Reject Codes

IRS reject codes for federal income tax returns. When an electronically filed tax teturn has an error or something that contradicts, a reject code is displayed – indicating the reason for the error. Find out what the common reject codes mean and the solution to the error.

-

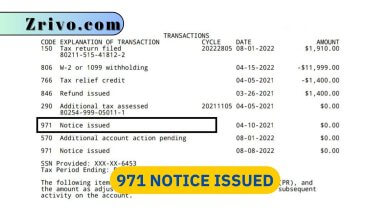

971 Notice Issued 2023 - 2024

IRS transcript codes are a system of alphanumeric codes used by the Internal Revenue Service (IRS) to categorize and summarize…

-

IRS Transcript Code 768

Transcript codes, or transaction codes, are a series of three-digit codes used by the Internal Revenue Service (IRS) to identify…

-

IRS Code 846

IRS Code 846, also known as “Refunds of Overpayments,” is a section of the Internal Revenue Code pertaining to refunding…

-

IRS Code 290

IRS Code 290, known as “Additional Tax Assessments,” plays a significant role in the Internal Revenue Service’s efforts to ensure…

-

IRS Code 150

If you have recently filed your taxes, you may be eagerly awaiting news on the status of your return. When…

-

Common IRS Reject and Error Codes

The IRS may reject a tax return for various reasons, such as incorrect personal information, errors in income reporting, deductions,…

-

IND-032-04

The IRS reject code IND-032-04 is one of the commonly came across error codes that actually has a simple solution.…

-

F540-960

Reject Code F540-960 is about your California state income tax return. Upon filing your state income tax return through eFile,…

-

IRS Reject Code IND-031-04

The IRS reject code IND-031-04 refers to a mismatch of prior year Adjusted Gross Income or PIN. If what entered…