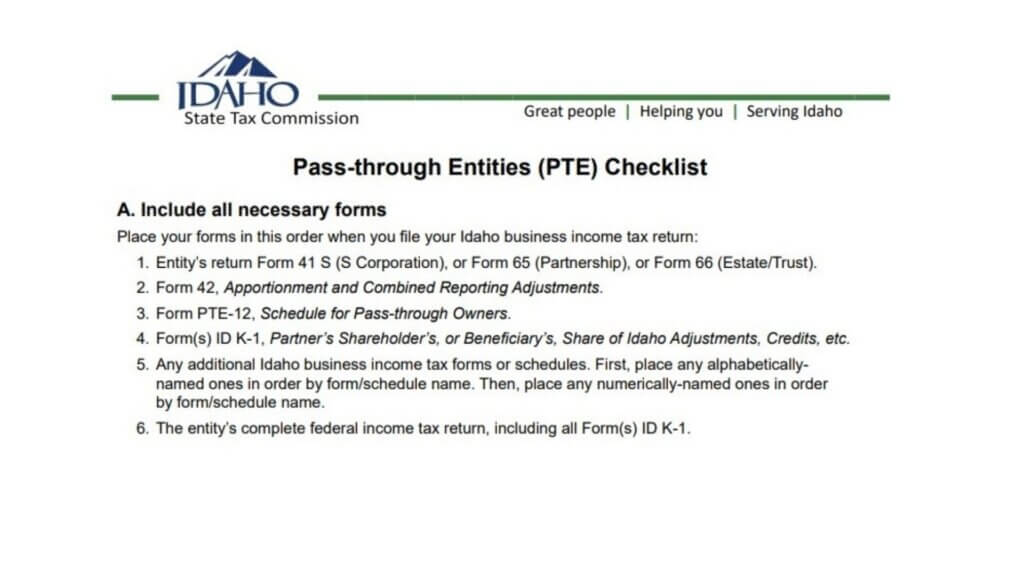

Generally, S Corporations, partnerships, and LLCs that qualify for the election will need to file Form 41ES to report their income to the state of Idaho. The STC website explains how to complete this form and what information it requires. You should also use the Idaho Filing Code PTE-12 when entering this tax in Lacerte. This will ensure that the State Tax Commission pays the correct amount. If you have a nonresident owner, the entity should submit withholding using Form PTE-01 and enter code W for this purpose.

How to File Idaho PTET?

An Idaho elective pass-through entity tax (PTET) is a state tax on taxable business income reported on Form 41. This tax is imposed by the state of Idaho and applies to all multi-member LLCs and some single-member LLCs. The PTET is typically filed along with federal taxes and is based on the company’s profit, less certain deductions and allowances.

For entities making the PTET election, their Idaho income tax payments are due by April 15 for calendar filers and the fifteenth day of the fourth month following the close of each taxable year. The entity’s taxable income passes through to its owners, who report it on their individual tax returns.

Nonresident individual owners can file a composite return with the entity and pay Idaho tax withholding by filing Form PTE-NROA. They must also complete and include their information on the reconciliation schedule PTE-12. This is required by Idaho Code Section 63-3036B. If they do not complete a PTE-12, their share of Idaho-source distributable income is taxed at the corporate rate (5.8%). For more information, contact your accountant or professional tax preparer.

How to Pay Idaho Pass-through Entity Tax?

Pass-through entities that elect to pay the Idaho PTET must file an Elective Pass Through Entity (EPT) return by April 15. The EPT account is created instantly on MyTaxes when a taxpayer selects “Request Elective Pass Through” and answers the questions. Then, payments are made to the account. These payments are deductible on the owners’ tax returns in the year paid.

Idaho pass-through entity tax tax is due quarterly and is payable by April 20, June 15, September 15 and December 15. Businesses that are required to make federal estimated tax payments and have an Idaho business income tax liability must also pay quarterly estimates.