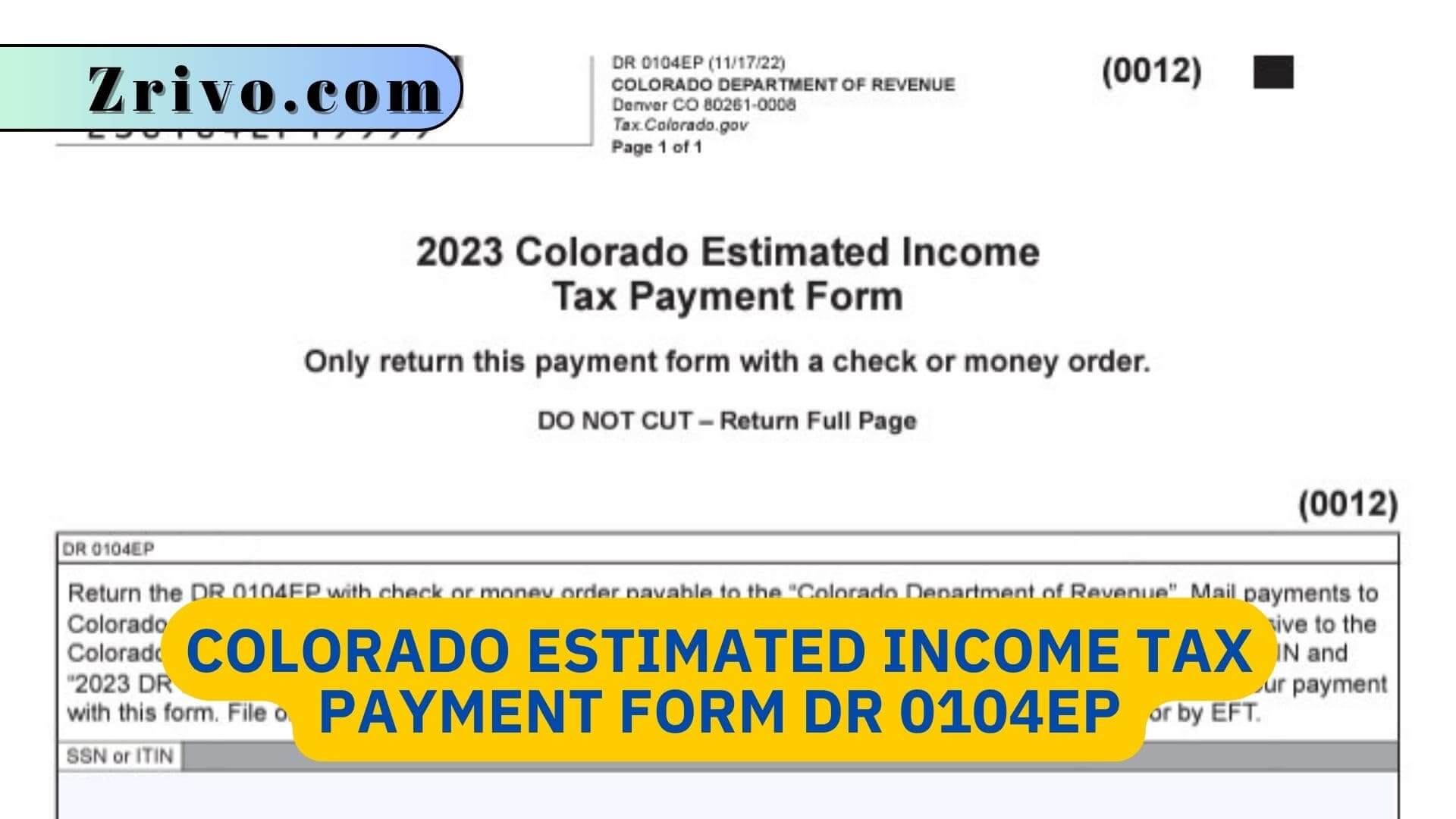

Colorado Estimated Income Tax Payment Form DR 0104EP

Every Colorado individual who expects to owe individual income tax must make estimated tax payments. These payments must be made by credit or debit card or e-check through Revenue Online.

The Colorado Department of Revenue requires all taxpayers to make quarterly estimated tax payments on Colorado Estimated Tax Payment Form DR 0104EP. The payments are based on the taxpayer’s net income for the year, less withholding and credits. These payments are due by the 15th day of the year’s 4th, 6th, 9th and 12th months. Taxpayers who are traveling or residing outside the United States may request an automatic extension until October 15. However, they must pay 90% of their tax liability by April 15 to avoid late payment penalties.

Who Must File Colorado Estimated Tax Payment Form?

While most Colorado taxpayers have income taxes withheld from their paychecks, there are some who need to make estimated tax payments on a quarterly basis. If you are required to file estimates, it’s important to submit them on time or face a penalty. Fortunately, you can file your Colorado estimated tax payment using an online form or through the mail.

The quarterly estimated tax payments amount is determined by multiplying your net income for the current year by the applicable estimate rate. For example, if your net income is $100,000, then the quarterly estimated tax payment will be $5,000.

How to File the Colorado Estimated Tax Payment Form?

To calculate your estimated tax payments:

- Use the worksheet provided on the DR 0104EP Form.

- Input your payment information, select the payment date and confirm your payment amount.

- Click the “Submit” button to complete your transaction. You can also view a record of your estimated tax payments in your Revenue Online(opens in new window) account.

When entering data for the State Common Data worksheets, be sure to use the State Code field to identify Colorado. If an entry is present with a code of “ALL”, the program will apply that date to all states and cities. If the State Code field is entered with a code of CO, the program will only process that entry for Colorado.

If you fail to pay the estimated tax in a timely manner, the state will assess a penalty against you. The penalty is equal to the appropriate Colorado income tax interest rate multiplied by the underpayment for each quarter times the underpayment period. The penalty is also imposed on C corporations that don’t pay their estimated tax in a timely manner.