Economic Impact Payments

Economic impact payments are one of the programs launched by the US government to aid those who are in need. The third payment within the program has already started. Each state has its payment schedule, and you can learn more about it by visiting the official website of the IRS.

Unfortunately, there will be no fourth economic impact payment this year. So, if you would like to benefit from this opportunity and receive financial support from the government, you may want to take action right now and apply for it.

Details on Economic Impact Payments 2024

If you meet one or more of the following conditions, then you are eligible for third-round economic impact payments:

- If you have a child born in 2023 or later, and the child is claimed as a dependent on your income tax return, you can apply for EIP. You can also use it if you have adopted or have a foster child.

- Families with dependent relatives such as a grandchild, parent, niece, or nephew can also apply for aid for that particular dependent.

- If you are a single filer and if you had more than $80,000 in income before the pandemic but make less now, you are eligible to apply for economic impact payments. If you are a married couple who had more than $160,000 in income before the pandemic but make less now, you are also eligible for the payment.

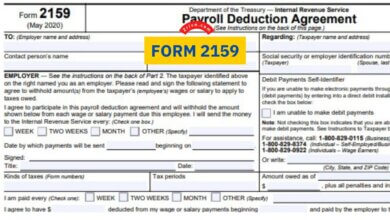

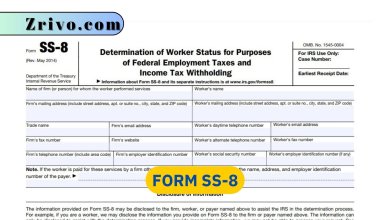

How to File Your Forms for Economic Impact Payment?

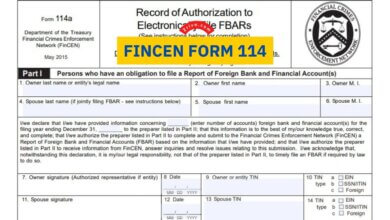

Although you can use both methods that the IRS offers, which are mailing and electronically filing, the IRS recommends you prefer electronically filing. By filling it out online, your application can be processed quickly, and you will get your economic impact payment faster compared to filing it via mail.

It is worth noting that each state has its payment dates for the economic impact payment. In addition, if you prefer applying for the program via mail, you need to make sure that you mail your documents to the correct address as well. Otherwise, you may not be able to apply for this program.