IRS Code 150

In this article, we'll provide an overview to IRS Code 150, including what it means, what to expect after seeing this code, and some frequently asked questions about the code and its implications for your tax return.

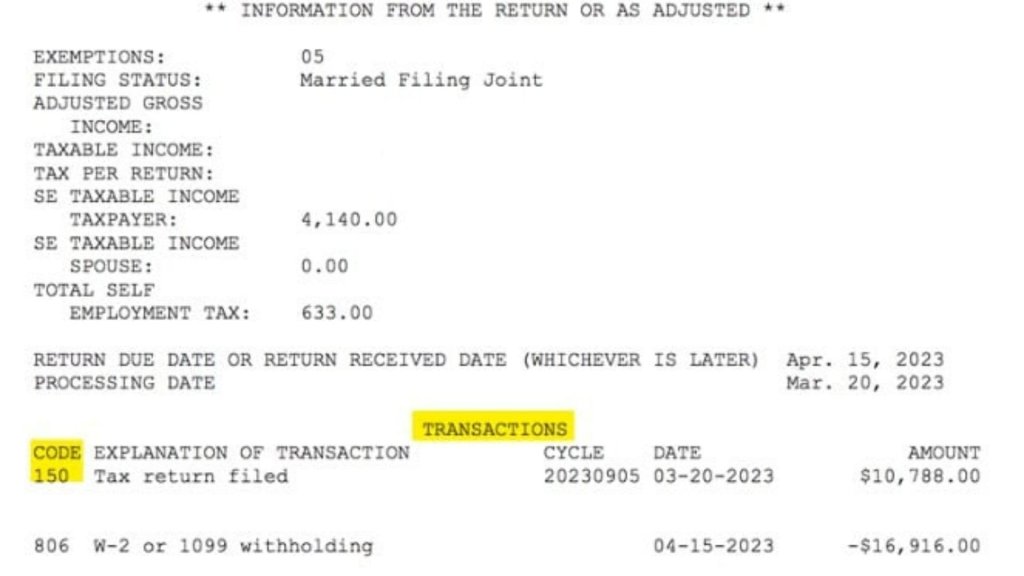

If you have recently filed your taxes, you may be eagerly awaiting news on the status of your return. When you check the IRS’s online “Where’s My Refund?” tool or call the IRS’s toll-free hotline, you may see a message indicating that your return has been received and that IRS Code 150 has been applied. IRS Code 150 is a generic code used by the IRS to indicate that they have received and processed a taxpayer’s tax return and that the return has been accepted as filed.

It means that the IRS has completed its initial review of your tax return and determined that it meets the basic requirements for processing. This code does not provide any information about the status of any refund due or indicate whether your return has been approved or rejected. Whether you are a seasoned taxpayer or filing your first return, understanding IRS Code 150 can help demystify the tax filing process and provide peace of mind as you await news on the status of your tax return.

Does IRS Code 150 Mean Good or Bad?

While IRS Code 150 is a positive sign that your tax return has been accepted, it does not necessarily mean your return has been approved. The IRS may still review your return further and request additional information or documentation to support the items reported on your return. If the IRS finds any errors or discrepancies, they may adjust your return or send you a notice explaining why your return was rejected or modified.

If you receive a notice from the IRS, it is important to respond promptly to avoid further delays or penalties. The notice should provide instructions on what to do and how to respond. In some cases, you may need to provide additional documentation or amend your return to correct any errors or discrepancies. Reviewing the notice carefully and seeking professional help if you are unsure how to respond is important.

IRS Code 150 is a positive sign that your tax return has been accepted as filed by the IRS. However, it does not necessarily mean that your return has been approved or will receive a refund. It is important to continue monitoring your return’s status and respond promptly to any notices or requests from the IRS.

IRS cycle codes for deposits

- 20240102: January 3, 2024

- 20240102: January 4, 2024

- 20240104: January 5, 2024

- 20240105: January 6, 2024

- 20240201: January 7, 2024

- 20240202: January 10, 2024

- 20240202: January 11, 2024

- 2024020: January 12, 2024

- 20240205: January 13, 2024

- 20240301: January 14, 2024

- 20240302: January 17, 2024

- 20240302: January 18, 2024

- 20240304: January 19, 2024

- 20240305: January 20, 2024

- 20240401: January 21, 2024

- 20240402: January 24, 2024

- 20240402: January 25, 2024

- 20240404: January 26, 2024

- 20240405: January 27, 2024

- 20240501: January 28, 2024

- 20240502: January 31, 2024

- 20240503: February 1, 2024

- 20240504: February 2, 2024

- 20240505: February 3, 2024

- 20240601: February 4, 2024

FAQs

What does IRS Code 150 mean?

IRS Code 150 is a generic code used by the IRS to indicate that they have received and processed a taxpayer’s tax return, and that the return has been accepted as filed.

Does IRS Code 150 mean that my return has been approved?

No, IRS Code 150 only means that your return has been received and accepted for processing. The IRS may still review your return further and request additional information or documentation to support the items reported on your return.

Does IRS Code 150 mean that I will receive a refund?

No, IRS Code 150 does not indicate whether you will receive a refund or not. The status of your refund can be checked separately using the “Where’s My Refund?” tool on the IRS website or by calling the IRS’s toll-free hotline.

How long does it take to receive a refund after seeing IRS Code 150?

Generally, it takes about 21 days to receive a refund if you filed electronically and opted for direct deposit. However, this timeline can vary depending on the complexity of your return and the volume of returns the IRS is processing.

What should I do if I receive a notice from the IRS after seeing IRS Code 150?

If you receive a notice from the IRS, it is important to respond promptly to avoid any further delays or penalties. The notice should provide instructions on what you need to do and how to respond. In some cases, you may need to provide additional documentation or amend your return to correct any errors or discrepancies.