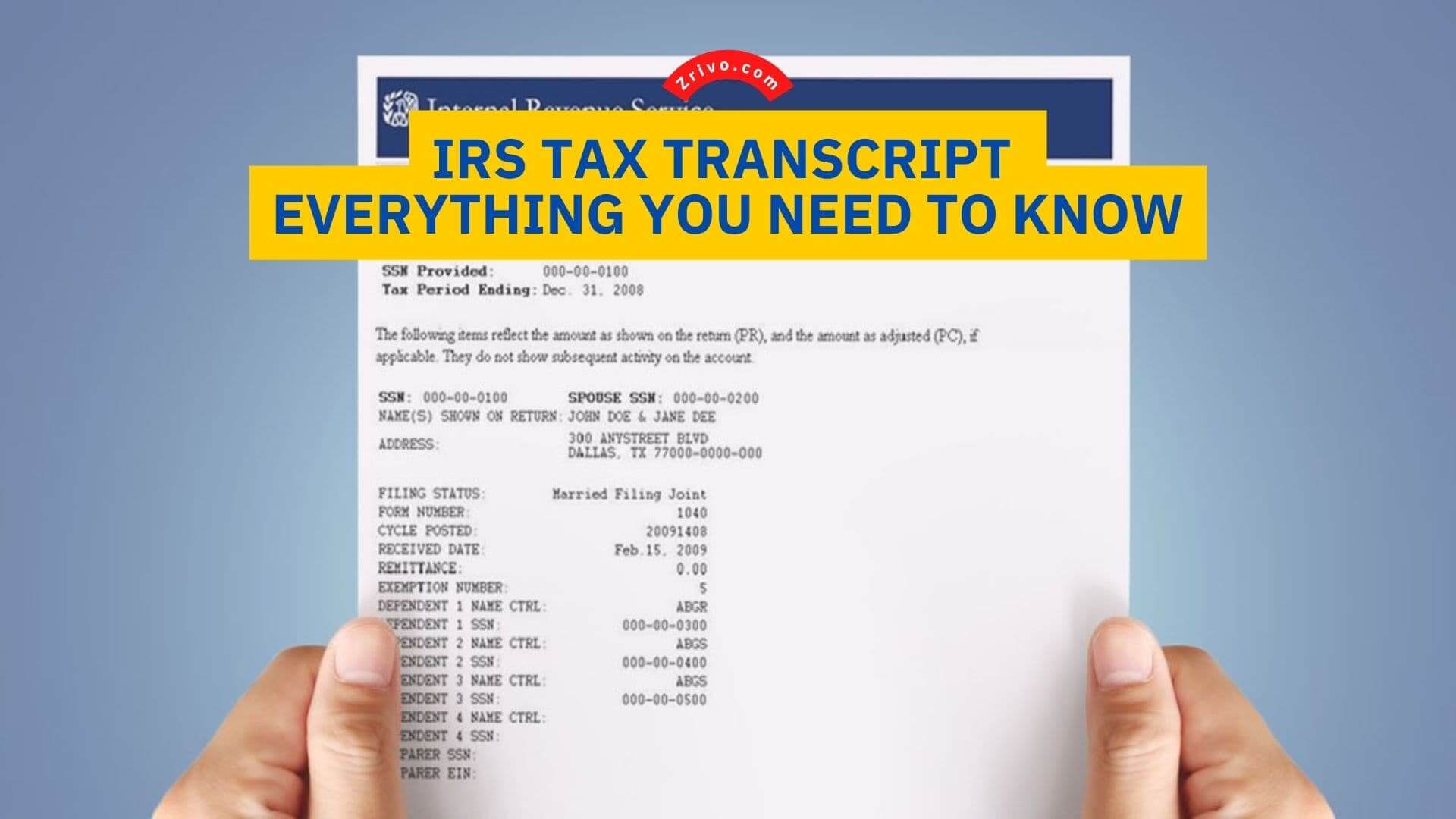

IRS Tax Transcript – Everything You Need To Know

The IRS tax transcript is an official document that shows the records of your past tax returns or similar taxation items. Most of the time, you need this document to submit to another institution, and you can request it online or by mail.

