Securities Act of 1933

The Securities Act of 1933 (or the '33 Act) ensures that investors have accurate and relevant financial information before buying stocks. It also prohibits deceit and misrepresentation in the sale of securities.

The Securities Act of 1933 was Congress’ opening shot in the war against stock market fraud. It requires companies that offer securities to the public to disclose all material information. The law also allows the SEC to prosecute parties that violate federal securities laws and can issue civil penalties, cease-and-desist orders, and other sanctions against violators. The SEC usually seeks these actions after receiving complaints or investigating possible violations. It is able to conduct information inquiries, interview witnesses, examine brokerage records, and review trading data. The commission’s usual leads are complaints from investors and the public or price fluctuations that appear to be caused by manipulation rather than by normal market forces.

The act is followed by the Securities Exchange Act of 1934, which formally created the SEC and granted it broad authority to enforce federal securities laws. It includes registration requirements and the power to regulate and oversee brokerage firms, transfer agents, and self-regulatory organizations, such as the New York Stock Exchange and the National Association of Securities Dealers.

It also covers proxy solicitation, which requires that management or a dissident minority disclose information about important issues to shareholders so they can vote on them intelligently. The act also makes it illegal to commit fraud in connection with the offer or sale of securities and allows defrauded investors to sue for recovery.

The act also has a rule called Section 17(a), which is an antifraud provision. It states that anyone who engages in a fraudulent sales of securities is subject to liability for damages suffered by the purchaser. Over the years, courts have interpreted this rule to allow private lawsuits against individuals who violate the law by engaging in fraudulent sales of securities.

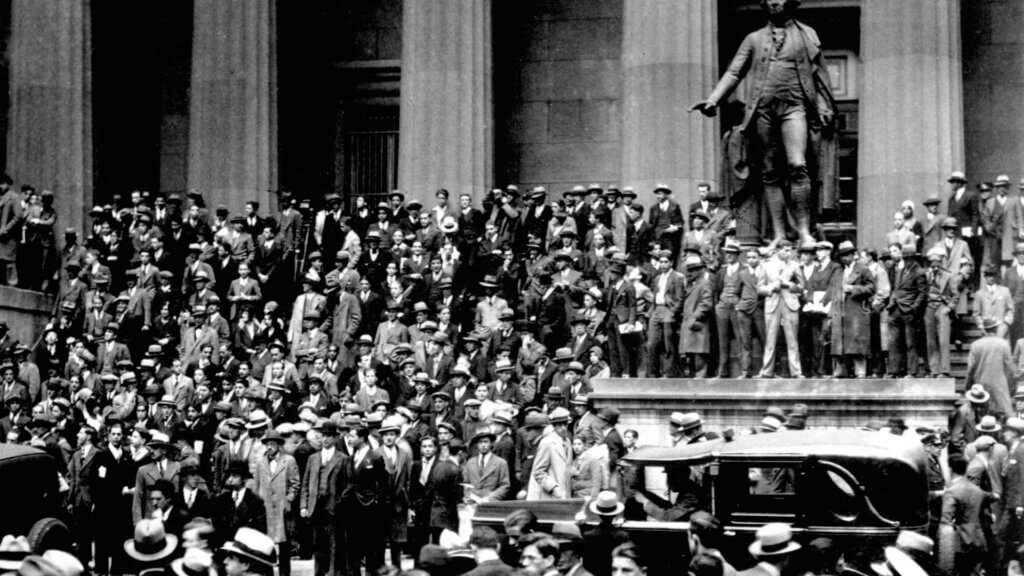

Stock Market Crash of 1929

In the aftermath of the stock market crash of 1929 and the onset of the Great Depression, Congress passed the Securities Act of 1933. The act aimed to regulate and prevent fraud in the sale of stocks and bonds. The law required that companies that sold securities to disclose all material information to potential investors. It also provided that defrauded investors could sue for recovery.

The law also prohibited the sale of unregistered securities. It established a system of regulations that requires public companies to file disclosure reports with the SEC. These reports contain important information about the company, its financial condition, and management. This information is available to the public on the SEC’s EDGAR database.

Before the 1934 act, many states had enacted “blue sky laws” to protect their citizens from fraudulent practices in stock trading. These laws sought to ensure that corporations were not hiding or obscuring valuable information from investors, such as bribes paid to foreign officials in order to win contracts or licenses. These bribes were often hidden since it was feared that they would raise massive criticism from the government and media. The 1934 act also introduced insider trading penalties for corporate executives and tippees. The Sarbanes-Oxley Act further amended this law.