1099 Composite: A Comprehensive Guide

This article will delve into the comprehensive details about the 1099 Composite tax form, explaining how it works, its importance, and how to handle it correctly.

Contents

1099 Composite is a tax form that is generated by broker-dealers or other financial institutions. It combines various types of income, such as dividends, interest, and capital gains, into a single document, making it easier to report different types of income on your tax return. The 1099 Composite is a consolidated tax form that includes multiple types of 1099 forms. Its purpose is to simplify the process of reporting different types of income that an individual or entity might receive from investments during the year. The form consolidates information from forms such as the 1099-DIV (dividends and distributions), 1099-INT (interest income), 1099-B (proceeds from broker and barter exchange transactions), and sometimes 1099-R (distributions from pensions, annuities, retirement, or profit-sharing plans).

This form is typically used by broker-dealers and other financial institutions that manage investments on behalf of their clients. The 1099 Composite is crucial for tax reporting. Its primary purpose is to track income that may not be subject to withholding. Providing a composite view of these various income sources simplifies the tax filing process, saving time and reducing errors. It’s important to note that not all income on the 1099 Composite may be taxable. For example, some municipal bond interest can be tax-free, depending on your state of residence and the type of bond.

When is a 1099 Composite Issued?

A 1099 Composite is generally issued by January 31st of 2024, reflecting income from the previous year (2023). Brokerage firms are required by the Internal Revenue Service (IRS) to provide these documents to investors who have earned income from their investments.

However, the dates can vary. Certain forms of income, such as those from complex trusts or real estate mortgage investment conduits (REMICs), may not be reported until later.

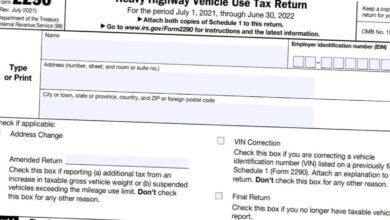

Reading a 1099 Composite Form

Understanding your 1099 Composite form can be a complex task due to the variety of information presented. Here’s a simple breakdown of what you might find on your 1099 Composite:

- Payer’s name, address, and telephone number: The entity that paid the income.

- Recipient’s name and address: The individual or entity who received the income.

- Account number: This may be shown if you have multiple accounts with the payer.

- Various types of income: These are listed separately and correspond to different IRS forms, such as 1099-DIV, 1099-INT, and 1099-B.

Reporting Income from a 1099 Composite

Income from a 1099 Composite must be reported on your tax return. This income will typically be reported on different lines of the tax return, depending on the type of income. For example, dividend income is reported on Schedule B of your 1040 tax return, while capital gains or losses from sales of securities are reported on Schedule D.

It’s also essential to consider cost basis information when reporting sales of securities. Cost basis is the original value of an asset for tax purposes, typically the purchase price. This information is critical for calculating a sale’s capital gain or loss. Brokerage firms are now required to track and report cost basis information to both investors and the IRS.

Don’t forget: Even if you don’t receive a 1099 Composite, you’re still required to report all taxable income to the IRS.

Errors on a 1099 Composite

Errors can occur on the 1099 Composite form, and it’s important to correct them as soon as possible. If you find a mistake, contact the issuing institution immediately. They will then issue a corrected form, known as a 1099 Composite-C.

Incorrect information on a 1099 Composite can cause issues with your tax return, potentially leading to an audit or penalties. Therefore, always compare your records with the details on your 1099 Composite form.

1099 Composite and State Taxes

How income from a 1099 Composite is treated can vary by state. Some states might exempt certain types of income, such as certain interest or dividend income, from state tax. Conversely, other states may tax these types of income. It’s always crucial to check the tax rules in your specific state.

Who receives a 1099 Composite?

Any investor who has received income from investments held in a brokerage account should receive a 1099 Composite.

What should I do if I don’t receive my 1099 Composite?

Contact your broker or financial institution. They may have made an electronic copy available online. Remember, all income must be reported, even if you don’t receive a 1099 Composite.

Can I file my taxes without a 1099 Composite?

Yes, but you must report all income, even if you have not received a 1099 Composite.

What if there is an error on my 1099 Composite?

Contact the issuing institution immediately. They should issue a corrected 1099 Composite.

In conclusion, the 1099 Composite is a consolidated tax form that helps investors and entities to simplify their tax filing process. However, understanding and handling this form correctly can be challenging. It’s advisable to seek help from a tax professional if you’re unsure about any aspects of your 1099 Composite. This way, you’ll be sure to correctly report all your income and avoid potential penalties.