Form 982 2023 - 2024

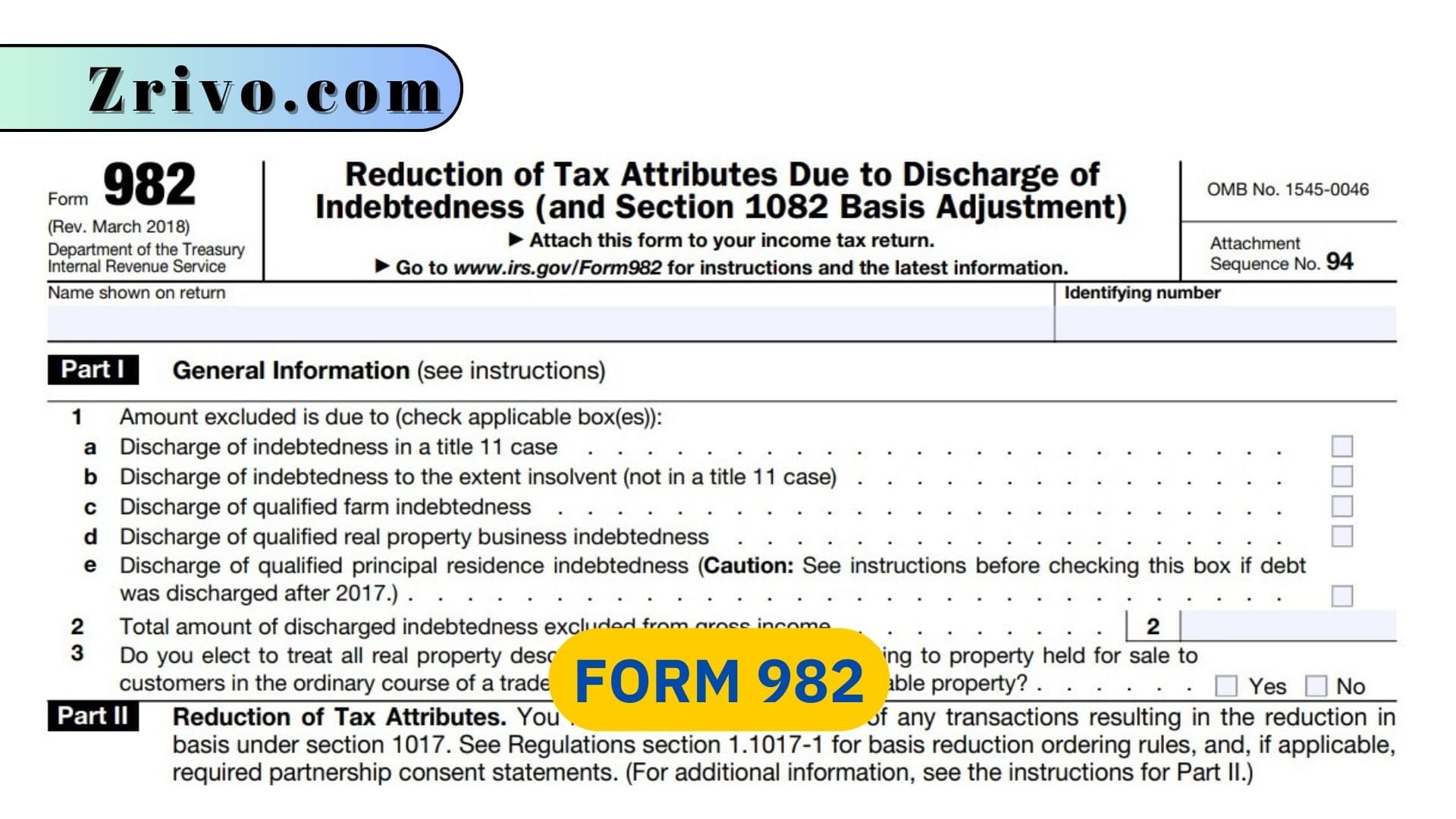

If you receive a Form 1099-C for canceled debt, you may need to file Form 982. This tax form determines under certain circumstances the amount of canceled debt that can be excluded from income.

The form that is used to calculate how much of the debt canceled or forgiven is taxable income is called Form 982. You must file this form with your tax return for the year in which you receive a 1099-C for canceled debt. The 1099-C is a form that lenders send to those who have had more than $600 in debt forgiven by the creditor. The lender is legally obligated to provide this form because the IRS considers the canceled debt taxable income. Under certain circumstances described in Section 108, you can exclude the amount of discharged debt from your gross income. This excludes the debt from your tax liability and reduces your taxable income dollar for dollar.

If you are not sure if you qualify to exclude the amount of canceled debt from your taxes, consider seeking the help of a tax professional. A professional can help determine whether you meet the qualifications and accurately complete Form 982. A tax professional can also assist with determining if you qualify for any available exclusions or deductions. The tax professional can also help you determine if it is appropriate to use one of the many tax software programs available to help with filing your return.

Who Must File Form 982?

Individuals may need to file Form 982 for a variety of reasons. One common reason is for a mortgage debt canceled through foreclosure, short sale or deed in lieu of foreclosure. Often, the lender will send a 1099-C to the individual for this type of cancellation and it is important that they also file Form 982 so that the amount canceled does not get categorized as income. Failure to do so will raise a red flag with the IRS and could result in a future audit or even a tax debt from the IRS. If the debt was canceled in bankruptcy, it can be excluded from income under the insolvency exclusion. This is determined by comparing the individual’s aggregate liabilities to the fair market value of all assets.

Partnerships must also file this Form 982 when excluding COD income from qualified real property business debt. This is done at the partner level and reduces each partners’ basis in the partnership’s depreciable property. If the partnership was engaged in the business of farming, it must also attach a schedule, similar to Schedule K, to its tax return for the year of discharge. Unless stated otherwise, by filing this form, the corporation agrees to the general rule for adjusting the basis of property described in Treasury Regulations section 1.1082-3(b). A request for deviation from the general rule must be included with this form.