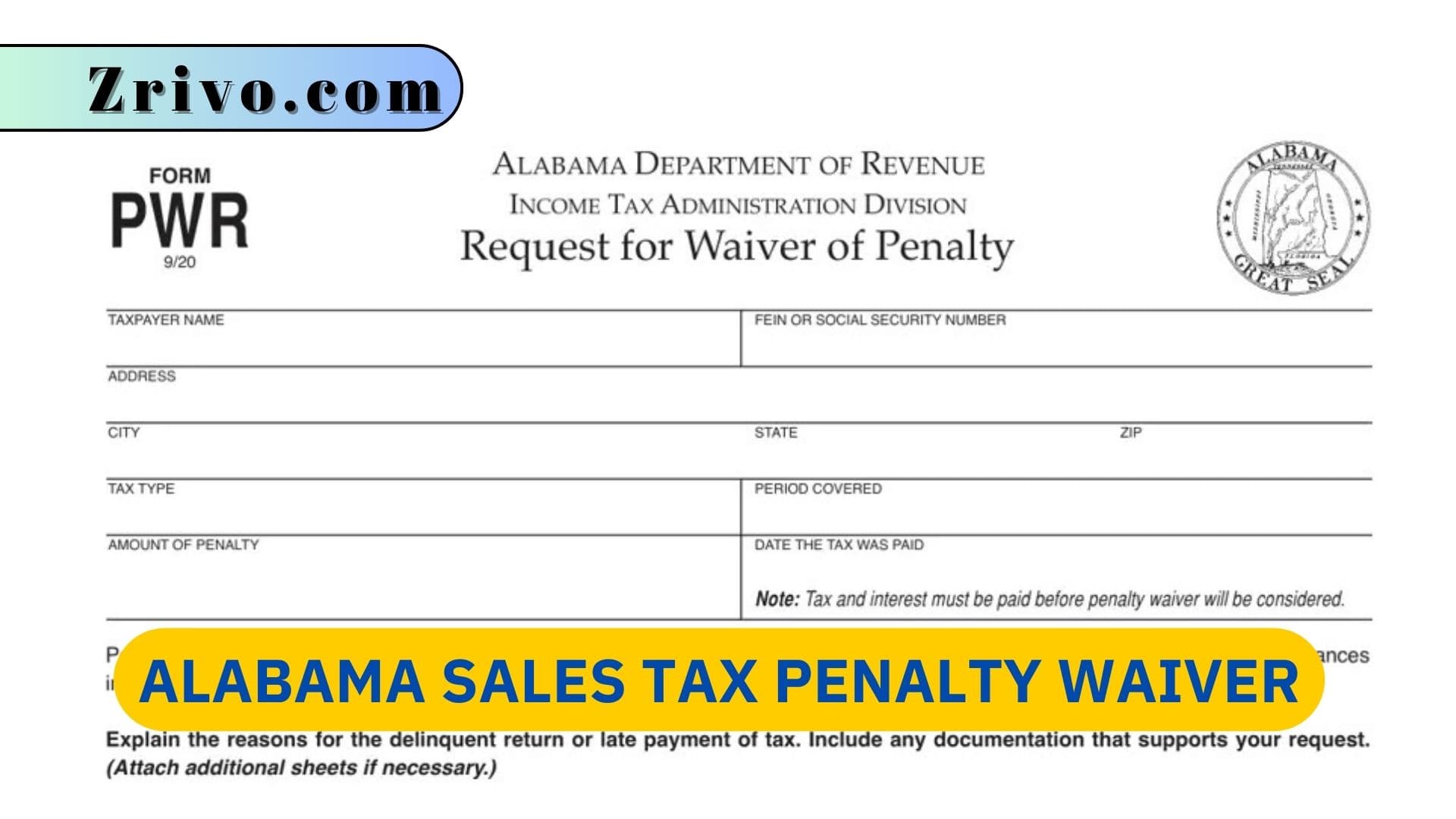

Alabama Sales Tax Penalty Waiver

Alabama's tax collection laws require remote sellers to register and collect local sales taxes. If you do not, you may be subject to penalties for failure to file or pay taxes.

The Alabama Department of Revenue (ALDOR) has several options for businesses that are behind on sales tax payments. You can request a waiver of penalties and interest charges if you meet certain conditions. If you can’t pay your back taxes, the state may also levy a writ of execution against your business and sell your property. This includes real property and personal property. You can avoid these consequences by working with a tax resolution specialist experienced with Alabama state taxes.

Alabama Sales Tax Penalty Waiver Eligibility

To qualify for a penalty waiver, you must show that the late filing or payment of the sales tax was caused by an unavoidable circumstance beyond your control and that you have tried to comply with the state’s laws. If you have a valid reason for missing the deadline, you should apply for a waiver as soon as possible.

A tax consultant can help you file your Alabama sales tax return and calculate the correct amount of taxes to collect. He or she can also provide advice on the types of exemptions and resale certificates you need to use. In addition, a tax consultant can help you with the appeals process.

Alabama is a destination-based sales tax state, which means you are responsible for collecting and remitting the appropriate sales tax rate on all taxable transactions. You can manage this responsibility with a software solution. Such systems integrate with the business systems you already use to automatically deliver accurate sales and use tax calculations in real-time.

The state of Alabama is often willing to waive penalties on a case-by-case basis if you can show reasonable cause. Reasonable causes could include:

- Death.

- A natural disaster.

- Inability to obtain records.

- Reliance on the incorrect advice of a tax adviser.

You can request a penalty waiver by filing Form PWR with the ALDOR. If you are unable to pay your back taxes, you can contact an experienced attorney who can help you negotiate a settlement.

What Are the Reasonable Causes for a Sales Tax Penalty Waiver in Alabama?

Alabama allows for waivers of civil penalties associated with sales tax, but you’ll need to demonstrate “reasonable cause” for not complying with the regulations. Here are some generally accepted reasons that might be considered reasonable cause:

Death, major illness, or unavoidable absence: This could apply to a sole proprietor who was incapacitated and unable to handle tax filings or payments.

Casualty or natural disaster: A fire, flood, or other disaster that significantly impacted your ability to meet tax obligations could be considered.

Inability to obtain necessary records: If issues beyond your control prevent you from obtaining essential records for filing, it might be a reasonable cause.

Non-recurring honest mistake: An unintentional error in calculating or filing your sales tax return could be considered, especially if it’s a one-time occurrence.

Reliance on the advice of a competent tax advisor: If you received incorrect advice from a qualified tax professional and acted in good faith based on that advice, it might be a valid reason.

Reliance on erroneous advice of ADOR personnel: Mistaken information provided by the Alabama Department of Revenue (ADOR) itself could be a basis for a waiver.

How to Request an Alabama Sales Tax Penalty Waiver?

There are two ways to request a waiver:

- Form 911AL: This form includes a checkbox for a penalty waiver. Fill it out and submit it with any supporting documentation for your reasonable cause claim.

- My Alabama Taxes (MAT) Account: If you have a MAT account, you can submit a request electronically by clicking on the applicable tax account and selecting “Ask a question” under “I want to.” Be sure to explain clearly your reason for requesting a waiver.