IRS Cycle Code 2024

The IRS cycle code is displayed on your account transcript and indicates when your tax return was processed, and this article includes information on how IRS Cycle Codes work.

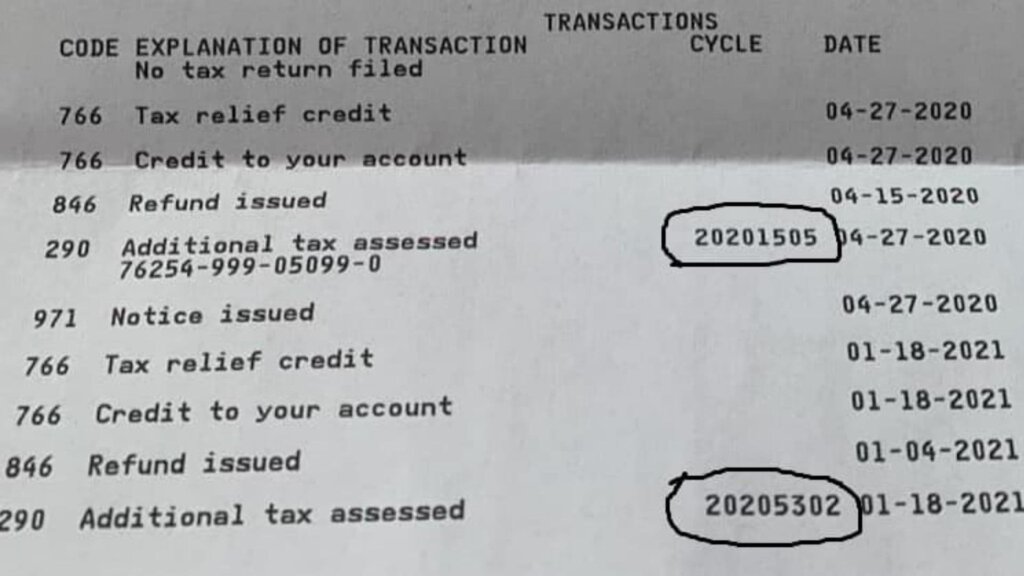

Millions of taxpayers struggle to determine when they’ll receive their tax refund every year. While the IRS’s refund schedule has estimated dates for when they will make deposits to bank accounts, statutory limitations, and processing delays can make those dates obsolete. However, the account transcript can offer clues you can use to figure out when your refund should arrive. It contains an eight-digit IRS Cycle Code that tells you when your account was posted to the IRS master file and whether it’s in a daily or weekly batch cycle.

This is a piece of important information for taxpayers who have filed their tax returns early in the tax season and are hoping to get a tax refund. It helps you to know whether you’re in a daily or weekly batch cycle and when your tax refund might be deposited into your bank account. In short, the cycle code is an 8-digit sequence that is year-week of year-day of the week and can tell you when your tax return was entered into the Master File system by the IRS. The first four digits indicate the tax processing year, while the fifth and sixth digits indicate the week of the year.

It’s important to note that this information is only updated periodically and can change throughout your tax season. For example, your tax return may be pushed out one or more cycles as the IRS works to solve issues with prior years’ returns. This can result in a delay in your refund, which can be stressful.

How to Find IRS Cycle Code?

To find your tax return’s cycle code, simply visit the IRS website and look for it under the “Explanation of Transactions” portion of your tax transcript. Once you’ve found it, combine it with the other transaction codes in this section to determine when your refund might be deposited into your account.

Once you have the date and the amount of your tax refund figured out, you can then begin to work on getting it deposited into your bank account. However, be sure to keep in mind that paper checks can take a few days longer than direct deposit transactions. To check your tax refund status:

- Visit the IRS website

- Click Get Transcript

- Click the “Get Transcripts Online” button

- Now you have access to your transcripts for the past nine fiscal years.

In addition to the cycle date, you should also check your CSED or collection start date. Normally, this is ten years after your return was filed. The CSED date can be extended if you voluntarily filed a return or if a statute allows the IRS to extend the time for collections.