When Will I Get My Tax Refund?

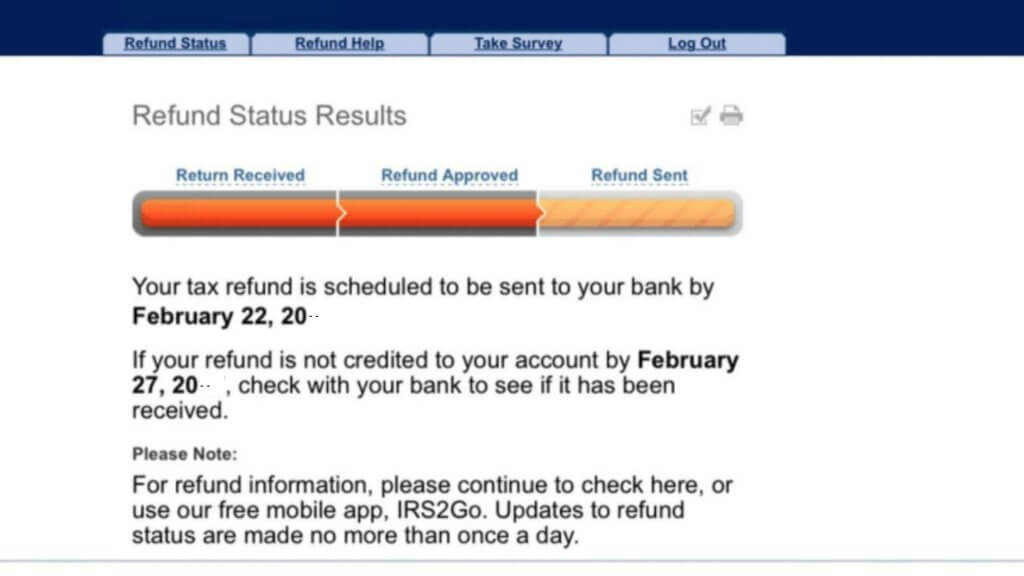

If you’re expecting a refund, knowing how long you may have to wait is good. You can track your refund using the IRS’s “Where’s My Refund” tool.

Getting your tax refund quickly depends on the options you choose when filing. The fastest way to get your money is to have it direct deposited into your bank account. You can also receive your refund by check, which can take several weeks to arrive. In addition, the amount of time it takes to receive your refund may depend on how you file your return and how busy your bank is. Generally, taxpayers can expect to receive their refund within 21 days of filing their returns, so long as they file electronically and have their refund delivered through direct deposit. However, the IRS cautions that it’s not guaranteed a refund will be received in this time frame. The IRS’s Where’s My Refund tool provides real-time updates, and you can check its status using your social security number, filing status, and the exact dollar amount of your refund.

The IRS also notes that this year’s refund amounts are expected to be smaller than last year due to fewer taxpayers taking the standard deduction and a lower inflation rate. Taxpayers who itemize their deductions may have a smaller refund, as will those who claim the Earned Income Tax Credit or additional child tax credit. Taxpayers can also get an idea of how long they should wait to receive their tax refund by calling their financial institution or checking the online banking portal. Some banks don’t process financial transactions on weekends or holidays, which can add to the delay in receiving your refund.

Other Ways to Check Refund Status

Getting your tax refund check is always good news, but knowing how long you’ll have to wait depends on the IRS process and your filing method.

The IRS says that over 9 out of 10 taxpayers who file error-free returns should receive their refund within 21 days. However, refunds may be delayed if the IRS needs to review your return for fraud or identity theft concerns. It also takes longer to process paper returns than electronic ones.

In addition to e-filing, you can speed up your tax refund by signing up for direct deposit. This allows the IRS to directly deposit your money into your bank account, saving you the hassle of waiting for a physical check. It is also a secure way to keep your refund money safe.

For those who prefer to use a debit card, the IRS recommends using one that has a low fees, offers multiple ways to deposit and withdraw funds, and requires verification of your identity when you open it. This can save you from paying expensive ATM fees and other charges that come with some prepaid cards.

The IRS expects most EITC and ACTC-related refunds to be available in taxpayer bank accounts or on debit cards by Feb. 28. The agency has a new system this year to verify the accuracy of these refunds, so it is taking a little longer than usual. You can check the status of your EITC and ACTC refund through the Where’s My Refund? tool.

It’s important to remember that the IRS does not have an official tax refund calendar but provides some basic guidelines. The most common factors influencing when you’ll get your refund include how you file and whether you choose to have it deposited electronically or by mail. Depending on your situation, it may take up to 12 weeks for you to see the results of your tax refund.