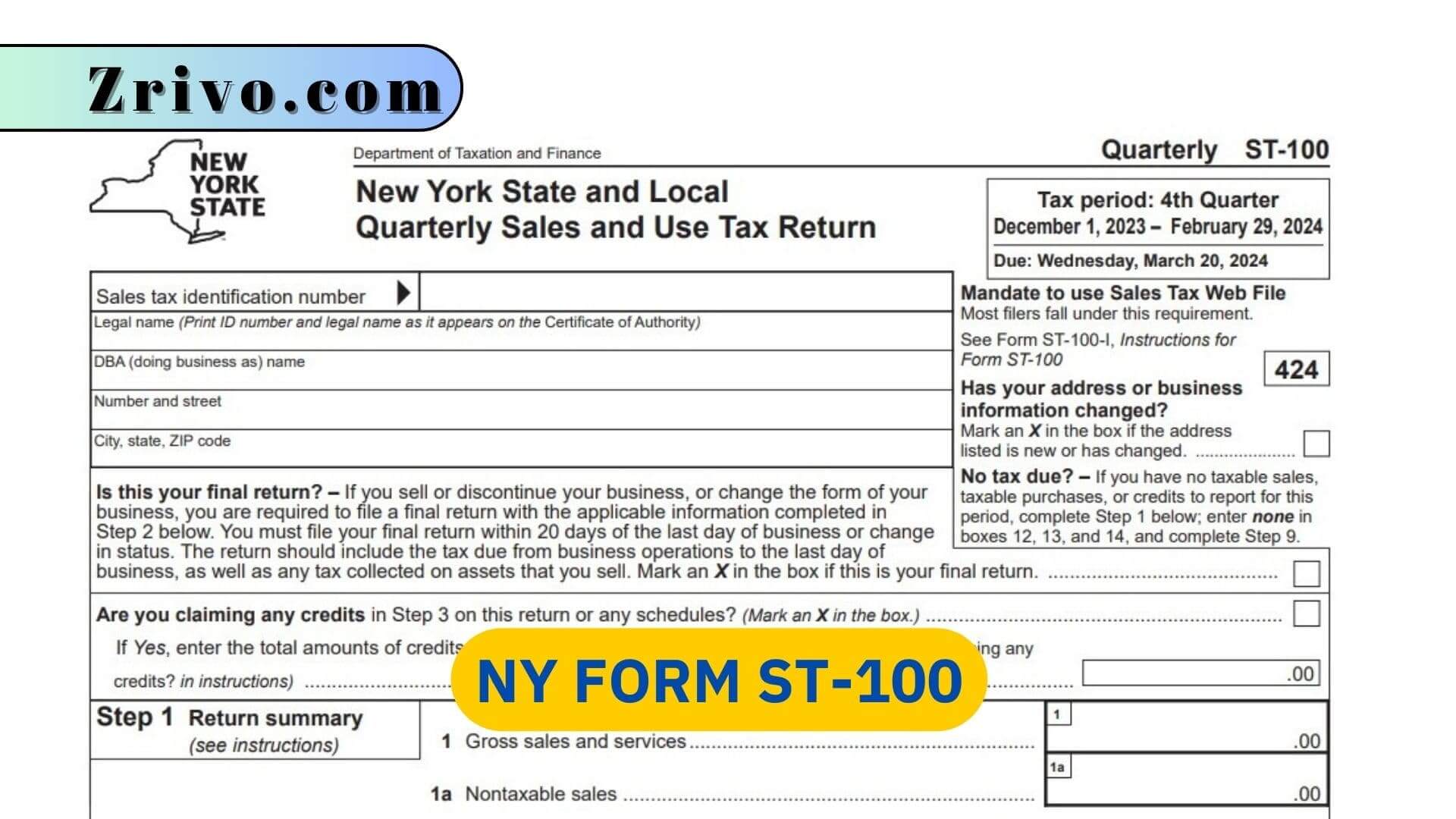

NY Form ST-100

. This article provides a comprehensive guide to understanding NY Form ST-100, including who needs to file it, how to file it electronically, and step-by-step instructions on filling out the form.

Known as the New York State and Local Quarterly Sales Tax Return, NY Form ST-100 is used to report sales and use tax to the State of New York. These forms help the government collect taxes that fund public services and infrastructure. Businesses must comply with strict legal obligations to file these returns. Not all businesses in New York State need to file Form ST-100. The primary responsibility falls on businesses registered to collect sales tax within the state. This registration typically occurs when a business meets a specific sales threshold or when the nature of their business involves selling taxable goods or services. Here’s a breakdown of who typically needs to file:

- Businesses selling taxable goods or services: This includes retailers, wholesalers, manufacturers, service providers, and anyone else engaged in the sale of taxable items within New York.

- Businesses with a sales tax registration: If you have a sales tax registration in New York, you are required to file Form ST-100, even if you haven’t made any taxable sales during the quarter.

- Out-of-state vendors with nexus in New York: Businesses outside New York but with a physical presence or economic activity within the state (nexus) might also need to register and file Form ST-100.

Before You File Your Form ST-100: Important Considerations

Before diving into the specifics of Form ST-100, here are some crucial preliminary steps:

- Sales Tax Registration: Ensure you have a valid sales tax registration in New York State. You can register online through the Department of Taxation and Finance website https://www.tax.ny.gov/bus/st/register.htm.

- Recordkeeping: Maintain accurate records of your sales activity for each quarter. This includes taxable sales, exempt sales, non-taxable sales, and any applicable sales tax collected.

- Tax Rates: Be familiar with the different sales tax rates that apply in your specific location within New York State. The combined state and local sales tax rate can vary depending on your county or city.

How to File NY Form ST-100 Online?

The New York Department of Taxation and Finance strongly encourages businesses to file Form ST-100 electronically. To file electronically, you can utilize the Sales Tax Web File application available on the Department of Taxation and Finance website https://www.tax.ny.gov/bus/st/stmp.htm. Authorized third-party tax preparation software providers also integrate with the department’s system.