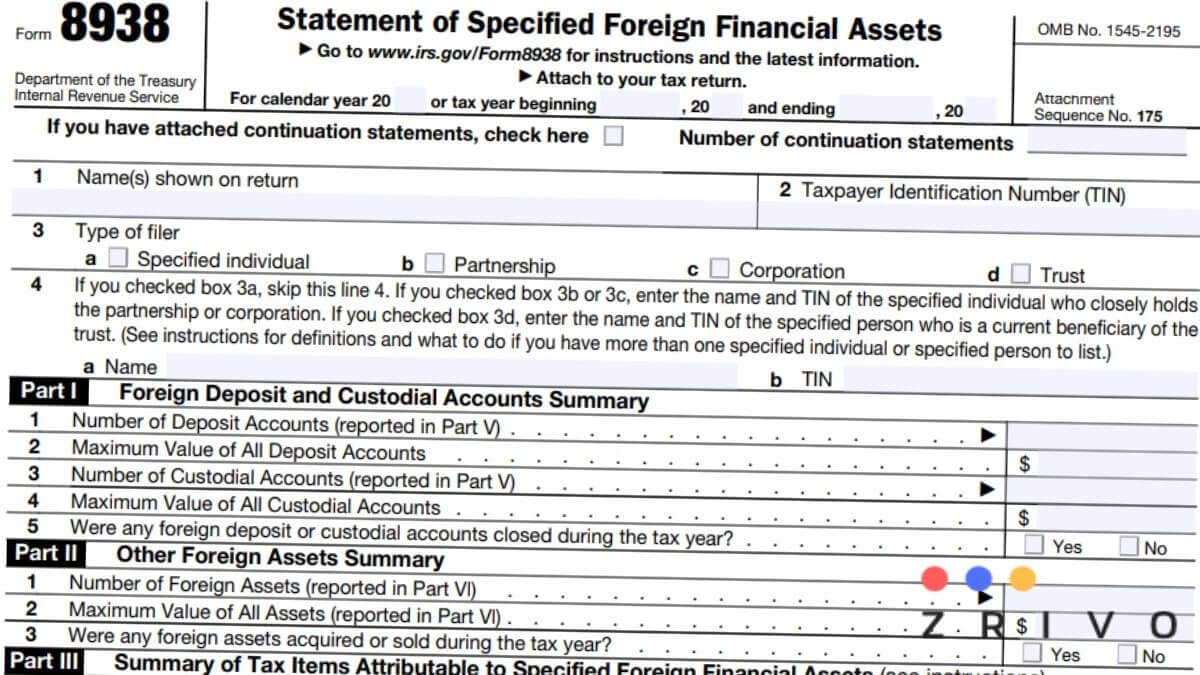

Form 8938—Statement of Specified Foreign Financial Assets is for reporting specified foreign financial assets. This tax form must be filed if the total value of all the assets you have an interest in is more than the designated reporting thresholds.

You must be a person to file Form 8938 and have an interest in specified foreign financial assets. Not all assets that gain interest must be reported though. If the specified foreign financial asset needs to be reported, you must report it to the IRS.

If you’re an individual and meet the following requirements for filing a Form 8938, you must report the specified foreign financial assets in 2024.

- You have a financial account by a foreign financial institution

- You have foreign assets held as investments in an account outside of the United States. This can be a stock, security issued by someone who’s not a U.S. citizen, resident alien, or nonresident alien, and/or a financial instrument or contract that is issued to you other than a U.S. person.

Those who meet a single requirement above must file Form 8938 report these assets. Here is how you can file a Form 8938.

File Form 8938 to Attach to Form 1040

Form 8938 must be filed with your federal income tax return. It is also possible to file Form 8938 electronically through an e-file provider. The below Form 8938 is only for those who are going to file a paper federal income tax return.

Related Article: How to attach tax forms to 1040?

Click the boxes where you need to enter your tax identification information and money amounts and start filling out. Once you’re done, you can print out a paper copy or download it as a PDF file.

8938 Form 2021

0%

100

Form 8938—Statement of Specified Foreign Financial Assets is for reporting specified foreign financial assets. This tax form must be filed if the total value of all the assets you have an interest in is more than the designated reporting thresholds.