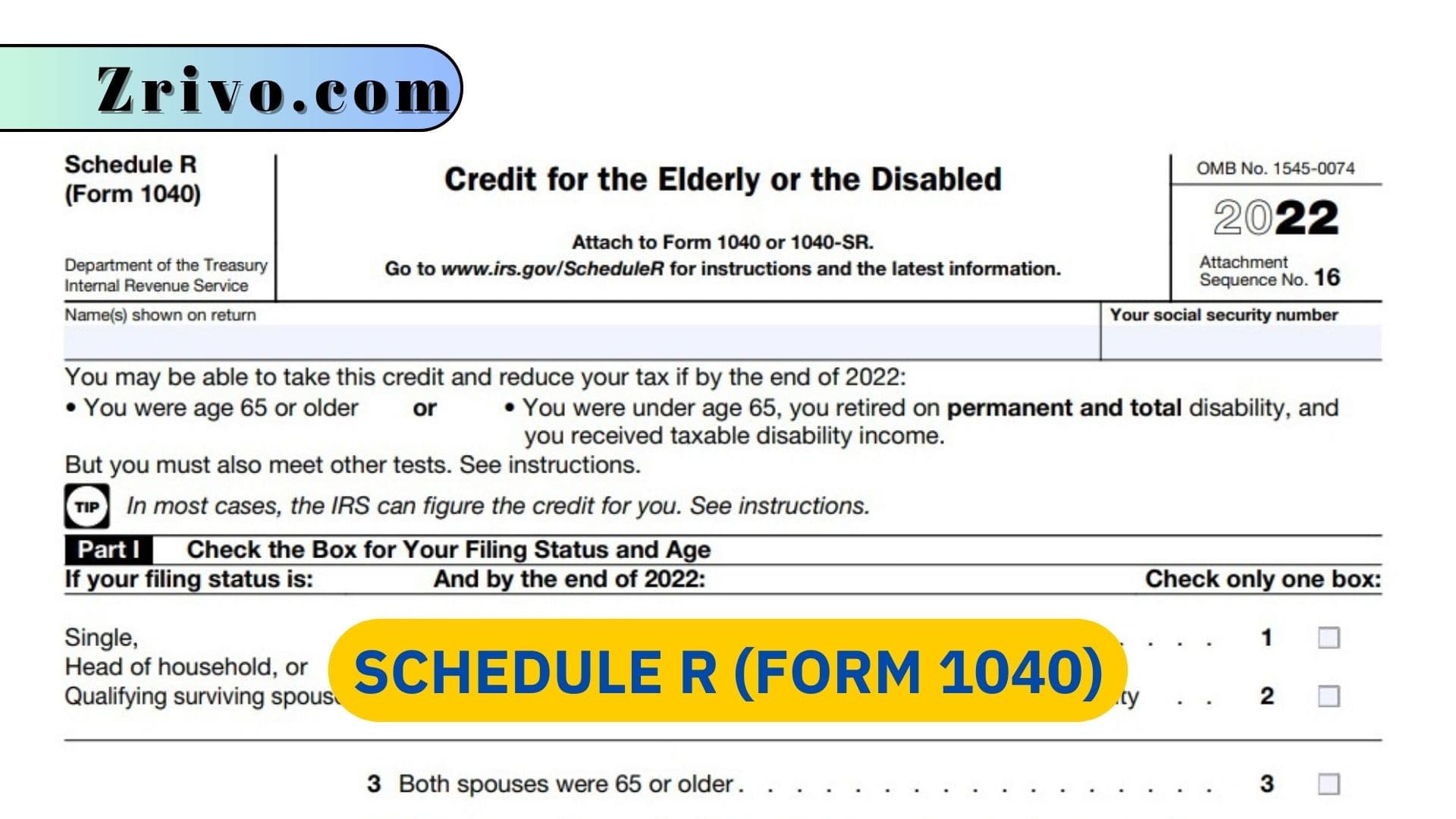

Schedule R (Form 1040)

Schedule R is an essential form that accompanies the main individual income tax return, Form 1040. It is used to calculate the Credit for the Elderly or the Disabled.

Schedule R is a supplemental form, also known as Form 1040 Schedule R, which is used for calculating the Credit for the Elderly or the Disabled. This tax credit aims to provide financial assistance to individuals who meet specific age or disability requirements Credit for the Elderly or the Disabled provides financial relief to eligible individuals who meet specific age and disability criteria. Schedule R must be filed by individuals who meet the eligibility criteria for the Credit for the Elderly or the Disabled. This credit is designed to assist taxpayers who are either 65 years or older or permanently and totally disabled, regardless of age. The eligibility requirements for this credit are as follows:

- To qualify based on age, you must be at least 65 years old by the end of the tax year for which you are filing.

- To qualify based on disability, you must meet one of the following conditions:

- You have received a determination from a government agency stating that you are permanently and totally disabled.

- You have reached the age of retirement defined by your employer, and your disability prevents you from engaging in substantial gainful activity.

How to File Schedule R?

- Collect all relevant documents, including your Form 1040, your records of income and deductions, and any documentation related to your age or disability status.

- Download Schedule R (Form 1040). Ensure you have the latest version of the form corresponding to the tax year you are filing for.

- Enter your personal information at the top of the form, including your name, Social Security number, and filing status. Indicate the tax year for which you are filing.

- Complete the relevant sections of Schedule R based on your eligibility. Provide the necessary information, including your age, disability status, and any other details requested on the form.

- Follow the Schedule R Instructions to calculate the credit amount accurately. Ensure that you use the appropriate worksheet provided by the IRS to determine the correct credit based on your income and filing status.

- Once you have calculated the credit, transfer the resulting amount to the designated line on your Form 1040. This credit will directly reduce your tax liability or increase your refund, depending on your individual circumstances.

Schedule R (Form 1040) is crucial in determining and claiming the Credit for the Elderly or the Disabled. This tax credit provides valuable assistance to individuals with specific age or disability requirements. Before submitting your tax return, carefully review Schedule R and all other forms for accuracy. Check for any errors or omissions to avoid potential delays or issues with your tax filing.