EFTPS

EFTPS is a convenient and easy way to make all of your estimated tax payments.

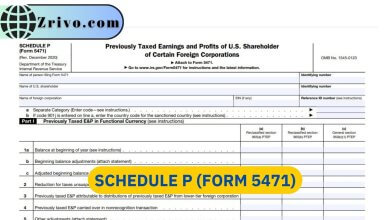

The Electronic Federal Tax Payment System (EFTPS) is a free online service that provides individuals and businesses a secure way to pay federal taxes, including federal income, employment, excise, and installment payments. You can also track your payment history. It’s used by over 12 million groups. The system is free and offers a wide range of features, including the ability to schedule payment dates up to 365 days in advance. In addition to using the online system, clients can also make EFTPS payments over the phone by calling a special number. This service is available 24 hours a day and can be used to make multiple payments at once.

Enrollment in the EFTPS

Business owners can enroll their company in EFTPS to make payments with their business’s Employer Identification Number (EIN). This ID is the same as a Social Security number or taxpayer identification number.

- Enrollment in the IRS EFTPS system is free and takes less than a minute to complete. The system uses a three-step authentication process involving an IRS PIN, an 18-digit enrollment number, and a self-created password.

- After completing the enrollment process, you’ll receive an email with your PIN and an acknowledgment number that you can use to track your payment. You can also choose to receive your acknowledgment by mail.

If you have any questions about how to use the EFTPS, contact the IRS customer support department at 888-994-2787 or visit their website. They can answer any questions about your account and help you get started. As a business owner, you’re responsible for making all federal tax payments on time, regardless of whether you outsource your payroll or not. If you do, it’s important to monitor your payments regularly and verify that your third-party service providers are making their EFTPS payments in a timely manner.

Differences Between Direct Pay and EFTPS

- The Electronic Federal Tax Payment System (EFTPS) is an IRS online payment tool that can be used to pay individual and business taxes. It is free and easy to use. EFTPS is designed to secure your personal information, requiring a three-step authentication process each time you log in. It is also available 24/7, so it is easier to make a payment if you lose internet access.

- Direct Pay is another IRS online payment option that you can use to pay your estimated taxes. It is similar to EFTPS in that you can set up a direct debit from your bank account. However, Direct Pay requires more upfront work to set up than EFTPS and takes longer to verify your banking information before you can use it. Once you’re signed in, it is easy to make a payment, and you can even schedule payments up to a year in advance.

- Both EFTPS and Direct Pay are free for individuals and businesses to use. The main difference between them is that EFTPS allows individuals to make any type of federal tax payment, while Direct Pay only works for certain types of taxes, including income tax and estimated taxes.

It is important to know the differences between Direct Pay and EFTPS before you decide which one is best for you. You must consider your financial situation and tax payments each year.