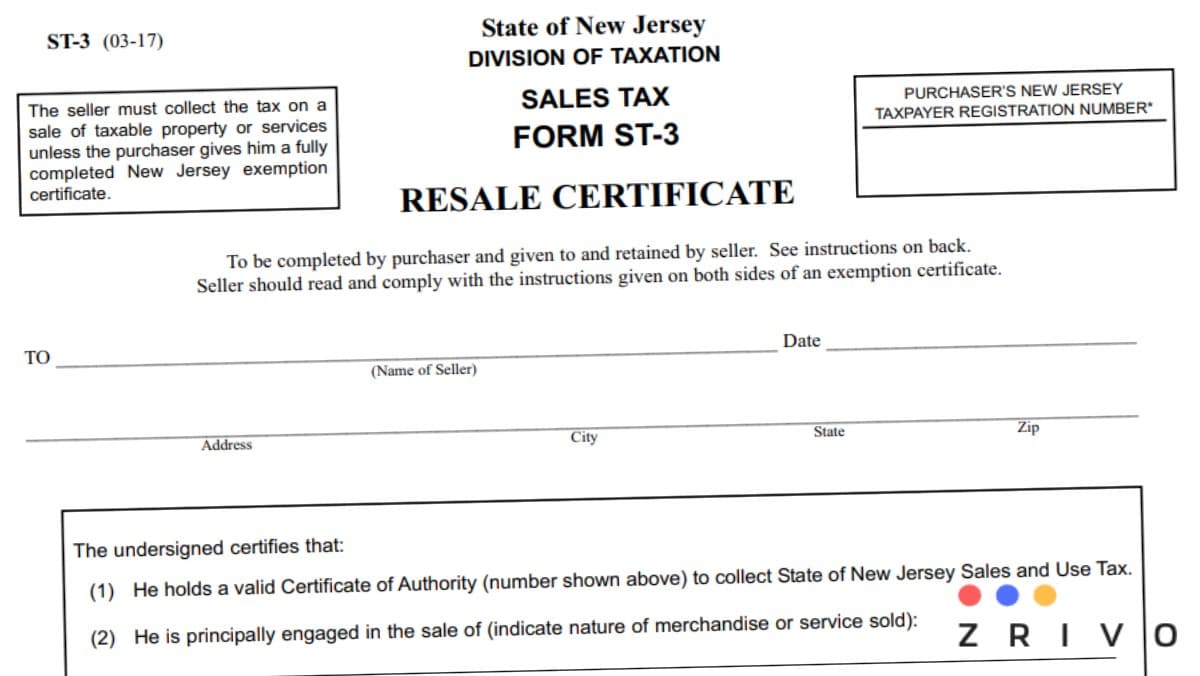

ST3 Form NJ

Form ST-3 Resale Certificate is used in New Jersey by the purchaser and furnished to the seller. The seller then keeps Form ST-3 and there is no need for further filing for this with the state tax department.

The purpose of the resale certificate is to waive the sales tax on the purchase. For example, when a convenience store buys candles to be sold at the store, the business doesn’t pay sales tax on the purchase but the end-user of the product, meaning the customer, pays the sales tax. The business owner then forwards the sales tax to the state tax department.

Form ST-3 basically lifts off the sales tax from the business owner so that the business can sell the products to generate sales tax. Otherwise, there would be double sales tax imposed on both the customers and the business owner.

Get your free copy of Form ST-3 NJ to use in 2024 and beyond.

How to properly complete Form ST-3?

The business that sells the products must register for a NK Business Tax Identification Number. This number is also known as the Certificate of Authority or seller’s permit or sales tax license.

Here is how to fill out Form ST-3, a line by line instruction.

Part 1. Identify the business.

Part 2. Identify and describe the product of the service of the buyer

Part 3. List the products or the services being purchased.

Part 4. Identify whether the merchandise is for:

- resale in present form;

- resale and being converted;

- use in the performance of a taxable service on personal property.

Part 5. Indicate whether the seller will collect NJ sales tax from the products or services, or if the services will be held on personal property for sale.

Part 7. Provide the purchaser personal information, the type of business, and signature.