If you want to learn more about the IRS tax transcript, then keep reading! We have covered everything you might need to know about the IRS Tax Transcript.

What Does an IRS Tax Transcript Show?

There are different IRS tax transcripts, and depending on which one you are going to request, the content of the tax transcript varies. Below, we have provided all five IRS tax transcripts and the content they show for you.

Tax Return Transcript: This is the most commonly requested transcript, and it shows the records of the past tax returns you claimed with Form 1040-series and other forms and schedules. However, it doesn’t show the changes you made after the original return.

Additionally, tax return transcripts can show the records of the current and past three tax years. Most of the time, taxpayers need this document for student loans or mortgages. You can request this transcript online, by mail, or by calling 800-908-9946.

Tax Account Transcript: This transcript shows the records of filing status, payment types, and taxable income. Unlike the tax return transcript, it shows the changes that you made after the original return. You can find the records of the current and past nine tax years.

If you need the records from older years, then you need to submit Form 4506-T to the IRS and request them. It is requested before filing the tax returns when the taxpayers have estimated tax payments or overpayments from the previous year’s return. You can request this transcript by mail or by calling 800-908-9946.

Record of Account Transcript: This transcript shows the records of both the tax return transcript and the tax account transcript on the same document. The Record of Account Transcript shows the records of the current and past three tax years, and you can request it by mail or by filing Form 4506-T.

Wage and Income Transcript: This transcript shows the records of returns that taxpayers receive with forms such as W-2, 5498, 1098, and 1099. If you request this transcript but encounter the “no record of return filed error,” it means that your transcript is not ready yet.

We recommend checking again in late May and early July. The transcript can show the records of the current and past three tax years, and you can request it by mail or by filing Form 4506-T.

Verification of Non-filing Letter: This document means that there is no processed Form 1040-series tax return record for you with the IRS for the period you have requested it. However, this does not mean that you need to file a return for that year. In general, if you are going to request it for this tax year, this letter is available after June 15 or anytime when you request it for the past 3 tax years.

How Do You Get Your IRS Transcript?

Getting your IRS tax transcript is probably the easiest thing that you can get from the IRS. There are three ways to request your IRS transcript, and depending on your preferred method, you will get your transcript on various days.

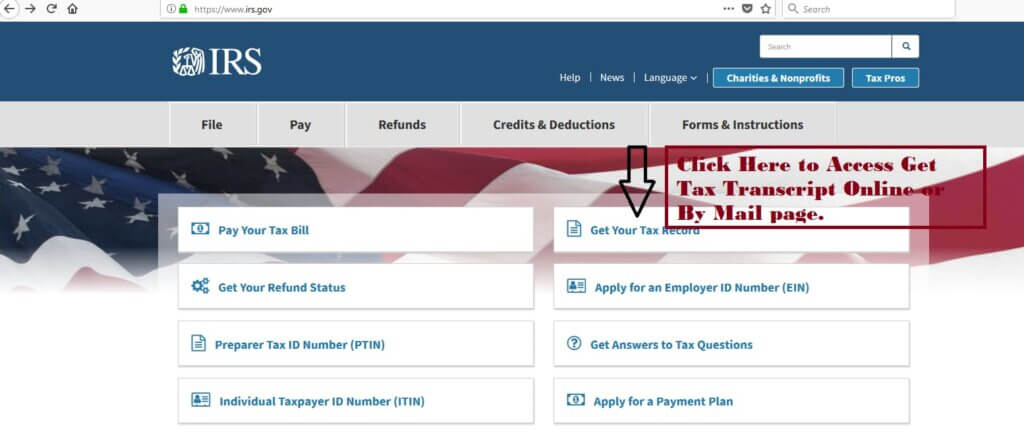

Before providing these methods, we would like to emphasize that pulling your IRS transcript has become much easier as you can order them over the internet now. The other two methods include ordering by mail and by phone.

To order your IRS transcript online, all you need to do is visit the official IRS website and check for the online tool called “Order a Transcript.” On the other hand, you can also call 800-908-9946 to order your transcripts by phone as well. These two methods let you get your transcript only between 5 and 10 days starting from the time the IRS receives your request.

If you want to receive your transcript by mail, then you need to file the relevant forms to request them. In addition, this method will let you get your transcript in a week to two months.