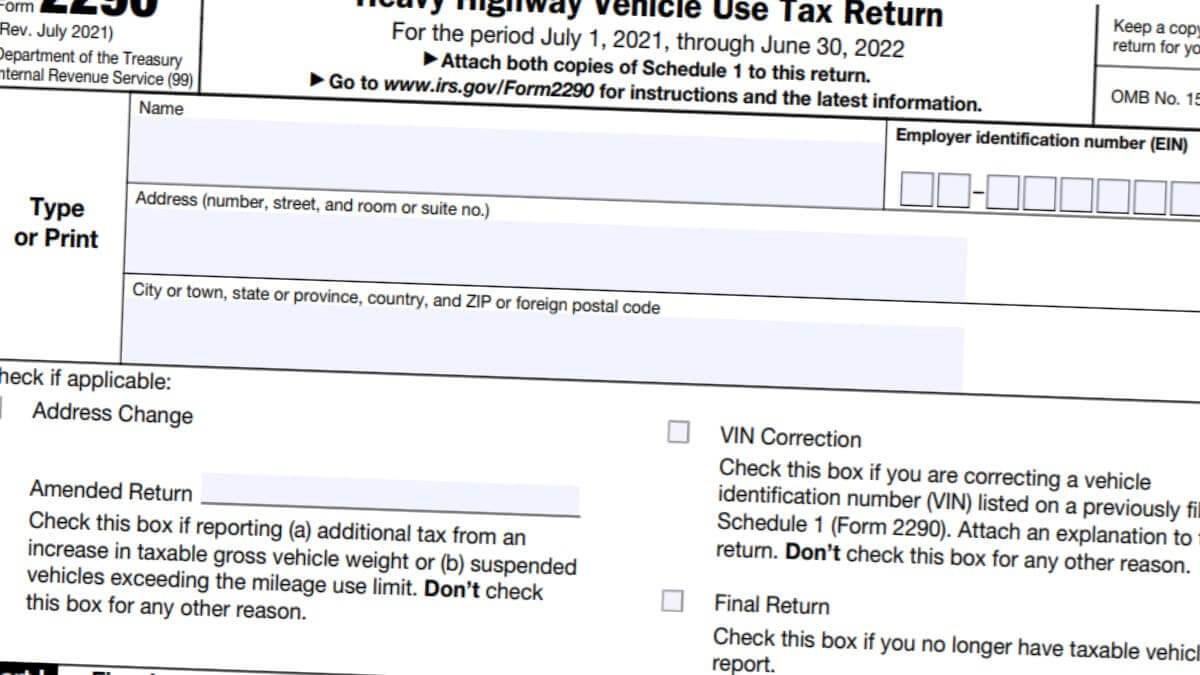

2290 Form 2023 - 2024

Form 2290, Heavy Highway Vehicle Use Tax Return, is the tax form used for calculating and paying taxes related to HVUT. On US highways, any vehicle that’s under 55,000 pounds are exempt from highway vehicle use tax. The vehicles above this weight threshold are subject to paying the HVUT annually. It’s mandatory, like insurance and registering the vehicle.

Everything related to the highway vehicle use tax, you’ll use Form 2290 so that you can drive without problems on US highways. This tax will pose a problem if not paid, especially when using interstate highways. Fill out Form 2290 to figure out the HVUT for the taxable gross weight of the vehicle.

What is taxable gross weight?

Contrary to popular belief, the taxable gross weight doesn’t refer to the loaded weight of the trailers and semitrailers. This weight refers to the unloaded weight of the vehicle with any equipment required to function fully. That said, you can find the gross weight on the title of the vehicle.

Fill out Form 2290 for 2023 - 2024

For the 2023 taxes you’ll file in 2024, you must file Form 2290 by August 31. You can fill out and mail Form 2290 to the Internal Revenue Service. Unlike other and similar tax returns, the addresses are the same regardless of the state you or your client lives in.

Start filling out Form 2290 PDF below and mail it to the following address once you’re done filing it.

Form 2290 mailing address

Mail Form 2290 to the following address if you’re making a payment with the form.

Internal Revenue Service

P.O. Box 932500

Louisville, KY

40293-2500

Mail Form 2290 to the following address if you’re not making a payment with the form.

Department of the Treasury

Internal Revenue Service

Ogden, UT

84201-0031

Note that you only need to mail Form 2290 to the address where you’re supposed to send with payment only if you’re paying the tax with money or check order. If you’re going to make an online payment through Direct Pay or a payment processor, you aren’t required to mail it to the address with payment.