Should You Front-Load Your 401k

For some, a new year’s resolution is to front-load their 401k retirement accounts to get more returns. It’s always a good idea to max out your 401k as early as possible so that the money contributed has a long time ahead to appreciate in value. While this makes sense to most people, there are other things to keep in mind that could have a negative impact rather than benefitting you.

Your funds

Without the means for contributing to your 401k and maxing it occasionally, we won’t be talking about this. Take a look at the income you’re generating and see if you have the wherewithal to do so to max out your 401k earlier in the year. It’s never a good idea to max out 401k and not have enough to focus on other investments.

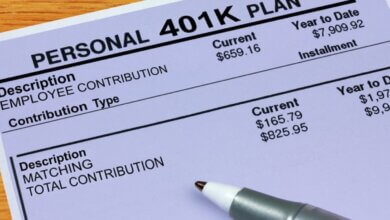

Employer matching

Regardless of the percentage that your employer matches your contributions, see if any matching rules limit employer match contributions for each pay period. For example, with $100,000 and 7 percent employer match contributions, your employer will contribute up to $7,000 to your 401k. However, your employer may only match a certain amount per pay period.

Read more: 401k contributions deduction 2022

That said, the $7,000 that your employer matches may be divided into $583 chunks that contribute every pay period. If such a limit applies to you, front-loading won’t be as feasible since you will get a reduced matching. Make sure to speak to your plan administrator to see if front-loading will benefit you in the long run. After all, you’re saving up for retirement.

Choosing not to front-load

Even if you have the funds to front-load, not doing so doesn’t really negatively impact your investments. Though it’s better to front-load than not, as nobody knows how the market will perform, it’s completely fine to contribute throughout the year even though you have the funds.