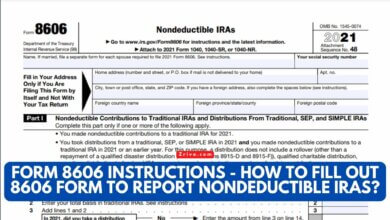

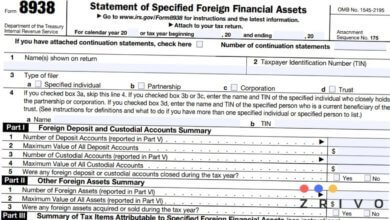

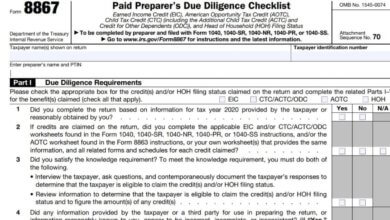

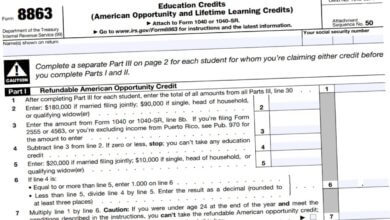

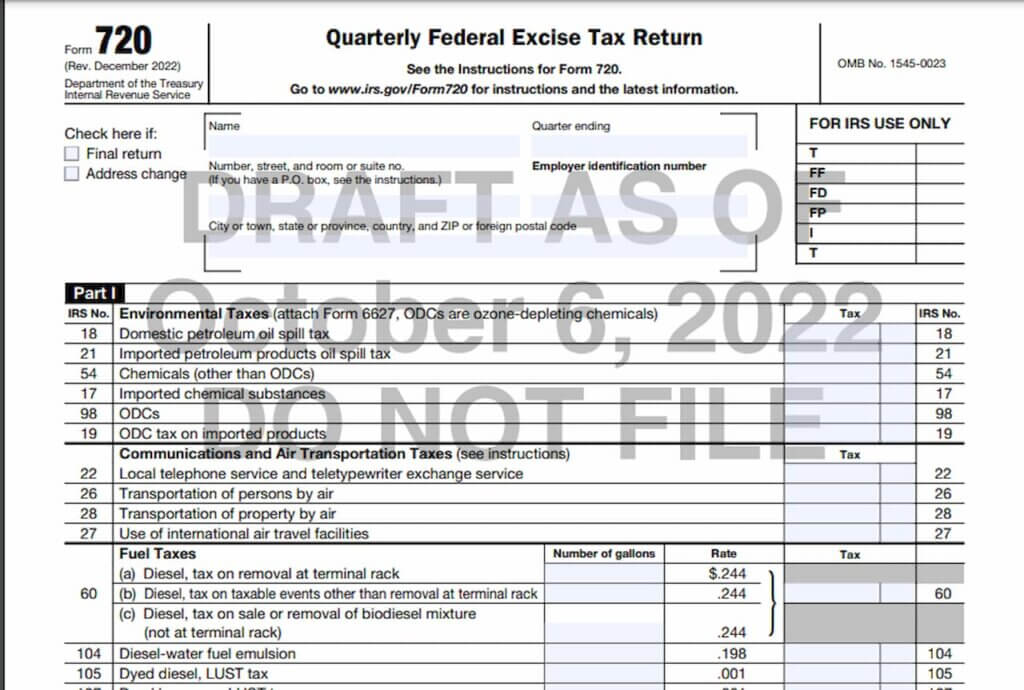

IRS Draft Forms 2023 - 2024

If you are looking for the IRS draft forms for the current year, this guide is for you! We have compiled all you may want to know about the IRS draft forms.

As you know, most of the IRS forms are updated annually to reflect the changes in rates. Some forms are updated more than once during the same tax year. Thus, taxpayers need to follow and acquire the updated versions all the time before they submit their files.

However, considering the number of forms you must file during a year, this can be a challenging task. This is why the IRS has compiled all the IRS draft tax forms for the current year on its website. You can find every draft form you’re looking for by following the link below:

Thus, you can access any form you’d like at any time by simply visiting that page. We encourage you to bookmark this page so that you can easily visit it back whenever you need a new draft. In addition to this, you can also check the newly included draft tax forms for the upcoming year.

To Find the IRS Draft Forms Easily, Add Bookmark To That Page

Adding the page as a bookmark is pretty easy. All you need to do is press the CTRL and B keys at the same time. This will add a bookmark to the existing page you are visiting in your browser.

On your future visits, you can easily click on this bookmark to quickly access the page. One thing we would like to note is that this list is not complete yet at the date, we published this article. However, we will be updating the list as the IRS releases new revisions and draft tax forms.

As you might already know, the IRS updates most of its forms towards the end of October and at the beginning of November. Thus, it is still a bit early to access most draft tax forms for the current year.

However, the IRS has shared the PDF versions of each available form here. In this way, you can simply download these printable files and use them. As you can print them with your printer, you can also use various software to fill them out online.