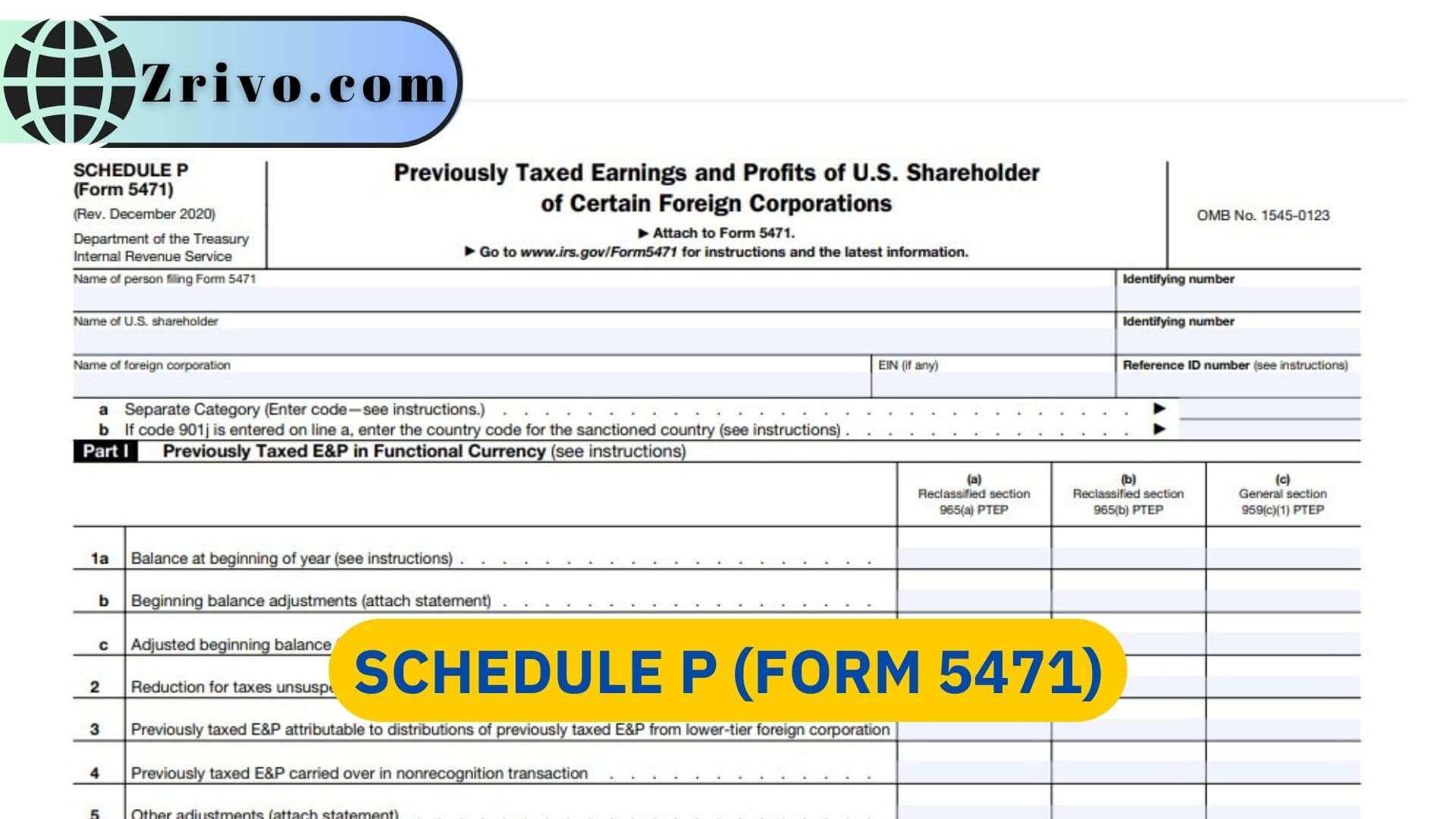

Schedule P (Form 5471) 2023 - 2024

Form 5471 is one of the more complex tax forms to file, and it sometimes requires schedule forms, like Schedule P, attached to it. This article will examine the rules and regulations surrounding Form 5471 and its related schedules J, P, and H.

Schedule P is a crucial component of Form 5471, a comprehensive reporting requirement imposed by the U.S. Internal Revenue Service (IRS) on individuals and entities with ownership or control over controlled foreign corporations (CFCs). Schedule P captures information about specific transactions between a CFC and its related parties. It serves as a detailed record of financial interactions that may have tax implications. As an integral part of the reporting process, Schedule P requires filers to provide comprehensive details on various types of transactions, including loans, accounts receivable/payable, sales and purchases, cost-sharing arrangements, services, royalties, and leases.

By mandating the disclosure of these transactions, the IRS aims to gain insight into the financial activities of CFCs and ensure compliance with U.S. tax laws. Given the complexity and significance of Schedule P, filers are advised to adhere to the IRS guidelines diligently, consult the official instructions, and seek professional assistance to complete the schedule and fulfill their reporting obligations accurately.

Who Must File Schedule P?

Schedule P of Form 5471 must be filed by individuals, corporations, partnerships, or trusts who fall under the “Category 5” filer classification. Category 5 filers are U.S. persons who have an officer, director, or shareholder position in a controlled foreign corporation (CFC) that is also a foreign corporation during the tax year. Essentially, if you have a significant level of control or ownership in a CFC, you are likely required to file Schedule P along with Form 5471. It is crucial to determine whether you meet the Category 5 criteria to ensure compliance with IRS regulations.

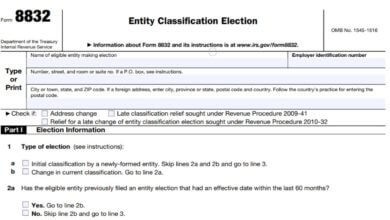

How to File Schedule P?

To file Schedule P, you need to complete and attach it to your Form 5471, which is filed as an attachment to your annual U.S. income tax return. The deadline for filing Form 5471, including Schedule P, is generally the same as the due date for your individual or corporate tax return, including any applicable extensions. Ensure that you carefully review the IRS instructions for Form 5471 and follow the guidelines for submitting the form electronically or by mail. It’s essential to meet the filing deadlines to avoid potential penalties and ensure compliance with tax regulations.

How to Fill Out Schedule P?

Filling out Schedule P requires providing detailed information about transactions between the controlled foreign corporation (CFC) and its related parties. Each specific transaction category listed on Schedule P, such as loans, accounts receivable/payable, sales and purchases, cost-sharing arrangements, services, royalties, and leases, necessitates accurate reporting. When completing Schedule P, gather the relevant financial data, including:

- The names and addresses of the related parties involved in the transactions and the nature of each transaction.

- Specify the amounts involved, such as loan amounts, sales proceeds, or royalty payments.

- Provide any additional details required by the IRS.

- Review the instructions on Schedule P carefully to ensure you include all necessary information and calculations.

Due to the complexity of Schedule P and the potential impact on your tax liability, it is advisable to seek the guidance of a qualified tax professional or CPA who specializes in international tax matters. They can provide valuable assistance in accurately completing Schedule P and meeting your reporting obligations in accordance with IRS guidelines.